Tags

Bond Market, Deficit Reduction, DOGE, DOGE Dividend, Donald Trump, Elon Musk, Federal Reserve, Fiscal policy, Gaza, Greenland, Jerome Powell, Marginal Revolution, Matt Yglesias, Mineral Rights, Prodding Diplomacy, Sovereign Wealth Fund, Treasury Debt, Tyler Cowen, Ukraine

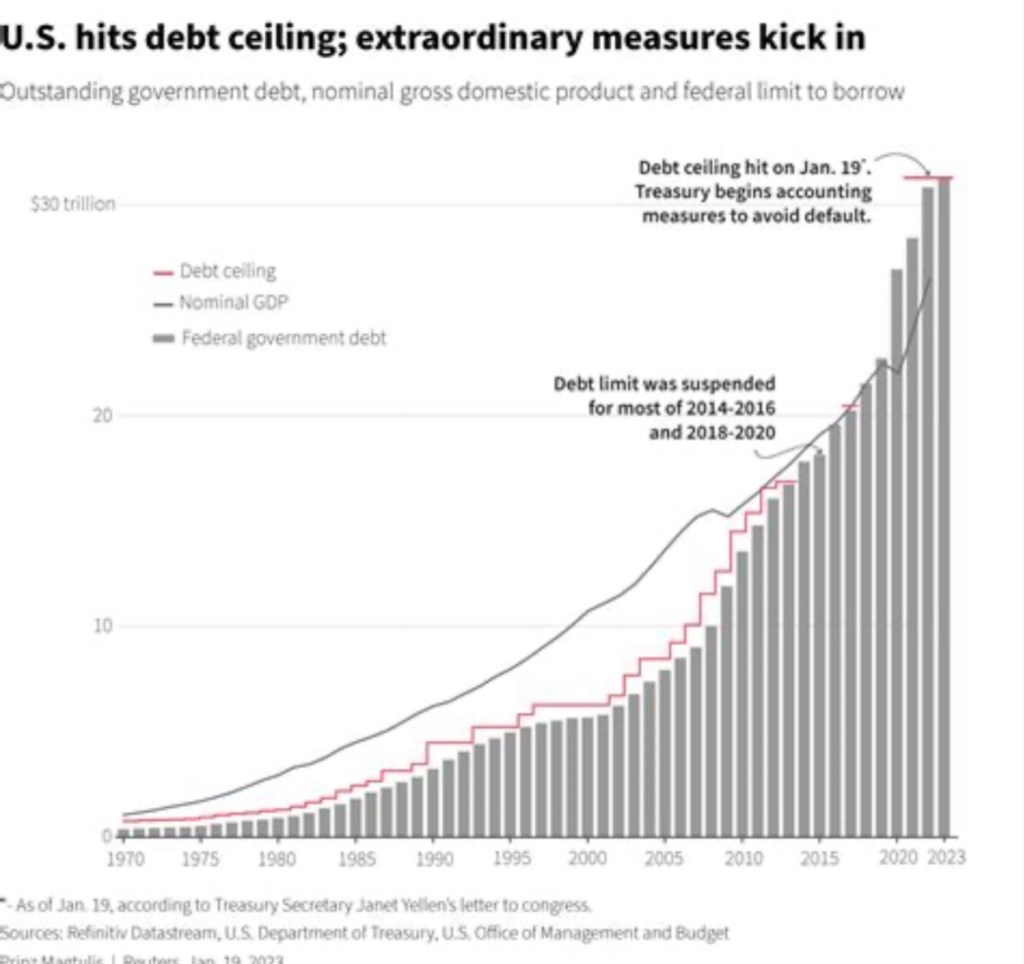

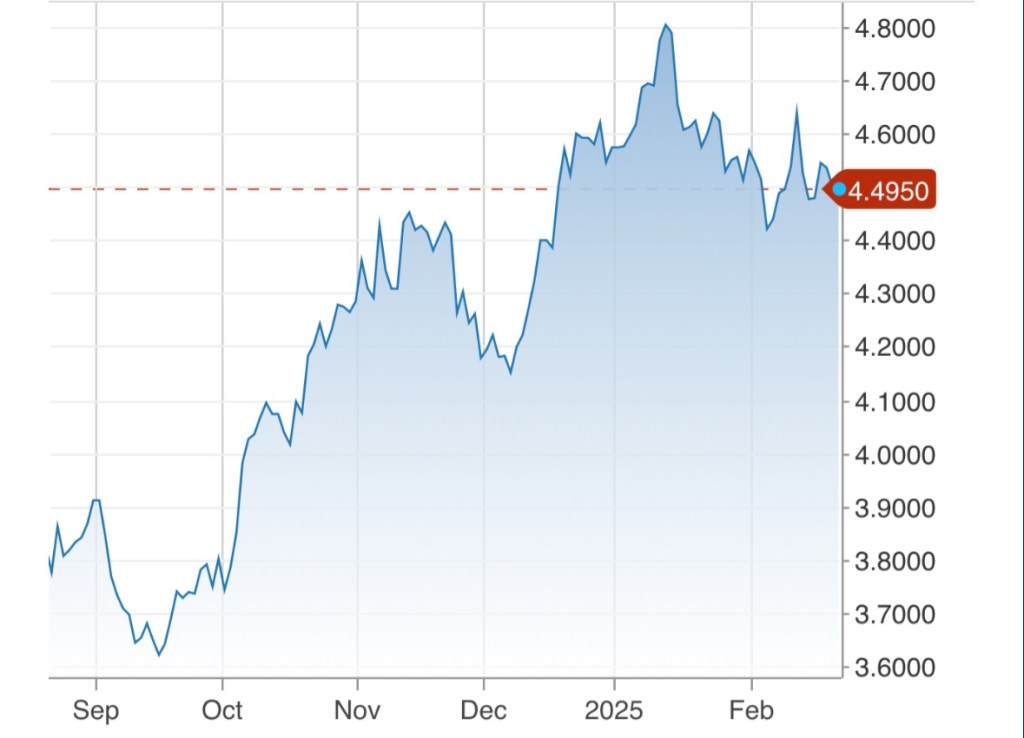

Matt Yglesias tweeted on X that “the bond market does not appear to believe in DOGE”. He included a chart much like the updated one above to “prove” his point. Tyler Cowen posted a link to the tweet on Marginal Revolution, without comment … Cowen surely must know that any such conclusion is premature, especially based on the movement of Treasury yields over the past month (or more, since the market’s evaluation of the DOGE agenda preceded Trump’s inauguration).

Of course, there is a difference between “believing” in DOGE and being convinced that its efforts should have succeeded in reducing interest rates immediately amidst waves of background noise from budget and tax legislation, court challenges, Federal Reserve missteps (this time cutting rates too soon), and the direction of the economy in general.

In this case, perhaps a better way to define success for DOGE is a meaningfully negative impact on the future supply of Treasury debt. Even that would not guarantee a decline in Treasury rates, so the premise of Yglesias’ tweet is somewhat shaky to begin with. Still, all else equal, we’d expect to see some downward pressure on yields if DOGE succeeds in this sense. But we must go further by recognizing that DOGE savings could well be reallocated to other spending initiatives. Then, the savings would not translate into lower supplies of Treasury debt after all.

Certainly, the DOGE team has made progress in identifying wasteful expenditures, inefficiencies, and poor controls on spending. But even if the $55 billion of estimated savings to date is reliable, DOGE has a long way to go to reach Musk’s stated objective of $2 trillion. There are some juicy targets, but it will be tough to get there in 17 more months, when DOGE is to stand down. Still, it’s not unreasonable to think DOGE might succeed in accomplishing meaningful deficit reduction.

But if bond traders have doubts about DOGE, it’s partly because Donald Trump and Elon Musk themselves keep giving them reasons. In my view, Musk and Trump have made a major misstep in toying with the idea of using prospective DOGE savings to fund “dividend checks” of $5,000 for all Americans. These would be paid by taking 20% of the guesstimated $2 trillion of DOGE savings. Musk’s expression of interest in the idea was followed by a bit of clusterfuckery, as Musk walked back his proposal the next day even as Trump jumped on board. PLEASE Elon, don’t give the Donald any crowd-pleasing ideas! And don’t lose sight of the underlying objective to reduce the burden of government and the public debt.

Now, Trump proposes that 60% of the savings accomplished by DOGE be put toward paying for outlays in future years. Sure, that’s deficit reduction, but it may serve to dull the sense that shrinking the federal government is an imperative. The mechanics of this are unclear, but as a first pass, I’d say the gain from investing DOGE savings for a year in low-risk instruments is unlikely to outweigh the foregone savings in interest costs from paying off debt today! Of course, that also depends on the future direction of interest rates, but it’s not a good bet to make with public funds.

Nor can the bond market be comforted by uncertainty surrounding legislation that would not only extend the Trump tax cuts, but will probably include various spending provisions, both cuts and increases. As of now, the mix of provisions that might accompany a deal among GOP factions is very much up in the air.

There is also trepidation about Trump’s aggressive stance toward the Federal Reserve. He promises to replace Jerome Powell as Fed Chairman, but with God knows whom? And Trump jawbones aggressively for lower rates. The Fed’s ill-advised rate cuts in the fall might have been motivated in part by an attempt to capitulate to the then-President Elect.

Trump’s Executive Order to create a sovereign wealth fund (SWF), which I recently discussed here, is probably not the most welcome news to bond investors. All else equal, placing tax or tariff revenue into such a fund would reduce the potential for deficit reduction, to say nothing of the idiocy of additional borrowing to purchase assets.

Finally, Trump has proposed what might later prove to be massive foreign policy trial balloons. Some of these are bound up with the creation of the SWF. They might generate revenue for the government without borrowing (mineral rights in Ukraine? Or Greenland?), but at this point there’s also a chance they’ll create massive funding needs (Gaza development?). Again, Trump seems to be prodding or testing counterparties to various negotiations… prodding diplomacy. It’s unlikely that anything too drastic will come of it from a fiscal perspective, but it probably doesn’t leave bond traders feeling easy.

At this stage, it’s pretty rash to conclude that the bond market “doesn’t believe in DOGE”. In fact, there is no doubt that DOGE is making some progress in identifying potential fraud and inefficiencies. However, bond traders must weigh a wide range of considerations, and Donald Trump has a tendency to kick up dust. Indeed, the so-called DOGE dividend will undermine confidence in debt reduction and bond prices.