Tags

Alex Tabarrok, Barriers to Entry, Corporatism, Free Market Capitalism, Government Protection, Graft, Guy Rolnik, Industrial Concentration, Koch Industries, Marginal Revolution, Natural Monopoly, Pro-Market, rent seeking, Stigler Center

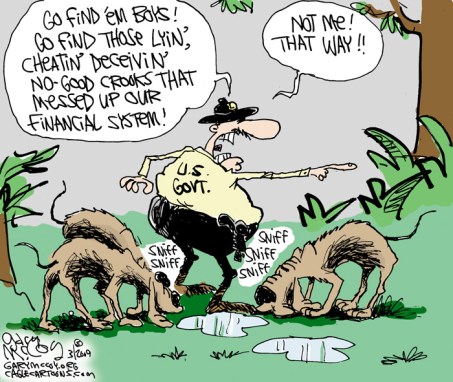

Are you investing in graft and rent-seeking activity without knowing it? Is a significant share of your saving channeled into sectors that profit from political influence over politicians, regulators and government planners? Maybe it’s no surprise, and you knew all along that your capital backs firms who manipulate the political system to extract resources beyond what they can earn through honest production. You have an interest in the success of the rent seekers, and you might well get a tax benefit to go along with it!

All this is almost certainly true if your savings are in a 401k, an IRA, a public or private pension fund, or in publicly-traded stocks. These sources of investor funding are dominated by firms that rent seek…. an indication of just how far the cancer of corporatism has gone toward completely subverting free market capitalism. It can be turned back only by ending the symbiosis between industry and government and encouraging real competition in markets.

This question of investing in rent seekers is raised by Guy Rolnik at Pro-Market (the blog of the Stigler Center at the University of Chicago Booth School of Business):

“Put another way, are we facing an economic model in which tens of millions of Americans’ pensions are relying on the ability of companies to extract rents from consumers and taxpayers?“

Rolnik’s emphasis is primarily on mergers and acquisitions, industrial concentration, diminished competition, and monopoly profits extracted by the surviving entities. As Alex Tabarrok at Marginal Revolution notes, “The Number of Publicy Traded Firms Has Halved” in the past 20 years. At the same time, the trend in business startups has been decidedly negative. While I strongly believe in the benefits of a healthy market for corporate control, these trends are a sign that the rent seekers and their enablers in government are gaining an upper hand.

Monopoly must be condoned if there are natural barriers to entry in a market, but such monopolists are generally subject to regulation of price and service levels (complex issues in their own right). If there are other legitimate economic barriers to entry such as differentiated products and strong brand reputations, there is no reason for concern, as those are signs of value creation. And given the private freedom to innovate and compete, there is little reason to suspect that above-normal profits can persist in the long run, as new risk-takers are ultimately drawn into the mix. That is how a healthy economy works and how prices direct resources to the highest-valued uses.

Rent seekers, on the other hand, always have one of the following objectives:

Government Protection: Increased concentration in an industry is a concern if there are artificial barriers to entry. One sure way to protect a market is to enlist the government’s help in locking it down. This happens in a variety of ways: tariffs and other restrictions on foreign goods, patent protection, restrictions on entry into geographic markets, implicit government guarantees against risk (too big to fail), union labor laws, and complex regulatory rules and compliance costs that small competitors can’t afford. The upshot is that if we want more competition in markets, we must reduce the size of the administrative state.

Subsidies: Another aspect of rent seeking is the quest for taxpayer subsidies. These are often channeled into politically-favored activities that can’t be sustained otherwise, and the recipients are always politically-favored firms with friends in high places. This is privilege! Look no further than the renewable energy industry to see that politically-favored, subsidized, and uneconomic activities tend to be dominated by firms with political connections. Naturally, good rent-seekers have an affinity for central planning and its plentiful opportunities for graft. With big-government control of resources you get big-time rent seeking.

Contracts: Government largess also means that big contracts are there to be won across a range of industries: construction, defense, transportation equipment, office supplies, computing, accounting and legal services and almost anything else. Because these purchases are made by an entity that uses other people’s money, incentives for efficiency are weak. And while private firms may compete for these contracts, there is no question that political connections play an important role. As government assumes control of more resources, more favorable rent-seeking opportunities always appear.

Influencing public policy is a game that is much easier for large firms to play. Moreover, the revolving door between government and industry is most active among strong players. This is not to say that large corporations don’t engage in many productive activities. They often excel in their areas of specialization and therefore earn profits that are economically legitimate. However, when government is involved as a buyer, subsidizer or regulator, the rewards are not as strongly related to productive effort. These rewards include above-normal profits, a more dominant market position, a long-term pipeline of taxpayer funding, the prestige of running a large operation with armies of highly-skilled employees engaged in compliance activities, and prestigious appointments for officers. Some of these gains from graft are shared by investors… and that’s probably you.

For society, the implications of channeling saving into rent-seeking activities are unambiguously negative. To say it differently, the private return to rent seeking exceeds the social return, and the latter is negative. Successful rent seekers artificially boost their equity returns and may simultaneously undermine returns to smaller competitors. The outcomes entail restraint of trade and misallocation of resources on a massive scale. The public-sector largess that makes it all possible gives us high rates of taxation, which retard incentives to work, save and invest. If taxes aren’t enough to cover the bloat, our central bank (the Fed) is not shy about monetizing government debt, which distorts interest rates, inflates asset prices and inflates the prices of goods. In the aggregate, these things warp the usual tradeoff between risk and return and worsen society’s provision for the future.

How should you feel about all this? And your portfolio? As an investor, you might not have much choice. It’s not your fault, so take your private returns where you can find them. Some firms swear off rent seeking of any kind, like Koch Industries, but it is not publicly traded. You could invest in a business of your own, but know that you might compete at a disadvantage to rent seekers in the same industry. Most of all, you should vote for lower subsidies, less regulation and less government!