Tags

Anti-Deficiency Act, Charles Blahous, Deficits, DI, Disability Income, Discretionary Budget, entitlements, Federal Reserve, Fiscal Inflation, Fiscal Tiger, Hospitalization Insurance, Joe Biden, Mandatory Spending, Medicaid, Medicare Part A, Medicare Part B, Medicare Part D, Medicare Reform, Medicare Trust Fund, Monetization, OASI, Old Age and Survivorship Income, Pay-As-You-Go, payroll taxes, SMI, Social Security Reform, Social Security Trust Fund, Student Loan Forgiveness, Supplementary Medical Insurance

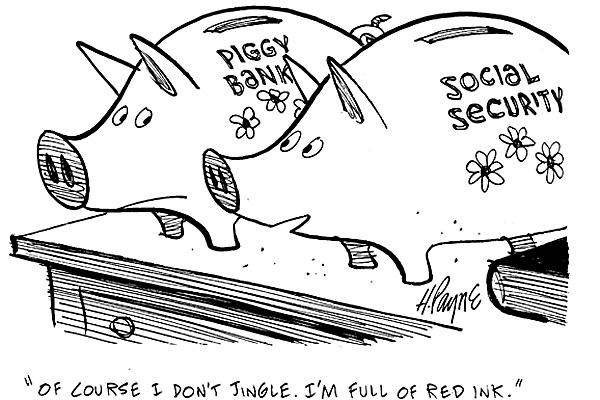

The Social Security and Medicare trust funds are starting to shrink, but as they shrink something else expands in tandem, roughly dollar-for-dollar: government debt. There is a widespread misconceptions about these entitlement programs and their trust funds. Many seem to think the trust funds are like “pots of gold” that will allow the government to meet its mandatory obligations to beneficiaries. But, in fact, the government will have to borrow the exact amounts of any “assets” that are “cashed out” of the trust funds, barring other reforms or legislative solutions. So how does that work? And why did I put the words “assets” and “cashed out” in quote marks?

The Trust Funds

First, I should note that there are two Social Security trust funds: one for old age and survivorship income (OASI) and one for disability income (DI). Occasionally, for summary purposes, the accounts for these funds are combined in presentations. There are also two Medicare trust funds: one for hospitalization insurance (HI – Part A) and one for Supplementary Medical Insurance (SMI – Parts B and D). The first three of these trust funds are represented in the chart at the top of this post, which is from the Summary of the 2021 Annual Reports by the Boards of Trustees. It plots a measure of financial adequacy: the ratio of trust fund assets at the start of each year to the annual cost. The funds are all projected to be depleted, HI and OASI much sooner than DI.

Fund Accumulation

The first step in understanding the trust funds requires a clearing up of another misconception: the payroll taxes that workers “contribute” to these systems are not invested specifically for each of those workers. These programs are strictly “pay-as-you-go”, meaning that the payroll taxes (and premiums in the case of Medicare) paid this year by you and/or your employer are generally distributed directly to current beneficiaries.

Back when demographics of the American population were more favorable for these programs, with a larger number of workers relative to retirees, payroll taxes (and premiums) exceeded benefits. The excess was essentially loaned by these programs to the U.S. Treasury to cover other forms of spending. So the trust funds accumulated U.S. Treasury IOUs for many years, and the Treasury pays interest to the trust funds on that debt. On the upside, that meant the Treasury had to borrow less from the public to cover its deficits during those years. So the government spent the excess payroll tax proceeds and wrote IOUs to the trust funds.

Draining the Funds

The demographic profile of the population is no longer favorable to these entitlement programs. The number of retirees has increased so that benefit levels have grown more quickly than program revenue. Benefits now exceed the payroll taxes and premiums collected, so the trust funds must be drawn down. Current estimates are that the Social Security Trust Fund will be depleted in 2034, while the Medicare Trust Fund will last only to 2026. These dates are reflected in the chart above. It is the mechanics of these draw-downs that get to the heart of the first “pot of gold” misconception cited above.

To pay for the excess of benefits over revenue collected, the trust funds must cash-in the IOUs issued to them by the Treasury. And where does the Treasury get the cash? It will almost certainly be borrowed from the public, but the government could hike other forms of taxes or reduce other forms of spending. So, while the earlier accumulation of trust fund assets meant less federal borrowing, the divestment of those assets generally means more federal borrowing and growth in federal debt held by the public.

Given these facts, can you spot the misconception in this quote from Fiscal Tiger? It’s easy to miss:

“In the cases of Social Security, Medicare, and Medicaid, payroll taxes provide some revenue. Social Security also has trust funds that cover some of the program costs. However, when the government is short on funds for these programs after getting the revenue from taxes and trust funds, it must borrow money, which contributes to the deficit.”

This kind of statement is all too common. The fact is the government has to borrow in order to pay off the IOUs as the trust funds are drawn down, roughly dollar-for-dollar.

A second mistake in the quote above is that federal borrowing to pay excess benefits after the trust funds are fully depleted is not really assured. At that time, the Anti-deficiency Act prohibits further payments of benefits in excess of payroll taxes (and premiums), and there is no authority allowing the trust funds to borrow from the general fund of the Treasury. Either benefits must be reduced, payroll taxes increased, premiums hiked (for Medicare), or more radical reforms will be necessary, any of which would require congressional action. In the case of Social Security (combining OASI and DI), the projected growth of “excess benefits” is such that the future, cumulative shortfall represents 25% of projected benefits!

Again, the mandatory entitlement spending programs are technically insolvent. Charles Blahous discusses the implications of closing the funding gap, both in terms of payroll tax increases or benefit cuts, either of which will be extremely unpopular:

“How likely is it that lawmakers would immediately cut benefits by 25% for everyone, rich and poor, retiring next year and beyond? More likely, lawmakers would phase in reforms gradually, necessitating much larger eventual benefit changes for those affected—perhaps 30% or 40%. And if we want to spare lower-income individuals from reductions, they’d need to be still greater for everyone else.”

It should be noted that Medicaid is also a budget drain, though the cost is shared with state governments.

Discretionary vs. Mandatory Budgets

When it comes to federal budget controversies, discretionary budget proposals receive most of the focus. The federal deficit reached unprecedented levels in 2020 and 2021 as pandemic support measures led to huge increases in spending. Even this year (2022), the projected deficit exceeds the 2019 level by over $160 billion. Joe Biden would like to spend much more, of course, though the loss of proceeds from his student loan forgiveness giveaway does not even appear in the Administration’s budget proposal. Biden proposes to pay for the spending with a corporate tax hike and a minimum tax on very high earners, including an unprecedented tax on unrealized capital gains. Those measures would be disappointing in terms of revenue collection, and they are probably worse for the economy and society than bigger deficits. None of that is likely to pass Congress, but we’ll still be running huge deficits indefinitely..

In a further complication, at this point no one really believes that the federal government will ever pay off the mounting public debt. More likely is that the Federal Reserve will make further waves of monetization, buying government bonds in exchange for monetary assets. (Of course, money is also government debt.) The conviction that ever increasing debt levels are permanent is what leads to fiscal inflation, which taxes the public by devaluing the public debt, including (or especially) monetary assets. The insolvency of the trust funds is contributing to this process and its impact is growing..

Again, the budget discussions we typically hear involve discretionary components of the federal budget. Mandatory outlays like Social Security, Medicare, and Medicaid are nearly three times larger. Here is a good primer on the mandatory spending components of the federal budget (which includes interest costs). Blahous notes elsewhere that the funding shortfall in these programs will ultimately dwarf discretionary sources of budgetary imbalance. The deficit will come to be dominated by the borrowing required to fund mandatory programs, along with the burgeoning cost of interest payments on the public debt, which could reach nearly 50% of federal revenues by 2050.

Conclusion

It would be less painful to address these funding shortfalls in mandatory programs immediately than to continue to ignore them. That would enable a more gradual approach to changes in benefits, payroll taxes, and premiums. Politicians would rather not discuss it, however. Any discussion of reforms will be controversial, but it’s only going to get worse over time.

Political incentives being what they are, current workers (future claimants) are likely to bear the brunt of any benefit cuts, rather than retirees already enrolled. Payroll tax hikes are perhaps a harder sell because they are more immediate than trimming benefits for future retirees. Other reforms like self-directed Social Security contributions would create better tradeoffs by allowing investment of contributions at competitive (but more risky) returns. Medicare has premiums as an extra lever, but there are other possible reforms.

Again, the time to act is now, but don’t expect it to happen until the crisis is upon us. By then, our opportunities will have become more hemmed in, and something bad is more likely to be promulgated in the rush to save the day.