Tags

Bernie Sanders, CATO Institute, Currency Manipulation, Daniel J. Ikenson, Direct Foreign Investment, Don Boudreaux, Donald Trump, Dumping, Federal Reserve, Free trade, Hillary Clinton, NAFTA, Open Trade, Paul Krugman, People's Bank of China, Predatory Pricing, Protectionism, Reserve Currency, Ted Cruz, TPP, Trade Deficit, Trade War, Unfair Competition

The protectionist foreign trade rhetoric issued by the major-party presidential candidates is intended to appeal to ignorant economic instincts. Donald Trump and Bernie Sanders come to mind most readily, but Ted Cruz and Hillary Clinton are jumping in with similar campaign positioning. The thrust of these populist, anti-trade appeals is that America is losing jobs to “unfair” foreign competition, an argument that distorts the very objective of trade: consumers take part in exchange in order to consume; they capture value from high quality, unique merchandise and competitive terms. Ultimately, producers engage in trade to gain the wherewithal to consume. Consumption is the real end-game.

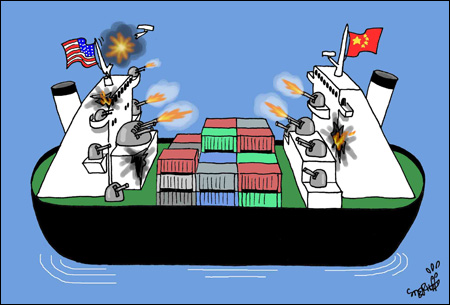

It can be misleading to talk about “nations” engaging in trade with each other, despite the emphasis placed on trade agreements like NAFTA and TPP. In the first place, it is better to stress consumers and producers, rather than “nations”, because most foreign trade is private, cooperative activity, not national decision-making. But the candidates persist in characterizing trade as a “contest”. That misleading notion is what prompts governments to muck up the trade environment by imposing restrictions on the free flow of goods and services. Trade agreements have been heralded as great achievements, but they never approximate a regime of truly liberalized trade because the latter requires no formal agreement whatsoever, merely a hands-off approach by government. And trade agreements tend to entangle trade issues with other policy objectives, holding consumers hostage in the process.

We hear from opportunistic candidates that jobs are lost to trade with foreigners. But again, consumption, not “jobs” per se, is the real objective of economic activity. If domestic jobs are lost, it is generally because consumers judge the value produced inferior to what’s offered from abroad. American consumers should not be obliged to support inferior value, domestic market power unchecked by competition, monopoly prices and limited choices. Patriotic jingoism attempts to blind us from these economic imperatives.

The standard protectionist narrative is that foreign “nations” cheat on trade with the U.S. via currency manipulation, predatory pricing or “dumping”, “unfair” wages or other unfair labor practices. Do any of these objections to free trade hold water?

The “fairness” of foreign wages and labor practices is a matter of perspective. Wages cannot be considered unfair merely because they are low relative to U.S. wages. Wages paid to workers by foreign exporters tend to be consistent with the standard of living in those societies, and they are often some of the best income opportunities available there. This is economic dynamism that lifts masses from the grips of poverty. It’s absurd to caste it as “exploitation”.

Is it “unfair” to competitors in the U.S.? Not if they know how to compete and are allowed to do so. Unfortunately, government regulatory policies in the U.S. often present obstacles to the competitiveness of domestic producers. This is well-illustrated by Daniel J. Ikenson of The CATO Institute in “Crucifying Trade For The Sins Of Domestic Policy“. He emphasizes that trade promotes economic growth, but when it causes job losses for some workers, U.S. economic policies make it difficult for those workers to find new jobs.

“Incentivize businesses to hire people to train them in exchange for their commitment to work for the company for a period of time. Reform a corporate tax system that currently discourages repatriation of an estimated $2 trillion of profits parked in U.S. corporate coffers abroad, deterring domestic investment, which is needed for job creation. Curb excessive and superfluous regulations that raise the costs of establishing and operating businesses without any marginal improvements in social, safety, environmental, or health outcomes. Permanently eliminate imports duties on intermediate goods to reduce production costs and make U.S.-based businesses more globally competitive. Advocate the retirement of protectionist occupational licensing practices.“

So-called “dumping” by foreign producers, or selling below cost, is an unsustainable practice, by definition. Pricing below cost is difficult to prove, especially if local wages are low and raw inputs are plentiful. If dumping can be proven, retaliation might feel good but would punish American consumers. A foreign producer might be subsidized by its government as a matter of industrial policy and economic planning, an unhealthy policy to begin with, and possibly to facilitate a long-run market advantage in foreign trade. The U.S. itself is thick with subsidized industry, however, so arguing for retaliation on those grounds is more than a little hypocritical.

I rarely quote Paul Krugman, but when I do, it’s from work he’s done as an actual economist, not as an agenda-driven pundit. So we have the following Krugman quote courtesy of Don Boudreaux:

“I believe that if the rhetoric that portrays international trade as a struggle continues to dominate the discourse, then policy debate will in the end be dominated by men like [James] Goldsmith, who are willing to take that rhetoric to its logical conclusion. That is, trade will be treated as war, and the current system of relatively open world markets will disintegrate because nobody but a few professors believes in the ideology of free trade.

And that will be a shame, because for all their faults the professors are right. The conflict among nations that so many policy intellectuals imagines prevails is an illusion; but it is an illusion that can destroy the reality of mutual gains from trade.“

David Harsanyi asks how American consumers will like more restrictive trade policy when forced to pay more for smart phones, laptops, HDTVs, cars, food, and any number of other goods. The usual anti-trade narrative is that foreign producers have harmed the manufacturing sector disproportionately, but in another article, Ikenson lays bare the fallacy that U.S. manufacturing has been victimized by trade.

The consequences of trade restrictions are higher prices, reduced production and reduced consumption, an undesirable combination of outcomes. This means higher prices of imported goods as well as domestic goods, whose producers will face less competition by virtue of the trade barriers. With reduced availability of imported goods, economic theory predicts that domestic producers will not fully meet the frustrated demands. This is a classic response of producers with monopoly power: restraint of trade. The negative consequences are compounded when foreign governments impose retaliatory measures against the U.S., harming American exporters.

A further misgiving expressed by politicians regarding free trade is that America’s trade deficit implies greater indebtedness to the rest of the world. This argument has been made by a few leftist economists who misunderstand the nature of direct investment, and who tend to think erroneously of economic outcomes as zero-sum. It’s true that foreign producers who receive dollars in exchange for goods often invest those proceeds in U.S. assets. A fairly small share of that investment is in debt issued by U.S. governments and private companies. But a much larger share is invested in U.S. equities and real assets, which are not U.S. debts. As Don Boudreaux points out, the domestic sellers of those assets generally reinvest in other U.S. assets, so private U.S. ownership of global capital is not diminished by increased foreign investment in the U.S.

An interesting aspect of the trade debate is that the dollar’s role as a global reserve currency implies that the U.S. must run a chronic trade deficit. The rest of the world uses dollars to trade goods and assets, but to acquire dollars, foreigners must sell things to holders of dollars in the U.S. This keeps the foreign exchange value of the dollar elevated, which makes imports cheaper to Americans and U.S. exports more costly to foreigners. Those dollars are a form of U.S. debt, but it is debt for which we should feel flattered, as long as confidence in the dollar remains. A diminished role for the dollar in world trade would lead to a surplus of dollars, undermining its value and promoting inflation in the U.S. Let’s hope for a gradual transition to that world.

Finally, the presidential candidates allege that foreign currency manipulation is another reason for American job losses. One prominent example occurred last year when China allowed the renminbi to decline to more realistic levels on foreign exchange markets. Donald Trump called this an unfair trade tactic, but apparently the People’s Bank felt that it couldn’t support the renminbi without undermining economic growth. The earlier dollar peg also helped to keep Chinese inflation in check. Contrary to Trump’s assertions, if China stopped manipulating its currency altogether, the renminbi would go even lower!

Beyond the opportunistic political arguments, the point is that central banks (including the U.S. Federal Reserve) manage their currencies to achieve a variety of objectives, not merely to promote exports. That is not an endorsement of such policies. It is an objective fact. Anyone can argue that a foreign currency is “too low” if their objective is to demonize a country and it’s exports to the U.S., but the assertion may not be grounded in facts as markets assess them.

The arguments against open trade policies are generally specious, hypocritical or grounded in a mentality of victimhood. Vibrant producers who are free of government restrictions should welcome the expanded markets available to them abroad and should not seek redress against competition via government protection. Liberalized trade has engendered tremendous economic benefits over the years, while protectionist policies have only brought severe contractions. Let’s be free and trade freely!