Tags

Artificial Intelligence, central planning, Common Law, Data Science, Digital Socialism, Friedrich Hayek, Jesús Fernández-Villaverde, Machine Learning, Marginal Revolution, Property Rights, Robert Lucas, Roman Law, Scientism, The Invisible Hand, The Knowledge Problem, The Lucas Critique, Tyler Cowen

Artificial intelligence (AI) or machine learning (ML) will never make central economic planning a successful reality. Jesús Fernández-Villaverde of the University of Pennsylvania has written a strong disavowal of AI’s promise in central planning, and on the general difficulty of using ML to design social and economic policies. His paper, “Simple Rules for a Complex World with Artificial Intelligence“, was linked last week by Tyler Cowen at Marginal Revolution. Note that the author isn’t saying “digital socialism” won’t be attempted. Judging by the attention it’s getting, and given the widespread acceptance of the scientism of central planning, there is no question that future efforts to collectivize will involve “data science” to one degree or another. But Fernández-Villaverde, who is otherwise an expert and proponent of ML in certain applications, is simply saying it won’t work as a curative for the failings of central economic planning — that the “simple rules” of the market will aways produce superior social outcomes.

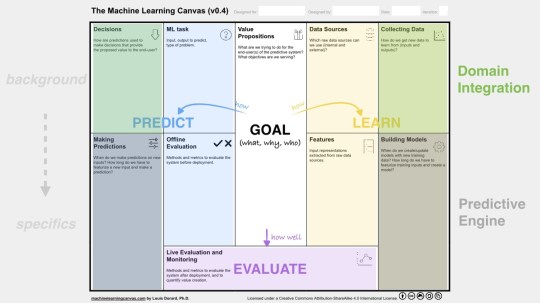

The connection between central planning and socialism should be obvious. Central planning implies control over the use of resources, and therefore ownership by a central authority, whether or not certain rents are paid as a buy-off to the erstwhile owners of those resources. By “digital socialism”, Fernández-Villaverde means the use of ML to perform the complex tasks of central planning. The hope among its cheerleaders is that adaptive algorithms can discern the optimal allocation of resources within some “big data” representation of resource availability and demands, and that this is possible on an ongoing, dynamic basis.

Fernández-Villaverde makes the case against this fantasy on three fronts or barriers to the use of AI in policy applications: data requirements; the endogeneity of expectations and behavior; and the knowledge problem.

The Data Problem: ML requires large data sets to do anything. And impossibly large data sets are required for ML to perform the task of planning economic activity, even for a small portion of the economy. Today, those data sets do not exist except in certain lines of business. Can they exist more generally, capturing the details of all economic transactions? Can the data remain current? Only at great expense, and ML must be trained to recognize whether data should be discarded as it becomes stale over time due to shifting demographics, tastes, technologies, and other changes in the social and physical environment.

Policy Change Often Makes the Past Irrelevant: Planning algorithms are subject to the so-called Lucas Critique, a well known principle in macroeconomics named after Nobel Prize winner Robert Lucas. The idea is that policy decisions based on observed behavior will change expectations, prompting responses that differ from the earlier observations under the former policy regime. A classic case involves the historical tradeoff between inflation and unemployment. Can this tradeoff be exploited by policy? That is, can unemployment be reduced by a policy that increases the rate of inflation (by printing money at a faster rate)? In this case, the Lucas Critique is that once agents expect a higher rate of inflation, they are unlikely to confuse higher prices with a more profitable business environment, so higher employment will not be sustained. If ML is used to “plan” certain outcomes desired by some authority, based on past relationships and transactions, the Lucas Critique implies that things are unlikely to go as planned.

The Knowledge Problem: Not only are impossibly large data sets required for economic planning with ML, as noted above. To achieve the success of markets in satisfying unlimited wants given scarce resources, the required information is impossible to collect or even to know. This is what Friedrich Hayek called the “knowledge problem”. Just imagine the difficulty of arranging a data feed on the shifting preferences of many different individuals across a huge number of products, services and they way preference orderings will change across the range of possible prices. The data must have immediacy, not simply a historical record. Add to this the required information on shifting supplies and opportunity costs of resources needed to produce those things. And the detailed technological relationships between production inputs and outputs, including time requirements, and the dynamics of investment in future productive capacity. And don’t forget to consider the variety of risks agents face, their degree of risk aversion, and the ways in which risks can be mitigated or hedged. Many of these things are simply unknowable to a central authority. The information is hopelessly dispersed. The task of collecting even the knowable pieces is massive beyond comprehension.

The market system, however, is able to process all of this information in real time, the knowable and the unknowable, in ways that balance preferences with the true scarcity of resources. No one actor or authority need know it all. It is the invisible hand. Among many other things, it ensures the deployment of ML only where it makes economic sense. Here is Fernández-Villaverde:

“The only reliable method we have found to aggregate those preferences, abilities, and efforts is the market because it aligns, through the price system, incentives with information revelation. The method is not perfect, and the outcomes that come from it are often unsatisfactory. Nevertheless, like democracy, all the other alternatives, including ‘digital socialism,’ are worse.”

Later, he says:

“… markets work when we implement simple rules, such as first possession, voluntary exchange, and pacta sunt servanda. This result is not a surprise. We did not come up with these simple rules thanks to an enlightened legislator (or nowadays, a blue-ribbon committee of academics ‘with a plan’). … The simple rules were the product of an evolutionary process. Roman law, the Common law, and Lex mercatoria were bodies of norms that appeared over centuries thanks to the decisions of thousands and thousands of agents.”

These simple rules represent good private governance. Beyond reputational enforcement, the rules require only trust in the system of property rights and a private or public judicial authority. Successfully replacing private arrangements in favor of a central plan, however intricately calculated via ML, will remain a pipe dream. At best, it would suspend many economic relationships in amber, foregoing the rational adjustments private agents would make as conditions change. And ultimately, the relationships and activities that planning would sanction would be shaped by political whim. It’s a monstrous thing to contemplate — both fruitless and authoritarian.