Tags

dependency, economic growth, Heritage Foundation, Obamanomics, Redistribution, stagnation, Stephen Moore, The Daily Kos

Sorry for the sarcasm, but I always have to laugh when I see that meme from The Daily Kos congratulating President Obama for a job well done. It lists some misleading, cherry-picked statistics about the economy, pre- and post-Obama, and it attributes certain outcomes to the president over which he has absolutely no control. Would it be unfair to say that Obama had any control over the lousy outcomes cited by Stephen Moore in “Obamanomics victimizes president’s biggest supporters most“? Probably not, because this is exactly where an economic philosophy based on redistribution takes you: increasing dependency on the state. That’s economic cannibalism, and it is sad, though in fairness it must also be said that the big-government Bush years were a period of relatively stagnant median income growth.

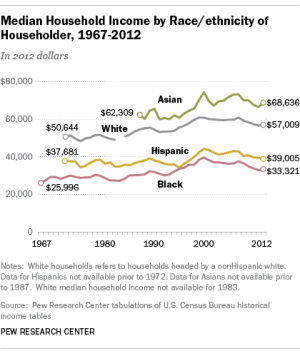

As Moore says, “Income redistribution is not an economic strategy for growth. It’s a lifeboat strategy. It would be hard to point to a single initiative the Obama administration has proposed that would help businesses grow and invest.” And so we see that certain groups — blacks, hispanics, Americans with a high-school education or less, and single women with children — have all suffered disproportionately under President Obama relative to the median family, and the median family has nothing to brag about, having weathered more than a 3% decline in income since June 2009. See the chart in Moore’s article. The one inserted above is a little older, but it shows growth over a longer period by race.

My apologies for the obnoxious pop-up ads that appear when you go to the link with Moore’s article.