Tags

#WeAreClosed, Brett Kavanaugh, Christine Blasey Ford, Coronavirus Relief, Faustian Bargain, Henry Ford, Mark Judge, Minimum Wage, Rental Assistance, Senate Judiciary Committee, Unemployment Compensation, Universal Basic Income

Mark Judge says he understands the real importance of #WeAreClosed, a hashtag that’s attained some popularity on Twitter in support of those having to choose between a return to low-paying jobs or continued unemployment benefits. Judge is a conservative author and an old high school friend of Supreme Court Justice Brett Kavanaugh. His notoriety soared in 2018 during Kavanaugh’s confirmation hearings. Christine Blasey Ford, who alleged that Kavanaugh sexually assaulted her more than 30 years before, said Judge had been in the room at the time. Judge offered to cooperate with investigators but denied any memory of the incident, and he was never compelled to testify before the Senate Judiciary Committee.

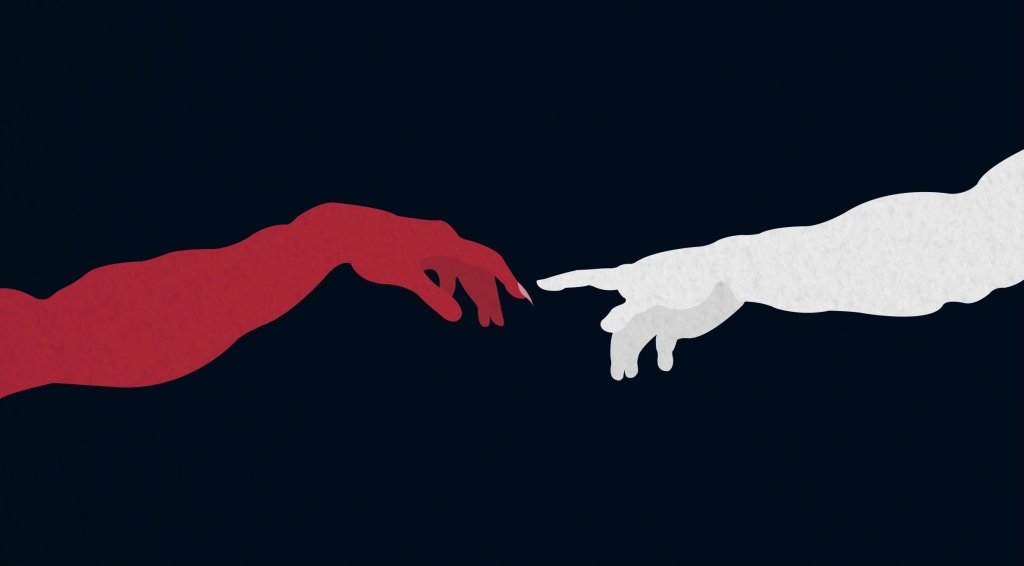

The Temptation of Joe Lunchpail

I often agree with Judge’s points of view, but not so much in the case of “We Are Closed”. I don’t think he’s identified the right problem or the right villain. He expresses sympathy for those who toil at jobs like dishwashing — and apparently he worked as a dishwasher in the not too distant past. I sympathize as well. It’s tough to make ends meet working a low-wage job. Judge views health insurance as indispensable, and that can take a big chunk out of a low earner’s paycheck. Child care can take another big chunk.

Of course, it’s easy to understand the dilemma faced by these potential re-entrants to the labor force. Under normal circumstances, a worker who is laid off or furloughed can expect to have 30% to 50% of their lost wages replaced by unemployment compensation, depending on the state. That’s somewhere between $500 to $850 a month for a worker earning $10 an hour. COVID assistance now adds another $300 a month, though a number of states will soon end those extended benefits. Still, for now, the extra $300 means the $10/hour worker can replace 50% to 70% of their income if they remain out of work. Rental assistance may also be available due to unemployment or a loss of income. Also, Obamacare premiums are subsidized at low income levels.

In addition to the incremental effect of a decision not to work, all those earning less than $75,000 a year are receiving checks for $1,400. It’s not dependent on being out of work, but it’s a cushion that might convince fence-sitters that marginal wages are not worthwhile for the time being. Any rational individual will weigh public aid against the prospect of a boring, physically demanding, low-wage position.

For the Intercession of Saintly Bosses

Judge cites Henry Ford as the kind of enlightened employer we need more of today. The story goes that Ford wanted his line workers to be able to afford the vehicles they produced, and he did pay his line workers more than the prevailing wage. After all, the technology he implemented made his workers highly productive. However, that he paid them enough to buy Model Ts is something of a myth. And paying employees on any basis other than their productivity is generally a bad business model.

Clearly Judge has large corporations in mind: “Companies that make millions in profit and have high-earning CEOs …” should pay their workers more, he says. It’s foolish to take the position that those “millions” represent some kind of fun money. While high profits surely reflect monopoly power or ill-gotten rents in some cases, my baseline assumption is that profits are necessary to attract the capital needed to maintain and grow a business. And CEO pay is a cheap target: high-level managerial talent is in very short supply. It’s an extremely competitive corner of the labor market, and one seldom gets there via shear nepotism, as Judge implies, or they won’t last long.

Large firms have traditionally paid premium wages. That might be a consequence of more rigorous screening of hires, and certainly large firms tend to have more productive capital per worker. There is some evidence that the large firm wage premium has diminished more recently. Still, if large firms made a regular practice of extracting excess profits by underpaying workers, that wage premium would be negative!

Recently we’ve seen several large corporations make waves by hiking wages in the relatively low-wage retail and food service industries. This includes Amazon, Costco (which has notoriously high labor productivity), Target, WalMart, and Chipotle. This is not so much a matter of enlightenment as it is a reaction to tight labor market conditions exacerbated by the #WeAreClosed” attitude.

Lucifer’s Leviathan

I’d like to cut Judge plenty of slack. He seems to understand work incentives, and he clearly believes work is more fulfilling and socially beneficial than life on the dole. He doesn’t advocate for a higher legal minimum or so-called “living wage”, at least not that I’m aware. Nevertheless, it’s important to note in this context that while a higher wage floor would help certain workers, it would harm the least productive and most needy, who are likely to lose hours or even their jobs if the pay rate threatens to exceed their contribution to output. Then there is the inevitable substitution of capital for labor, as automation becomes a more favorable alternative to higher wage payments. Those workers who keep their jobs may find deteriorated working conditions, as there are many margins along which employers are able to compensate for a higher wage. That includes the most obvious: higher customer prices. However, many small firms facing stiff competition might not be able to manage that. In the end, wage floors really don’t help the working poor, who pay higher prices and might well lose hours or their jobs.

Democrats have been unsuccessful in attaching a higher minimum wage to the Biden infrastructure bill, but they are using the post-pandemic labor shortage as a talking point in favor of putting it back in. It’s also being used in state-level negotiations over minimum wage legislation. Beefed-up COVID relief for workers, as well as the scare tactics regarding continuing COVID risks to workers, have helped to engineer tight labor market conditions and a higher reservation wage among potential workers. Firms are being forced to pay up or go without staff. The largest players with financial reserves may be only too willing to go along with it — we’ve already seen some evidence of that, which puts their smaller competitors in a real bind.

The conundrum faced by low-wage workers in the post-pandemic labor market just might offer a clue as to the impact of a universal basic income on labor force participation. That would bring us full circle to the point at which some will simply choose not to work. Unfortunately, politicians need only hear “Do Something!” to inspire incredibly crackpot policy initiatives. And that way lays the Beast!

The Final Judgement

I’m not sure Judge thought much about the market consequences of ongoing COVID relief or public aid in general. He’d like to see a higher equilibrium wage rate, but he’d surely have mixed feelings about the advantage it confers to large firms at the expense of small ones, given the strong sympathies and antipathies he expresses in his post.

Manual labor is hard! But in the end, low-wage earners who apply themselves and gain job experience can look forward to better things. It’s up to them to seek out the best employment relationship they can. Insisting that firms pay workers more than their productive value is not helpful. If anything, it may buttress political support for governments to impose wage mandates. Public efforts to “help” workers are at best uneven in their effects, helping some workers and harming others. That goes for minimum wages and many forms of public aid, especially the unconditional variety. Judge’s sympathies for those having to choose between returning to work and collecting aid are understandable, but they reflect the sad consequences of the knee-jerk temptation to offer public alms to those presently living and working below their aspirations.