Tags

Disablity, FICA Tax, Redistribution, Self-Directed Investments, Social Insurance, Social Security, Social Security Privatization, Social Security Returns, Social Security Trust Fund, Survivors' Benefits

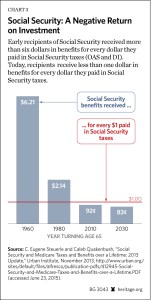

Social Security benefit levels are anything but sure for current workers, given the likelihood of benefit cuts to preserve the long-term solvency of the system. In fact, even without those cuts, Social Security provides very poor yields for retirees on their lifetime contributions. Instead of a tradeoff between risk and return, the system offers bad outcomes along both dimensions: lousy benefit levels that are not at all “safe”.

To get a clear sense of just how bad the returns on Social Security contributions (i.e., FICA tax deductions) truly are, take a look at this Sacred Cow Chips post from late 2015: “Stock Crash At Retirement? Still Better Than Social Security“. According to the Social Security Administration’s own calculations, without any future changes in the program, a retiree can expect to get back 1 to 4 times their lifetime contributions (obviously, this is not discounted). If you think that’s acceptable, consider a real alternative:

“Suppose you are given an option to invest your FICA taxes (and your employer’s [FICA] contributions) over your working life in a stock market index fund. After 40 years or so, based on historical returns, you’ll have stashed away about 12 – 18 times your total contributions (that range is conservative — 40 years through 2014 would have yielded 19x contributions). A horrible preretirement crash might leave you with half that much.“

Allowing workers to self-direct their contributions over a lengthy working life, whether they invest in equities, government bonds, or other assets, holds much more promise as a way to provide for their retirement needs.

As for risk, projected benefit levels are worse when possible program changes are considered. It’s widely accepted that changes must be made to the way contributions by current workers are handled and how future benefits are determined, or else the system’s value to them will be a greatly diminished. The Social Security Trust Fund, which once funded government deficits via FICA surpluses over benefit disbursements (while the demographics of the labor force allowed), has dwindled, and it has never been invested to earn the returns necessary for long-term solvency. Shall today’s workers face later eligibility? Reduced benefit levels? Or both? Or can we face up to the reality that workers will do better by choosing the way their funds are invested?

The contributions of today’s workers are paid out directly to current retirees. This practice must be modified, but the nation still faces a large and immediate liability to current retirees. How will it be paid if the system is overhauled to allow self-directed investment alternatives? Current workers must pay for some portion of that liability, but that portion could be phased out over several decades. The transition, however, would initially require additional taxes, borrowing, or voluntary conversion by some retirees to a discounted cash-balance equivalent, much as most private sector defined-benefit pensions have been converted to cash-balance equivalents.

Ultimately, workers should benefit from their own individual contributions. One objection is that self-directied investments and “privatization” of one’s own contributions would cause the system to lose its function as social insurance. Recall, however, that eligibility for benefits requires contributions, so it is not a general program of assistance. Nevertheless, there are several ways in which Social Security fulfills an insurance function. In a strong sense, it provides insurance against the risk of failure to save for retirement. More fundamentally, disabled workers can qualify for benefits, and the dependents of a deceased contributor are also eligible (survivors’ benefits). In addition, the current system provides greater returns to individuals with relatively low contributions. Under self-direction, these features could be retained via minor redistributional elements applied to investment returns, particularly given the superior returns available to equities over periods of sufficient length.

When U.S. politicians discuss the future of Social Security, they usually say they’ll fight against the dark intent of those who wish to take away hard-earned benefits from seniors. This despite the fact that few (if any) observers have suggested cutting benefits for current retirees, or even for those now approaching eligibility. The self-righteous proclamations about protecting retirees are a dodge that avoids the need to take a position on dealing with the system’s insolvency. But an easy answer is available: reform the system by allowing workers to self-direct their contributions into more promising investment vehicles.