Tags

ACA, American Enterprise Institute, CMS, Donald Trump, Health Savings Accounts, HHS, IPAB, John C. Goodman, MACRA, Medicare, Medicare Advantage, Medicare Part C, Medigap, Obamacare, Original Medicare, Premium Support Plan, Privatization, Tom Price

Here’s a bit of zero-sum ignorance: private profits are robbed from consumers; only non-profits or government can deliver full value, or so this logic goes. Those who subscribe to this notion dismiss the function of private incentives in creating value, yet those incentives are responsible for nearly all of the material blessings of modern life. What the government seems to do best, on the other hand, is writing checks. It’s not really clear it does that very well, of course, but it does have the coercive power of taxation required to do so. Capital employed by government is not a “free” input. It bears opportunity costs and incentive costs that are seldom considered by critics of the private sector.

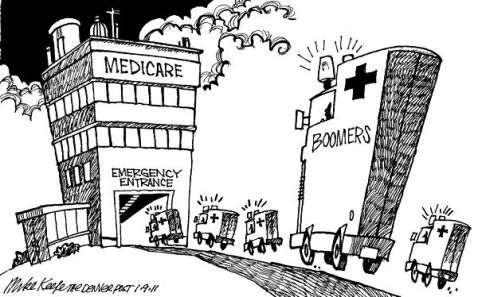

The role of private profit and the zero-sum fallacy come up in the context of proposals to privatize government services. In what follows, I discuss a case in point: privatization of Medicare. Rep. Tom Price, the Chairman of the House Budget Committee, is Donald Trump’s nominee to head HHS. In November, Price said Congress would attempt to pass legislation overhauling Medicare in the first year of the Trump Administration. James Capretta of the American Enterprise Institute (AEI) explains some of the features of the possible reforms. Price has supported the concept of a premium support plan whereby seniors would purchase their own coverage from private insurers, paid at least in part by the government (also see here).

Medicare and Its Ills

The Medicare program is beset with problems: it has huge unfunded liabilities; it’s cash flows are being undermined by demographic trends; fraud and bureaucratic waste run rampant; it’s unpopular with doctors; and the regulations imposed on healthcare providers are often misguided.

Writing checks to health care providers is really the primary “good” created by the federal government in the administration of Medicare. The Centers for Medicare & Medicaid Services (CMS), a branch of the Department of Health and Human Services (HHS), also performs regulatory functions mandated by legislation, such as the Affordable Care Act (ACA).

More recently, CMS has been implementing the Medicare Access and Chip Reauthorization Act of 2015 (MACRA), which will introduce changes to the payment formulas for physician compensation under the plan. Economist John C. Goodman offers a cogent explanation of the ill-conceived economic planning at the heart of Medicare regulation and its implementation of MACRA in particular:

“…the government’s current payment formulas create perverse economic incentives — to maximize income against the formulas instead of putting patient welfare first. The goal is to change those incentives, so that providers will get paid more if they lower costs and raise quality.

But after the new formulas replace the old ones, provider incentives in a very real sense will be unchanged. They will still have an economic incentive to maximize income by exploiting the formulas, even if that is at the expense of their patients.“

After describing several ways in which Medicare regulation, now and prospectively, leads to perverse results, Goodman advances the powerful argument that the market can regulate health care delivery to seniors more effectively than CMS.

“If the government’s metrics are sound, why not allow health plans to advertise their metrics to potential enrollees and compete on these quality measures. Right now, they cannot. Every communication from health plans to Medicare enrollees must be approved by CMS. … Under MACRA, health plans profit by satisfying the government, not their customers. … Better yet, why not let the market (rather than government) decide on the quality metrics?“

Private Medicare Exists

Wait a minute: profit? But isn’t Medicare a government program, free from the presumed evils of profit-seekers? Well, here’s the thing: almost all of the tasks of managing the provision of Medicare coverage are handled by the private sector under contract with CMS, subject to CMS regulation, of course. That is true even for Part A and Part B benefits, or “original Medicare”, as it’s sometimes called.

Under “original” Medicare, private insurers process “fee-for-service” claims and payments, provide call center services, manage clinician enrollment, and perform fraud investigations. Yes, these companies can earn a profit on these services. Unfortunately, CMS regulation probably serves to insulate them from real competition, subverting efficiency goals. Goodman’s suggestion would refocus incentives on providing value to the consumers these insurers must ultimately serve.

Then there are “Medigap” or Medicare Supplement policies that cover out-of-pocket costs not covered under Parts A and B. These policies are designed by CMS, but they are sold and managed by private insurers.

And I haven’t even mentioned Medicare Parts C and D, which are much more significantly privatized than original Medicare or Medigap. The Part C program, also known as Medicare Advantage, allows retirees to choose from a variety of privately-offered plans as an alternative to traditional Medicare. At a minimum, these plans must cover benefits that are the equivalent to Parts A and B, as judged by CMS, though apparently “equivalency” still allows some of those benefits to be declined in exchange for a rebate on the premium. More optional benefits are available for an additional premium under these plans, including a reduced out-of-pocket maximum, a lower deductible, and reduced copays. Part C has grown dramatically since its introduction in 1996 and now covers 32% of Medicare enrollees. Apparently these choices are quite popular with seniors. So why, then, is privatization such a bogeyman with the left, and with seniors who are cowed by the anti-choice narrative?

What’s To Privatize?

Not privatized are the following Medicare functions: the collection of payroll-tax contributions of current workers; accounting and reporting functions pertaining to the Trust Fund; decisions surrounding eligibility criteria; the benefit designs and pricing of Part A (hospitalization) and Part B (optional out-patient medical coverage, including drugs administered by a physician); approval of provider plan designs and pricing under Parts C; regulation and oversight of all other aspects of Medicare, including processes managed by private administrative contractors and providers of optional coverage; and regulation of health care providers.

The Independent Payment Advisory Board (IPAB) was created under the Affordable Care Act (ACA), aka Obamacare, to achieve Medicare costs savings under certain conditions, beginning in 2015. Its mandate is rather confusing, however, as IPAB is ostensibly restricted by the ACA from meddling with health care coverage and quality. Proposals from IPAB are expected to cover such areas as government negotiation of drug prices under Part D, a Part B formulary, restrictions on the “protected status” of certain drugs, and increasing incentives for diagnostic coding for Part C plans. Note that these steps are confined to optional or already-private parts of Medicare. They are extensions of the administrative and regulatory functions described above. Despite the restrictions on IPAB’s activities under the ACA, these steps would have an impact on coverage and quality, and they mostly involve functions for which market solutions are better-suited than one-size-fits-all regulatory actions.

The opportunities for privatization are in 1) creating more choice and flexibility in Parts A and B, or simply migrating them to Parts C and D, along with premium support; 2) eliminating regulatory burdens, including the elimination of IPAB.

Impacts On Seniors Now and Later

Privatization is unlikely to have any mandatory impact on current or near-future Medicare beneficiaries. That it might is a scare story circulating on social media (i.e., fake news), but I’m not aware of any privatization proposal that would make mandatory changes affecting anyone older than their mid-50s. Voluntary benefit choices, such as Part C and D plans, would be given more emphasis.

There should be an intensive review of the regulatory costs imposed on providers and, in turn, patients. Many providers simply refuse to accept patients with Medicare coverage, and regulation encourages health care delivery to become increasingly concentrated into large organizations, reducing choices and often increasing costs. Lightening the regulatory burden is likely to bring immediate benefits to seniors by improving access to care and allowing providers to be more patient-focused, rather than compliance-focused.

Again, the most heavily privatized parts of Medicare are obviously quite popular with seniors. The benefits are also provided at lower cost, although the government pays the providers of those plans extra subsidies, which may increase their cost to taxpayers. Enrollees should be granted more flexibility through the private market, including choices to limit coverage, even down to catastrophic health events. Consumers should be given at least limited control over the funds used to pay their premia. That would include choice over whether to choose lower premia and put the excess premium support into consumer-controlled Health Saving Account (HSA) contributions.

Other Reforms

Pricing is a controversial area, but that’s where the terms of mutually beneficial trades are made, and it’s what markets do best. Pricing flexibility for private plans would be beneficial from the standpoint of matching consumer needs with the appropriate level of coverage, especially with fewer regulatory restrictions. Such flexibility need not address risk rating in order to have beneficial effects.

Regulations imposed on physicians and other providers should be limited to those demanded by private plans and the networks to which they belong, as well as clear-cut legislative rules and standards of practice imposed by professional licensing boards. The better part of future contributions to the Trust Fund by younger workers (i.e., those not grandfathered into the existing program) should be redirected toward the purchase today of future benefits in retirement, based on actuarial principles.

Perhaps the best cost-control reform would be repeal of the tax deductibility of insurance premia on employer-paid insurance plans. This provision of the tax code has already inflated health care costs for all consumers, including seniors, via demand-side pressure, and it has inflated their insurance premia as well. If extended to all consumers, tax deductibility would be less discriminatory toward consumers in the individual market and most seniors, but it would inflate costs all the more, with unevenly distributed effects. Unfortunately, rather than eliminating it entirely, qualification for the tax deduction is very likely to be broadened.

Conclusions

The Medicare program is truly in need of an overhaul, but reform proposals, and especially proposals that would put decision-making power into the hands of consumers, are always greeted with reflexive shrieks from sanctimonious worshippers of the state. The most prominent reform under consideration now would offer more of what’s working best in the Medicare program: private choices in coverage and costs. Solving the long-term funding issues will be much easier without a centralized regime that encourages escalating costs.

Earning a profit is usually the mark of a job well done. It is compensation for the use of capital and the assumption of risk (i.e., no bailouts). Physicians, nurses, chiropractors, insurance agents and customer service reps all earn compensation for their contributions. Providers of capital should too, including the owners of health insurance companies who do well by their customers. And if you think the absence of profit in the public sector creates value, remember the damage inflicted by taxes. Capital isn’t “free” to society just because it can be confiscated by the government.