Tags

Bernie Sanders, Child Development, Cradle to Grave Socialism, Ezra Klein, Federal funding, Fertility Decisions, Head Start, Hillary Clinton, Negative Incentives, Pre-Kindergarten Education, Pre-School For All, Socialization, Subsidies, Tennessee Pre-K Study, Universal Pre-K, Vox, Welfare State

Can the middle class be sold on federal pre-kindergarten dependency? Is pre-K always beneficial to children? All children? One of many issues agitating the “government-must-do-something” crowd is universal pre-kindergarten. It’s a favorite topic of the Socialist-Democrat Bernie Sanders and, more recently, it became a campaign promise from the Democrat-Socialist Hillary Clinton. It’s typical of the freebies these two presidential candidates are compelled to promise their base. While federal funding of universal pre-K is often billed as way to assist low-income working families, the subsidies proposed are not well-targeted: Clinton’s proposal calls for pre-K subsidies for middle-class families as well. A “Pre-School For All” proposal by President Obama in 2013 required $75 billion in funding. These kinds of broad-based transfer payments aren’t cheap.

In addition to the expense, it’s not clear that pre-K schooling is beneficial to all children. In Vox, Ezra Klein describes a recent study on the efficacy of a pre-K program in Tennessee (hat tip: John Crawford). The selection of children for the pre-K and control groups was randomized by virtue of a “lottery” for admission in regions experiencing excess demand. Here is Klein’s description of the results:

“At the end of pre-K, the results look pretty much as you would expect: Teachers rates [sic] the children who went through pre-K as ‘being better prepared for kindergarten work, as having better behaviors related to learning in the classroom and as having more positive peer relations.’

The problem is those results dissipate by the end of kindergarten — by then, the group that attended pre-K is no better off than the group that didn’t — and then begin to reverse by the end of first grade. By the end of second grade, the children who attended the pre-K program are scoring lower on both behavioral and academic measures than the children who didn’t.“

Klein cites two other “high-quality” studies (one by Head Start) that are consistent with the findings in Tennessee. He also notes some weaknesses of earlier studies suggesting that pre-K provides developmental benefits.

Some prominent advocates of pre-K insist that there are long-term benefits that the recent studies fail to capture. If so, it is hard to square that belief with such negative results after three years. I suspect that there are significant developmental rewards for children who spend their days with family members or even family friends, and I am skeptical that improved socialization can be gained from full-time attendance at a public facility. Perhaps some children benefit, but clearly not all.

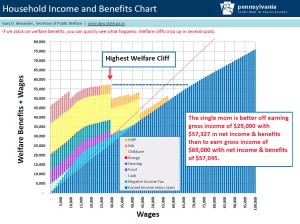

None of this is to suggest that low-income parents would not benefit economically from additional subsidies for early education. To the extent that the parents are able to earn more income, the entire household will benefit and perhaps even society will benefit. But this is a social safety net issue at its base, not a broad-based social need. Ideally, one’s prospects for income should have a strong bearing on fertility decisions. Individual families should not expect others to bear the costs. And as for the safety net, let’s face it, great parts of it would be unnecessary in the absence of the negative work and family incentives inherent in many transfer programs. Neutralizing the costs of raising children compounds the bad incentives.

Like so many other statist misadventures, the populist appeal of universal pre-K is a desire for a freebie at the expense of others. The politicians Sanders, Clinton and Obama understand that, and they recognize it as another pillar of support for the great federal highway of cradle-to-grave serfdom.