Tags

Alan D. Viard, Biden Administration, Compliance Costs, corporate income tax, Edward Lane, Investment Incentives, Joseph Sullivan, L. Randall Wray, Milton Friedman, Off-Shoring, Peggy Musgrave, Physical Capital, Pricing Power, Regressive Tax, Richard Musgrave, Shifting the Burden, Tax Avoidance, Tax Foundation, Transfer Pricing, Transparency

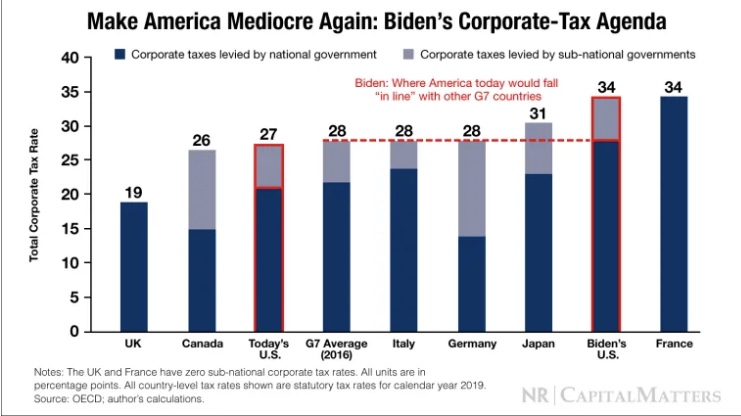

The Biden Administration is proposing a substantial increase in the corporate income tax rate from 21% to 28%. This is another case of a self-destructive policy that serves as a virtue signal to the progressive Left. See? We’re taxing the rich and their powerful corporations! What none of them realize is that the tax on corporate income is actually a regressive tax on consumers and workers; it is a disincentive to the formation of productive capital; and it is a highly wasteful tax due to compliance costs and the impact of avoidance. And the Biden proposal would make the U.S. less competitive internationally, as the chart above from Joseph Sullivan demonstrates. Maybe some of the proponents realize it, but they still like it because it sounds so good to their base!

It’s not as if all these unhealthy characteristics of the corporate tax are new findings. Milton Friedman explained some of the basics in 1971 when he said:

“The elementary fact is that ‘business’ does not and cannot pay taxes. Only people can pay taxes. Corporate officials may sign the check, but the money that they forward to Internal Revenue comes from the corporation’s employees, customers or stockholders. A corporation is a pure intermediary through which its employees, customers and stockholders cooperate for their mutual benefit.”

In 1984, two giants of public finance economics, Richard and Peggy Musgrave, investigated how the corporate tax was shifted to households. Here’s a description of their findings from a recent paper by Edward Lane and L. Randall Wray:

“… the bottom quintile pays 4.6–5.5 percent of its income toward the corporate profits tax, the top decile pays 2.5–3.7 percent of its income, and the ninth decile pays 2.4–2.9 percent of its income. They conclude that the corporate profits tax is largely regressive while the federal personal income tax is progressive.”

The incidence of the corporate tax rate falls primarily on workers in the form of lower wages and lost jobs, and on consumers in the form of higher prices. Lane and Wray cite several influential studies over the years showing a substantial negative association between corporate taxes and wages. As the authors note, major corporations often have pricing power in both product and labor markets, at least relative to their power in capital markets where they must raise capital. Capital markets are highly competitive, so they don’t provide much opportunity for shifting the burden of the tax to owners of equity and debt. There are limits on a firm’s ability to pass the tax along to customers and workers as well, of course, but shareholders are relatively well-insulated from the burden of the tax.

There are still other reasons to avoid increasing the corporate income tax rate. It currently raises about $200 billion annually for the U.S. Treasury, or about 7% of estimated federal tax revenue for the 2021 fiscal year. It also has extremely high compliance costs. Lane and Wray quote a 2016 Tax Foundation estimate that U.S. businesses face tax compliance costs on the order of $193 billion a year. Not all of that figure applies to corporations, and not all of it is for federal tax compliance, but a great deal of it is. There are also a number of ways the tax can be avoided, such as off-shoring operations and using overstated transfer prices of inputs obtained from units overseas. This is not an economically efficient way to generate tax revenue.

Moreover, the corporate income tax creates perverse incentives. When new investment in productive, physical capital is penalized at the margin, you can expect less capital investment, lower wages, and fewer jobs. Alan D. Viard explains that the dynamics of this mechanism take time to play out, but the longer-run decay in the capital stock is perhaps the most damaging aspect of a high corporate tax rate. And indeed, while there are probably short-run effects, the reduction in the incentive to invest is the real mechanism linking a higher corporate tax to reduced wages and higher prices, not to mention reduced economic growth.

Finally, there is a pernicious political-economic aspect of the corporate income tax owing to the difficulty for the general public in identifying its true incidence. This was also discussed by Milton Friedman:

“… Indirect effects make it difficult to know who ‘really’ pays any tax. But this difficulty is greatest for taxes levied on business. That fact is at one and the same time the chief political appeal of the corporation income tax, and its chief political defect. The politician can levy taxes, as it appears, on no one, yet obtain revenue. The result is political irresponsibility. Levying most taxes directly on individuals would make it far clearer who pays for government programs.

If the government intends to tax the owners of corporate wealth (a significant share of which is held in retirement savings accounts), it should be honest about doing so. That would mean taxing capital income in a more consolidated way, as Lane and Wray put it, at the individual level. That kind of transparency might be too much to hope for because the politics of doing so are much less favorable.

Meanwhile, the Biden Administration wants to have it all: higher corporate taxes and higher taxes on relatively high-earning individuals. But a significant burden of the corporate tax increase ultimately is shifted to individual workers and consumers. It is a regressive tax, and it is an inefficient tax with outrageously high compliance costs. It is a destructive tax because it undermines the economy’s growth in productive capacity. And it offers tax revenue to politicians who have little budgetary resolve, and with little political consequence.