Tags

Budget Deficit, Budget Neutrality, Budget Recissions, DEI Initiatives, DOGE, Donald Trump, Eric Beohm, Hawk Tuah Coin, House Budget Resolution, Medicaid Fraud, Overtime, Social Security, Strategic Bitcoin Reserve, Tariffs, TIPS, Trade War, Treasury Yields

No sooner had I posted this piece on the bond market’s bemused reaction to DOGE’s cost-cutting potential than Treasury rates began to drop sharply. The 10-year Treasury note fell by about 30 basis points over the course of a week. It’s stabilized and up a little since then, but that drop had little to do with DOGE and everything to do with uncertainty about Trumpian policies and signs of a flagging economy.

Despite those probable causes, the excitement of falling rates prompted the author of this article to dive headlong into fantasy: “Interest Rates Are Falling Thanks to Cuts in Government Spending”. I hope he’s right that real cuts in government spending will be forthcoming, but that’s highly speculative at this point.

In fact, markets are grappling with massive uncertainties at the moment. Under these circumstances, a preference for safety among investors means a flight to low-risk assets like treasuries, forcing their prices up and yields down.

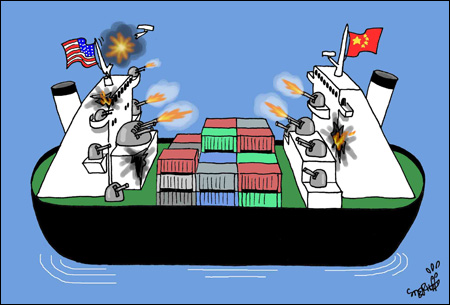

Tariff threats against long-time allies and adversaries alike are a huge source of uncertainty for markets, especially given Trump’s unpredictable thrusts and parries. The burden of U.S. tariffs falls largely on American buyers and tariffs are of limited revenue potential. They have already prompted announcements of retaliation, so the possibility of a trade war is real, which would create a major disruption in economic activity. This portent comes atop growing signs that a slowdown is already underway in the U.S. economy. As Eric Boehm notes, tariffs are all costs and no benefits, and their mere prospect adds significant risk to the economic and political outlook.

Budgetary developments have also been unsettling to markets. Despite promises of reduced federal spending, signs point to even larger deficits. The budget resolution passed by the House of Representatives in late February calls for various spending reductions, but it would extend the Trump tax cuts and increase defense and border control spending. On balance, deficits under the bill would be higher by $4 trillion over 10 years. That is not reassuring, and Trump still wants to eliminate taxes on tips, overtime, and Social Security benefits, which would require separate legislation. State and local tax deductions are also a hot topic. All this obviously undermines the notion that investors should take a rosy view of the outlook for reduced Treasury borrowing under Trump. Of course, higher deficits would be expected to push Treasury rates upward, but the point here is that on balance, DOGE and the Trump Administration have yet to provide a convincing case that rates should decline.

Every week the administration finds a way to demonstrate its lack of seriousness with respect to paying off the public debt. First we had the $5,000 “DOGE dividend” to all Americans. And last week a Strategic Bitcoin Reserve was authorized by Executive Order, to be funded by crypto asset forfeitures and civil penalties. While this type of funding technically qualifies as “budget neutral”, the better alternative would be to put those funds toward paying off debt. In any case, the whole idea makes about as much sense as a Hawk Tuah coin reserve.

The desire for safe assets is perhaps made more urgent by the bellicosity of Trump’s foreign policy initiatives. His multiple mentions of World War III simply can’t go over well with risk-averse investors. Rightly or wrongly, he’s thrown down the gauntlet with both Iran and Hamas, and he’s taken a fairly confrontational line with Greenland, Panama, Canada, Mexico, Venezuela, China, Russia, and especially (and unfairly) Ukraine. Ah, yes, all in the spirit of negotiating deals. We shall see.

As for DOGE, I’m a big fan of its mission to reduce waste and fraud in government, though its reporting of specific accomplishments thus far has been shrouded by inconsistencies and confusion. DOGE claims to have secured $105 billion in savings in the first six weeks of the Trump presidency, but that figure includes asset sales, which can pay down debt but aren’t deficit reduction. It’s also not clear how adverse court orders are reflected in the figure. For that matter, the reported savings are not given with any time dimension. The real savings thus far certainly don’t add up to $105 billion per year. And even at face value, those savings won’t get DOGE to its goal of $2 trillion in deficit reduction by July 2026 without some spectacular wins along the way. Medicaid fraud might be a big one, but that remains to be seen. This report on DEI initiatives by agency also offers some promising targets. (But now, apparently DOGE’s goal has been scaled back to $1 trillion in savings).

And there is one other hurdle: even after DOGE and the Administration identify and impound amounts already authorized, the savings will not be permanent without congressional action on budgetary recissions. That could be tough.

So the bond market is rightly skeptical of whether DOGE and the Administration can achieve major and permanent reductions in federal deficits. The recent drop in rates has much more to do with the economy and an array of uncertainties surrounding the values of risk assets.