Tags

8-Tracks, Blockbuster, Blockchain, Cassettes, Cloud Storage, Collecting, Crypto-Assets, Digital Assets, DVDs, Electronic Books, Film Collections, Grateful Dead, Hardware Requirements, Kyle Chayka, Microsoft Office, Music Collections, Netflix, NFTs, Non-Fungible Tokens, Ownership Rights, Personal Library, Phonographs, Photo Albums, Physical Media, Rent vs Own, Streaming Content, Use Rights, VCRs

Our material possessions aren’t the most important things in the world, but they are often part of our identities as people. Almost anything qualifies, from the big, expensive stuff like a home or a car, to whatever we find worth keeping. Declutter if you must, but the things that remain have a lot to do with our well being, even if they exist simply as part of our surroundings. They reflect our past, present, and hopes for the future, and they embody important aspects of our interests and passions.

I don’t doubt that individuals of high spiritual or metaphysical consciousness are able to transcend the desire for material goods. Very well, though for most of us, certain physical possessions matter. People collect things like matchbook covers or fine art because they are important in one way or another. Great works and quirky novelties all have their place… with someone.

We’ve witnessed an accelerating erosion in the personal art of “collecting” certain kinds of things, however, and that is the main subject of this post. It draws heavily on Kyle Chayka’s excellent piece, “The Digital Death of Collecting”. There are at least two aspects of this decline. One has to do with digital storage, which eliminates physical media and presents a new set of administrative issues. The other strand has to do with a loss of ownership. That’s a distinct phenomenon, but it has probably been driven by digital technology, at least to this point.

Losing Physical Control

Much of the entertainment we experience today is delivered electronically. Historically, we used physical storage media of various kinds: books, vinyl records, CDs, DVDs, books on tape, etc… so it was (and still is) possible to accumulate and possess a physical collection of music, for example. It can be fun to document those collections, like my old bootleg Grateful Dead concert tapes. Now, actually owning a collection of physical music media is an anachronism to many (mostly younger) people. Instead, their favorite music is stored on a device, a server, or “in the Cloud”. Often, without a shred of awareness, this has led to a kind of interference with the individual’s ability to possess and control a whole class of property closely associated with the cultural and intellectual self.

For example, with respect to physical media and storage, we used to shoot photos and, once developed, we’d curate them and put our favorites into photo albums. However, for the better part of the past two decades, phones have allowed us to snap photos and take videos more or less indiscriminately. I periodically transfer my photos to an electronic hard drive, with minimal curation, where they are automatically assigned names with inscrutable combinations of letters and numbers. I’ve been doing it for years now, and it’s a mess. How long will it take me to find a particular photo? Even one photo from a particular event? What if the drive fails?

I need to back them up, of course, but that was the original purpose of the external hard drive! As I updated and transitioned to new computers over the years, I failed to maintain a complete set on the new laptop hard drives. Now, they reside only on the external hard drive. Sadly, in the end, many of us are simply unable or unwilling to implement better record management practices. My “collection” of photos has been neglected. I could try to rename these images descriptively and sort them into folders, but digging into it now seems almost an insurmountable task.

To some extent, the advent of digital players had the same impact on music collections. Some listeners never made the transition and consigned themselves to the use of older media and technologies, despite the increasing difficulty and expense of finding recordings. But they kept their physical collections active, which is a gratifying thing. Those who made the transition grappled with new issues in managing their “collections”, often without the satisfaction of arranging and beholding the physical media. Granted, this isn’t always an either/or proposition, but doing both requires extra effort.

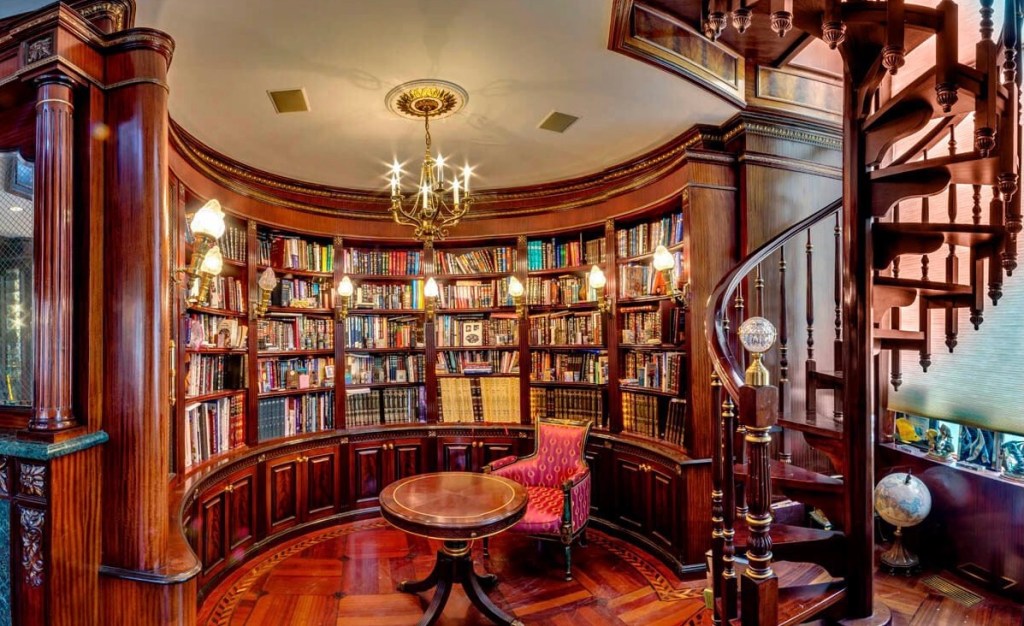

Similar transitions took place with digitized movies and reading material. I have a small movie collection, mostly movie musicals, animated children’s films, and a few cult films and classics. Not all are on DVD, and I haven’t added anything to this little trove in years. I still rent discs from Netflix, but like most people, streaming accounts for a growing share of my viewing. As for books, it’s less common today to see handsome collections of books arranged on shelves, but some doggedly attempt to maintain personal libraries, even if they aren’t all bound hardcovers.

Loss of Ownership

The other strand of our evolving relationship with digitized entertainment has to do with ownership itself. Today, we often purchase what amount to listening, viewing, or other “use rights”. This has sealed Chayka’s “Digital Death of Collecting”. Here’s how he sums it up:

“My lostness comes from the sense that our cultural collections are not wholly our own anymore. In the era of algorithmic feeds, it’s as if the bookshelves have started changing shape on their own in real time, shuffling some material to the front and downplaying the rest like a sleight-of-hand magician trying to make you pick a specific card — even as they let you believe it’s your own choice. And this lack of agency is undermining our connections to the culture that we love.”

Again, books are a case in point. Chayka notes that building a personal library is an expression of one’s intellectual history and interests. Yet today, with electronically delivered reading material sans physical media, you don’t really “own” the books you purchase. This blogger states the case well:

“As I’ve tried to point out before, both publishers and distributors like Amazon have spent the past decade or so removing rights that we used to have when books were physical property, and were something that you actually bought — along with the right to resell and/or lend them to whomever you wished, whenever you wished. Those rights no longer exist, which is why it’s better to think of an ebook purchase as an agreement to rent access under specific terms rather than an actual acquisition of something tangible.”

Free To Rent … and Pay As You Go

Subscriptions are replacing ownership in all sorts of contexts, and the use rights they confer are obviously of limited duration. For example, I was surprised when I realized that I could no longer “purchase” Microsoft Office and then download and install it to my computer. Instead, I have to buy annual subscriptions to continue to use it. Now, I don’t really “collect” software, unless the plethora of apps I’ve downloaded to my phone qualifies. Also, I understand that software becomes obsolete, so my “ownership” of Office was really equivalent to an indefinite but limited rental period. Maybe one-year subscriptions will be a better deal, though I have my doubts.

Renting certainly isn’t new in the “film space”. Blockbuster was a huge success for a time. And again, I get two discs at a time from Netflix to this day. People can still “collect” videos, but I suspect it’s not quite as common today in terms of collecting physical media.

I’ll always argue that renting is an economically rational alternative to homeownership. Same with leasing vs. owning a car, or anything else. And people often take a measure of pride even in things they rent. These own vs. rent choices and their relative values depend on one’s circumstances in life as well as one’s preference for control over the items in question.

Our Carts Runneth Over

A huge upside of all these changes is that we’re enjoying an astonishing array of choices as well as unprecedented convenience. (We can argue about the quality of the art, but that’s for another day.) In fact, the scarcity of new “collectibles” in the categories I’ve mentioned here might not be such bad news to collectors who’ve been at it for a while. After all, their existing collections might gain value. However, some forms of storage media might require technical or mechanical skill on the part of the collector. That’s because they have rigid hardware requirements. Eight-track players? Cassette tapes? VCRs? Who supports them? Yes, you can still buy a phonograph, but finding compatible “content” can be challenging. For the rest of us, streaming digital content frees us from those requirements and their inevitable obsolescence.

Unfortunately, our relationship to so much of our personal entertainment bounty seems more ephemeral than in the past. Streaming music and films is fine, but I’m much less likely to “burn them”, and ownership is an all but forgotten possibility. Like Chayka, I find the loss of owned, physical collections that has accompanied the digital revolution lamentable, not to mention the loss of control. I truly believe that if publishers ever quit printing physical books we’ll be poorer for it. But I’m not a complete technophobe, and I think there’s promise in recent developments in blockchain technology that might restore our ability as consumers to own more encompassing rights to digital assets.

Non-fungible tokens (NFTs) are essentially digital assets of almost any kind, with ownership documented in the blockchain. Some of the most publicized NFTs we’ve seen thus far are notoriously lacking in the actual rights they confer to the buyer. However, advances in standards are enabling the creation of more robust NFTs. There is no reason, in principle, why a consumer could not possess an NFT documenting ownership for a digital copy of a particular film, piece of music, e-book, or any other form one might collect. That might solve the ownership issue if and when crypto assets gain more acceptance. Individuals who are especially proud of their collections of NFTs could produce physical tokens to represent each NFT for display, if only for themselves to gaze upon lovingly. These could be plaques, for example, or the physical tokens could look like DVDs or books! Granted, it’s not the same as a real collection of physical media, but it might serve an emotional purpose.