Tags

Airbnb, Bryan Caplan, Build Baby Build, Fertility, Frederic Bastiat, Height Restrictions, Home Vacancies, Housing Developers, Housing Subsidies, Kevin Erdman, Labor Mobility, Lot Sizes, NIMBYism, Rent Control, Ryan Bourne, Seen and Unseen, The War on Prices, Urban Density, Veronique de Rugy, Zoning

Housing costs are taking a toll on many Americans. Home prices have risen about 47% cumulatively since 2020, while higher mortgage rates have compounded the difficulties faced by potential homebuyers. Meanwhile, rents are up about 23% over the same period. There just aren’t enough homes available, and the primary cause is an extensive set of regulatory obstacles to increasing the supply of homes.

High housing costs are often blamed on various manifestations of greed. Renters tend to resent their landlords, while those suffering from housing sticker-shock sometimes cast paranoid blame on people with second homes, investor properties, Airbnb rentals, and even residential developers, as if those seeking to build new housing are at the root of the problem.

Quite the contrary: we have an acute shortage of housing. The chart below shows how home vacancy rates have fallen to a level that can’t accommodate the normal frictions associated with housing turnover.

Doubts about this shortfall might owe to confusion over the meaning of one statistic: our high current level of housing units per capita. It does not indicate a plentiful stock of housing, as some assume. Alex Tabarrok, in commenting favorably on a lengthier post by Kevin Erdman, offers a simple example demonstrating that units per capita is not a reliable guide to the adequacy of housing supply:

“Suppose we have 100 homes and 100 families, each with 2 parents and 2 kids. Thus, there are 100 homes, 400 people and 0.25 homes per capita. Now the kids grow up, get married, and want homes of their own but they have fewer kids of their own, none for simplicity. Imagine that supply increases substantially, say to 150 homes. The number of homes per capita goes up to 150/400 (.375), an all time high! Supply-side skeptics are right about the numbers, wrong about the meaning. The reality is that the demand for homes has increased to 200 but supply has increased to just 150 leading to soaring prices.”

Fewer kids have led to more homes per capita even as we suffer from a shortage of housing. In the long run, lower fertility might make it easier for housing supply to catch up with demand, but not if government continues to hamstring housing construction. Only new construction can rectify this shortfall.

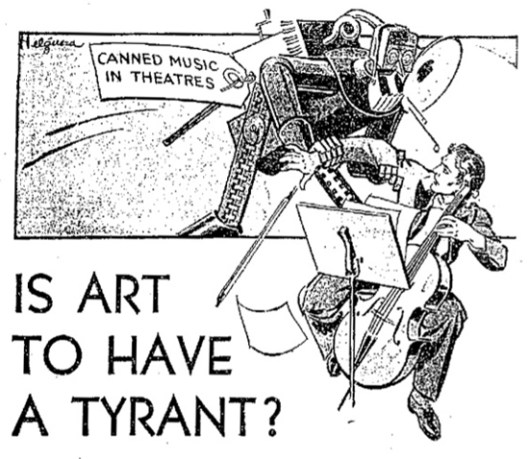

That’s the message of Bryan Caplan’s “Build Baby, Build!”. Caplan has been a prominent advocate of eliminating obstacles to the construction of new housing. His book is rather unique in its contribution to economic literature because it tells the story of counterproductive housing policy in the form of a “graphic novel”, which is to say an elaborate comic book. Caplan appears in the book as protagonist, teacher and persistent gadfly.

Government obstructs additions to the supply of housing in a variety of ways: rent controls, zoning laws, density restrictions, height limits, environmental rules, and compliance paperwork. And very often these interventions are supported by existing occupants and even owners of existing homes as a matter of NIMBYism. Construction of new homes, the sure answer to the problem of an inadequate supply of housing, is actively resisted. These limitations have widespread implications for the health of the economy.

As Caplan points out, the scarcity and expense of housing limits mobility, so workers are often unable to exploit opportunities that require a move, particularly to areas of rapid growth. This makes it difficult for the labor market to adjust to negative shocks or long-term decline that might displace workers in specific locales. The mobility of resources is key to well-functioning economy, but our policies fail miserably on this count.

Rent control is an insidious policy option usually favored in dense urban areas by current renters as well as politicians seeking a visible and easy “fix” to rising rental rates. The problem is obvious: rent control destroys incentives to improve or even maintain properties. Depending on specific rules, it might even discourage development of new rental units. The result is a slow decay of the existing housing stock.

Zoning laws are an old tool of NIMBYism. The objective is to keep multifamily housing (or certain kinds of commercial development) safely away from single-family neighborhoods, or to prevent developments with relatively small lot sizes. There is also agricultural zoning, which can prevent new development along urban peripheries. It’s not difficult to understand how restrictive zoning causes rents and housing prices to escalate.

Similarly, density limits, height restrictions, burdensome filing requirements, and environmental rules all work to limit the supply of new homes.

As if crushing the supply side wasn’t enough, housing costs will come under pressure from the demand side as the Biden Administration pushes new home buying subsidies. They propose tax credits of $400 a month (at least while mortgage rates remain elevated) and an end to title insurance fees on government-backed mortgages. This would drive prices higher still. The Administration also threatens to prosecute landlords who “collude” in utilizing third-party algorithms for information in establishing rental rates. Finally, Biden proposes to dedicate billions to the construction of affordable housing, but the history of affordable housing initiatives and building subsidies is one of drastically inflated costs. This is unlikely to differ in that regard.

As wrongheaded as it is, the fact that the public is often favorably disposed to so much housing regulation is easy to understand. Rent controls prevent increases in rents to existing tenants, an easily “seen” benefit. The deleterious long-term consequences on the stock of housing are “unseen”, in the language of Frederic Bastiat.

As for zoning, homeowners are resistant to the construction of nearby “low-value” units for a variety of reasons, some aesthetic and some practical, like maintaining home values or preventing excessive traffic. “Keeping the riffraff out” is undoubtedly at play as well.

This resistance extends well beyond the limits of enforcing private property rights. It is pure rent seeking behavior in the public sphere for private benefit. Politicians and government officials tend to view the motives behind zoning as sensible, however, despite the long-term consequences of strict zoning for housing supply. Similarly, environmental restrictions sound well and good, but they too have their “unseen” negative consequences.

Most puzzling is the animus with which so many regard private residential developers, who generally build what people want: low-density suburban enclaves. Developers do it for profit, but this alienates voters who are ignorant of the economic role of profit. As in any other pursuit, profit creates a basic incentive for development activity, and to provide the kinds of homes and neighborhood amenities demanded by consumers, and to do so efficiently.

On the other hand, sprawling development inflicts external costs on incumbent residents due to added congestion, and developers and their home buyers benefit from the provision of roads that are free to users. The solution is to internalize the cost of building roads by pricing their use. Homebuyers would then weigh the value of buying in a particular area against the full marginal cost, including road use, while helping to defray the cost of maintenance and upgrades to roads and other infrastructure.

Our housing policies restrict the actions of landlords, developers, and ultimately consumers of housing. The misallocations of resources occur every time a tenant or homeowner feels they can’t afford to move in response to changing circumstances. Here is Veronique de Rugy, in an article inspired by Ryan Bourne’s “The War on Prices”, on the constraints imposed on individuals by one form of misguided intervention (my bracketed additions):

“Prices and wages [and housing rents] set on market dynamics reflect underlying economic realities and then send out a signal for help. Price [rent] controls only mask these realities, which inevitably worsens the economy’s ability to respond with what ordinary consumers and workers need.“

But our housing problem is not solely caused by interference with the price mechanism. Rather, excessive regulation of rents and a panoply of other details of the legal environment for housing have led to our current shortfall. The lesson is deregulate, and to let developers build (and rehabilitate) the housing that people need.