Tags

Affordable Care Act, Anthony Weiner, Bill Clinton, Buffet Rule, Carried Interest Rule, Clinton Foundation, Daniel J. Mitchell, Exit Tax, Hillary Clinton, Hugo Chavez, Infrastructure bank, Joseph Stiglitz, Minimum Wage, Paid Family Leave, Peter Suderman, Public Option, Redistribution, Solyndra, Venezuela

Who cares about Hillary Clinton’s economic plan while her campaign quivers in the shadow of Weiner’s hard drive? Despite all the hubbub over Mrs. Clinton’s sloppy security practices, and her lies and destruction of evidence regarding those practices, it’s a good idea to remind ourselves of some of the frontrunner’s policy proposals and the general philosophy that informs them. Daniel J. Mitchell must have been feeling jovial when he took a crack at deciphering Hillary Clinton’s economic plan. He offered translations of each of 42 Hillary catch-phrases, but the translations were identical:

“Notwithstanding all the previous failures of government, both in America and elsewhere in the world, I’m going to make American more like Greece and Venezuela by using coercion to impose more spending, taxes, and regulation.“

Mitchell highlights two general themes at the start: one is the left’s constant misuse of the term “investment’ to describe spending on almost any government initiative; the other is the still fashionable Keynesian theory that a low-productivity government can make the economy grow by a multiple of any claim on resources it deigns to make.

I’ll try to do Mitchell one better. Here’s a run-down of the catch-phrases he cites along with my own interpretations:

- “…support advanced manufacturing” — because the government is adept at picking winners with taxpayer money, like Solyndra. Does “advanced manufacturing” involve politically-favored outputs, as opposed to market-favored outputs? Does it involve robots, or workers? Is it somehow preferable to “advanced services”?

- “a lot of urgent and important work to do” — there oughtta’ be more laws;

- “go out and make that happen” — we must impose the heavy hand of the state;

- “enormous capacity for clean energy production” — …if only we can provide our cronies with enough subsidies on your dime;

- “if we do it together” — …kumbaya; we’ll wreck the private economy together;

- “things that your government could do” — like, wreck everything;

- “I will have your back every single day” — …with a sharp knife, in case it’s in my interest to betray you;

- “make our economy work for everyone” — we’ll redistribute your wealth;

- “restore fairness to our economy” — be prepared to share your success;

- “go to bat for working families” — …by punishing your employer; but look, we have freebies!

- “pass the biggest investment” — mandatory campaign promise;

- “modernizing our roads, our bridges” — shovel-ready” projects;

- “help cities like Detroit and Flint” — redistribute resources to poorly-governed communities and impose federal oversight;

- “repair schools and failing water systems” — because local needs and the federal government are a perfect match;

- “we should be ambitious” — about government domination;

- “connect every household in America to broadband” — even if they don’t want it, and even if they’ve chosen to live in the badlands; at your cost, of course;

- “build a cleaner, more resilient power grid” — reduce carbon emissions by inflating your utility bill; dismantle markets and direct energy resources centrally;

- “creating an infrastructure bank” — we need another big federal agency, extending control and conjuring opportunities for cronyism and graft;

- “we’re going to invest $10 billion” — Whew! I thought you were going to say $100 billion. But… can you define “investment”?

- “bring business, government, and communities together” — …we’ll be as one at the federal level;

- “fight to make college tuition-free” — so that even the least qualified have a strong incentive to enroll, on your dime;

- “liberate millions of people who already have student debt” — because meeting the terms of a contract is a form of enslavement;

- “support high-quality union training programs” — with federal subsidies on your dime; non-union training programs would be so …exploitative;

- “We will do more” — …cause we’re from the government, and we’re here to help!

- “Investments at home” — Invest? Can you define that? Do you mean “spend”?

- “we need to make it fairer” — … by redistributing your income to others;

- “we will fight for a more progressive…tax code” — reduce those ugly private work incentives and quash the bourgeois tendency to save and invest in physical capital;

- “pay a new exit tax” — don’t get the idea it’s YOUR company; you didn’t build that;

- “Wall Street, corporations, and the super-rich, should finally pay their fair share” –because the highest corporate tax rate in the industrialized world is not high enough, and besides, we can pass the booty back to elites in myriad ways, as long as they give to the Clinton Foundation;

- “I support the so-called ‘Buffett Rule'” — …to quench the thirst of class warriors;

- “add a new tax on multi-millionaires” — we must tax wealth because a high income tax rate just isn’t enough to encourage capital flight;

- “close the carried interest loophole” — cause we think that loophole actually exists, and hey, it sounds good to class warriors;

- “I want to invest” — Invest? Can you define that? Do you mean “spend”?

- “affordable childcare available to all Americans” — …so that no parent need pay any attention to price; but your tax credit will diminish if you earn extra income, so don’t earn too much, for God’s sake!

- “Paid family leave” — …because it isn’t expensive enough to hire you already;

- “Raising the federal minimum wage” — … so the least skilled will be jobless and dependent on the state;

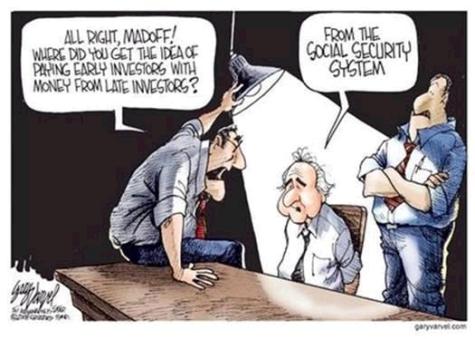

- “expanding Social Security” — …so what if it’s already insolvent? Oh, you must mean “expanding” payroll taxes!!

- “strengthening unions” — …because we mean to kill the sharing economy, and it isn’t expensive enough to hire you already;

- “improve the Affordable Care Act” — if it’s broke, break it more thoroughly;

- “a public option health insurance plan” — …shhh… don’t say single payer!

- “build a new future with clean energy” — in our judgement, your inflated utility bills will help all mankind; besides, we want to take control, and wreck something.

- Bonus: “wage equality once and for all” — because it should be illegal for employers to pay based on occupational risk, demands for paid leave and flexible hours, skill differentials and available supplies.

Lest you think my interpretation of that bonus quotation is unfair, remember: the so-called gender wage gap is almost entirely explained by the factors I’ve listed.

Hillary Clinton’s economic view is straight out of the statist theater of the absurd. Joseph Stiglitz, one of Hillary’s economic advisors, in 2007 endorsed Venezuelan socialism under Hugo Chavez, which proved to be disastrous. Was she forced to the left by Bernie Sanders? To some extent, perhaps. But Peter Suderman notes that Clinton’s current policy agenda constitutes a thorough rejection of Bill Clinton’s economic policies. The irony!