Tags

Asset Bubble, Asset Price Distortion, Boom and bust, capital costs, Capital investment, Easy Money, Jim Grant, Market Manipulation, Martin Feldstein, Quantitative Easing, Ryan McMaken, Seigniorage, Supportive Earnings, Zero Interest Rate Policy, ZIRP

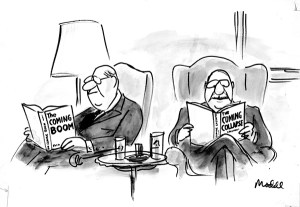

Printing money is a temptation that central banks can’t resist. And they distort prices when they do it. The new “liquidity” finds its way into higher asset values: stocks, bonds, real estate, even art. But as Jim Grant points out (as quoted by Ryan McMaken), the inflated prices are artificial, decoupled from the actual value those assets are capable of generating. The high asset prices are unsustainable:

“The idea is that you put the cart of asset values before the horse of enterprise. By raising up asset values, you mobilize spending by people who have assets… It was otherwise known as trickle-down economics before the enlightenment, then it became something much fancier in economic lingo. But that’s essentially the idea. So what you have seen is an artificial structure of prices worldwide.”

This comports with the general drift one gets from chatting with financial market professionals about the Federal Reserve and other central banks. These advisors usually add a reflexive assurance that corporate earnings are adequate to support stock prices. So which is it? Those very earnings might reflect trading gains on assets held by financial institutions and others, so the “supportive earnings” argument is circular to some degree. That aside, it’s suggestive that the recent market selloff has been centered on tighter monetary conditions:

“‘The risk of global liquidity conditions swinging is real for the markets, justifying a significant reduction in exposure for all asset classes,’ said Didier Saint-Georges, managing director at Carmignac, in a note to clients.“

Likewise, significant rebounds have been attributed, at least in part, to softening expectations that the Fed will move to increase short-term interest rates next week. If asset values are so heavily dependent on a continuation of a zero-interest rate, easy-money policy at this stage of an economic expansion, then it looks like a bubble is waiting to pop. More liquidity might delay the inevitable.

How did we get here? Martin Feldstein describes the policy of “quantitative easing” (QE) in “The Fed’s Stock Price Correction“:

“When the Obama administration’s poorly designed 2009 stimulus legislation failed to produce a strong economic turnaround, then-Fed Chairman Ben Bernanke announced that the central bank would pursue an ‘unconventional monetary policy’ by purchasing immense amounts of long-term bonds and promising to hold short-term interest rates near zero for an extended period.

Mr. Bernanke explained that the Fed’s policy was designed to drive down long-term interest rates, inducing portfolio investors to shift from bonds to stocks. This ‘portfolio substitution’ strategy, as he labeled it, would increase share prices, raising household wealth and therefore consumer spending.“

Feldstein does not buy the contention that “earnings are supportive”. Despite his conventional demand-side approach to macroeconomics, he too emphasizes that loose monetary policy has distorted asset prices.

The process is exacerbated by the bloated federal government’s appetite for funds. The Treasury is able to float debt at very low interest rates, thanks to the Fed’s willingness to provide liquidity to the banking system. By that, I mean the Fed’s willingness to buy Treasury bonds and monetize federal deficit spending.

Jim Grant’s argument regarding price distortion goes further. Increases in the prices of financial assets artificially deflate the cost of raising new capital, translating into over-investment in physical assets such as office buildings and machinery. Here’s Grant:

The prices themselves are the cosmetic evidence of underlying difficulty. So if you misprice something, it’s not just the price that’s wrong. It’s the thing itself that has been financed by the price. So you have perhaps too many oil derricks, too many semi-conductor fabs. We have too much of something, which is financed by an excess of credit or debt.“

Thus, the boom feeds the inevitable bust. That is certainly a danger. I’m sympathetic to Grant’s reasoning, but we have not experienced much of a boom in physical capital investment in the U.S., except perhaps for commercial real estate and in capital-intensive oil and gas extraction, and the latter is now on the skids. China, however, has been aggressively over-investing, and that is coming to an end.

While asset values have likely been inflated, it is fair to ask why the Fed’s accommodative policy has not led to a more general inflation in the prices of goods and services. For one thing, the strong dollar has held import prices down. (The international value of the dollar has been buttressed by the view that dollar-denominated assets are relatively safe, despite the risks created by the Fed.) More importantly, aging baby boomers have contributed to relatively strong saving activity (and less spending). Paradoxically, it’s possible that saving has been reinforced by the zero-rate policy of the Fed, as noted before on Sacred Cow Chips. Buying extra comfort in retirement requires greater set-asides if rates are low.

I am not optimistic about the direction of asset values, but I am not adjusting my own investment profile. Market timing is generally a bad strategy, and I will do my best to ride out the market’s ups and downs, even if they are manipulated by the Fed. However, we should all demand more discipline from the federal government and more restraint from the Fed. Better yet, limit the Fed’s discretion in the conduct of monetary policy by relying on a monetary standard that is less prone to manipulation and seigniorage.