Tags

central planning, Chinese malinvestment, Densification, Detached Housing, Fannie Mae, Freddie Mac, High-density housing, Housing, Housing inflation, Joel Kotkin, New Geography, Oversupply, Regionalism, Too big to fail, Urban planning

How will the next housing bust play out? Joel Kotkin believes that it will be an unavoidable consequence of “high-density” policies imposed by central planners. That is Kotkin’s major theme in “China’s Planned City Bubble Is About To Pop—And Even You’ll Feel It“, an essay in New Geography.

Central planning generally achieves undesirable results because it is incapable of solving the “knowledge problem”. That is, planners lack the detailed and dynamic information needed to align production with preferences. Freely-operating markets do not face this problem because voluntary trade between individuals establishes prices that balance preferences with resource availability. There are severe frictions in the case of housing that slow the process, but it is almost as if central planners willfully ignore strong signals about preferences, instead promoting measures such as “containment policies” and “regionalism” that restrict choice and inflate home prices. Of course, the technocratic elite think they know what’s good for you!

Kotkin begins by drawing a contrast between policies that led to the last housing crisis and the short-sighted policies now in place that could lead to another:

“If the last real estate collapse was created due to insanely easy lending policies aimed at the middle and working classes, the current one has its roots largely in a regime of cheap money married to policies of planners who believe that they can shape the urban future from above.“

The list of bad government policies precipitating the last housing bust is long, and I have discussed them before here on Sacred Cow Chips. They included federal encouragement of loose lending standards, a strong bias favoring mortgage assets embedded in bank capital standards, the implicit federal guarantee of Fannie Mae and Freddie Mac against losses, the mortgage-interest income tax deduction, and an easy-money policy by the Federal Reserve. These all represent market distortions that led to a malinvestment of excess housing. Several of those policies are still in place, and today the presumption of “too-big-too-fail” financial guarantees by the federal government is as strong as ever, so risk is not adequately managed.

But the tale of today’s housing market woes told by Kotkin really begins in China, where the government has been on a high-density housing binge for a number of years:

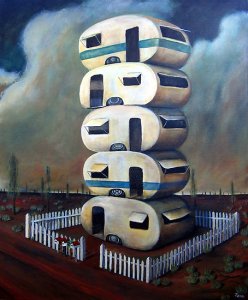

“As a highpoint in social engineering, a whole new dense city (Kangbashi) has been constructed by the Ordos, Inner Mongolia city government, in the middle of nowhere, growing, but still apparently mainly vacant. … The key here is not so much planning, per se, but planning in a manner that ignores the aspirations of people. Americans no more want to live stacked in boxes in the middle of nowhere than do their Chinese counterparts.“

Kotkin is too generous to central planning, and he is sloppy about the distinction between public and private planning efforts: while China’s current real estate difficulties may be a case of extreme negligence, central government planning always has and always will suffer from a mismatch between preferences and supplies that is strongly resistant to self-correction. Ultimately, resources are wasted. In any case, China’s easy monetary policy and efforts to “densify” led to an inflation of urban housing prices. The situation is unsustainable and the market is now extremely weak.

Can the U.S. “catch China’s cold”, as Kotkin suggests? That’s likely for several reasons. First, as noted by Kotkin, the Chinese government’s efforts to stabilize domestic asset prices and maintain economic growth have led to restrictions on foreign investment, which will undercut asset values in the U.S. (and even more in Australia). More importantly, governments in the U.S. have caught an extreme case of the “planning bug” with the same bias in favor of high density as the Chinese central planners:

“… increasingly, particularly during the Obama years, state planning agencies, notably in California, and the federal Department of Housing and Urban Development (HUD) have embraced a largely anti-suburban, pro-density agenda.“

Kotkin cites evidence of a strong preference among U.S. households for detached housing, but government authorities prefer to dictate their own vision of residential life:

“… like Soviet planners and their Chinese counterparts, our political elite and the planning apparat seem to care little about preferences, and have sought to limit single-family homes through regulations. This is most evident in California, notably its coastal areas, where house prices and rents have risen to hitherto stratospheric levels.

The losers here include younger middle and working class families. Given the regulatory cost, developers have a strong incentive to build homes predominately for the affluent; the era of the Levittown-style ‘starter home’, which would particularly benefit younger families, is all but defunct. Spurred by the current, highly unequal recovery, these patterns can be seen elsewhere, with a sharp drop in middle income housing affordability while the market shifts towards luxury houses.“

In an interesting aside, Kotkin emphasizes that high-density housing is often more expensive to construct than single-family homes, so it does not advance the cause of affordability, as is often claimed.

The close of Kotkin’s essay summarizes misguided policies now in place and the ominous conditions they have created in some of the nation’s most expensive housing markets:

“Today’s emerging potential bubble is driven in large part by low interest rates and a new post—TARP financial structure, anchored by ultra-low interest rates, which favor wealthy investors…. This, plus planning policies, has accelerated a boom in multi-family construction, much of it directed at high-end consumers. In New York and London, wealthy foreigners as well as the indigenous rich have invested heavily in high-rise apartments, many of which remain empty for much of the year. In San Francisco, for example, roughly half of all new condos are owned by non-residents, including both Chinese investors and Silicon Valley executives. … Since the vast majority of people cannot afford to buy these apartments, even if they want them, this kind of construction does little to address the country’s housing shortage.“

Housing policy has long been dominated by subsidies that encourage over-investment in housing. At the same time, restrictions increasingly limit the development of detached homes, which is what most people prefer. Local control over decisions about housing development is being compromised by intrusive federal policies of “regionalism” that demand more high-density housing in costly areas. These policies are unlikely to benefit low- and middle-income households, who are increasingly unable to afford the high cost of quality urban housing as either renters or buyers. Either prices must adjust downward, as Kotkin suggests, or more subsidies will be required to keep the bubble inflated. Like China, we will be unable to stave off a correction indefinitely.