Tags

Capital Flight, Capital-Labor Ratio, Class Struggle, Corporate Imcome Tax, Elasticity, Greedflation, Kamala Harris, Tax Incidence, Unrealized Capital Gains

Workers nationwide are assured that great joy will prevail if Kamala Harris retains her grip on the reins of power next year. Finally, greedy employers and rich people generally will have to “pay their fair share”. While slower job growth and stagnating real wages might dampen the enthusiasm, Harris offers vague assurances that “metrics” will demonstrate how her policies pay for themselves, achieving positive returns on investment (ROI). That creates an attractive buzz and it takes a lot of chutzpah, but she probably wouldn’t know an ROI if it bit her in the ass.

Tax “Big Greed”

This installment of my “Joy-Politik” series covers another federal tax proposal put forward by Harris. In my last post, I discussed her plan to tax unrealized capital gains, which is inimical to investment incentives, a healthy capital base, and economic growth. Here I discuss her proposal: to increase the corporate income tax rate from 21 percent to 28 percent (and increase the alternative minimum tax rate for corporations from 15% to 21%).

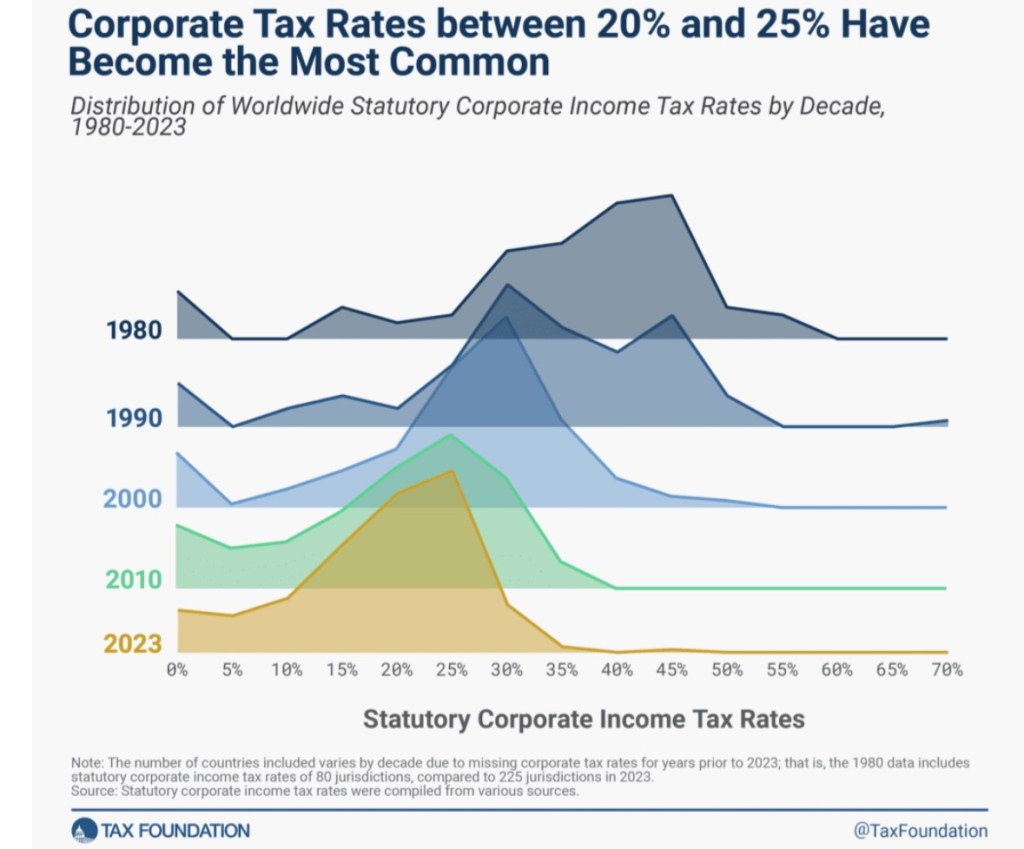

The chart at the top of this post shows that corporate statutory tax rates have trended down quite a bit over the past 40+ years. That’s a strong indicator of competition for corporate investment capital. It’s intense because governments know capital investment produces jobs, higher wages, and economic growth. U.S. corporate taxes today are competitive within the distribution, and they are below the international average. A hike to 28% would push the U.S. to a much less competitive level.

But here’s Harris’ rhetorical move: insist that the income of corporations must be taxed heavily, even punitively, for the benefit of the masses! While you’re at it, deride these greedy companies for causing inflation. The thinking is that a corporation’s shareholders will have to pay the tax. That’s who they’re after, and they can’t resist the left-populist optics!

Tax Incidence

Let’s put aside the “class struggle” premise and the political joy of bashing the rich; let’s also put aside the mistaken attribution of inflation to corporate greed. Beyond all that, Harris (and many others) makes a fundamental error in thinking that shareholders will bear the full burden of the tax. Anyone with a passing familiarity with tax incidence knows that the burden of the tax will be shared by the firm’s workers, customers, and shareholders. That’s because firms attempt to pass the tax along to consumers in higher prices and employees in lower wages.

Corporations cannot avoid tax incidence entirely. All parties (the firms, their consumers, workers, and shareholders) respond with some degree of elasticity. Ultimately, the interplay between their responses will yield a behavioral compromise whereby each of the three groups shoulders a portion of the burden.

Workers have limited mobility, but the supply of capital to a country is fairly elastic. Capital will deploy to locales where the returns net of taxes are most favorable. So capital tends to flee from jurisdictions in which it is more heavily penalized. This reduces the amount of capital available to each worker (tools, machinery, information/computing resources), ultimately leading to reduced productivity and wages.

As of 2021, even the federal government’s tax studies assumed that workers bore 20% – 25% of the burden of a corporate tax increase. However, the true labor share is likely to be higher. An abundance of research (for example, see here, here, and here) supports this conclusion. The full range of estimates runs from 15% – 100%. A number of studies suggest a range of 50% – 100%, with 70% seen as a reasonable midpoint. That means wages can be expected to decline in the wake of a corporate tax hike, and labor ultimately bears more than two-thirds of the increased corporate rate hike. With this in mind, no one should mistake Harris’ anti-corporate policy stance as labor-friendly. Quite the contrary!

Broad Economic Effects

The macroeconomic effects of the corporate tax hike are unfavorable, according to a Tax Foundation report:

“Raising the corporate income tax rate to 28 percent is the largest driver of the negative effects, reducing long-run GDP by 0.6 percent, the capital stock by 1.1 percent, wages by 0.5 percent, and full-time equivalent jobs by 125,000.“

The report’s estimates of losses for the entire Harris tax package through 2034 exclude a few provisions such as the new minimum tax on unrealized gains of high income earners. Therefore, the negative impacts are likely larger. But even without that, the losses in the report are a 2% decline in GDP, a 1.2% loss of wages, a 3% decline in the capital stock, and 786,000 fewer jobs.

Conclusion

Kamala Harris makes a great show of her desire to stick it to the rich for their “fair share.” In this case, the motives of corporations are demonized and presented as a natural vehicle through which the rich can be targeted. That effort would be worse than futile. The bulk of the incidence of the change in the corporate income tax rate would fall on workers. Even worse, the impact on jobs, the capital stock, and GDP are all likely to be negative. Rewarding workers by punishing their employers is a negative sum proposition, not a joyous thing.