Tags

Consumer Sentiment, Core PCE, Federal Funds Rate Target, Federal Open Market Committee, Hard Landing, Inflation, Jamie Diamond, Labor Market, Leading Indicators, Long and Variable Lags, Milton Friedman, Money Growth, Neutral Real Rate, Quantitative Tightening, Real Interest Rates, Real Wages, Recession, Scott Sumner, Soft Landing, Tight Money

The joke’s on me, but my “out” on the question above is “long and variable lags” in the impact of monetary policy, a description that goes back to the work of Milton Friedman. If you call me out on my earlier forebodings of a hard landing or recession, I’ll plead that I repeatedly quoted Friedman on this point as a caveat! That is, the economic impact of a monetary tightening will be lagged by anywhere from 9 to 24 months. So maybe we’re just not there yet.

Of course, maybe I’m wrong and we won’t have to get “there”: the rate of inflation has indeed tapered over the past year. A soft landing now seems like a more realistic possibility. Still, there’s a ways to go, and as Scott Sumner says, when it comes to squeezing inflation out of the system, “It’s the final percentage point that’s the toughest.” One might say the Federal Reserve is hedging its bets, avoiding further increases in its target federal funds rate absent evidence of resurging price pressures.

Strong Growth or Mirage?

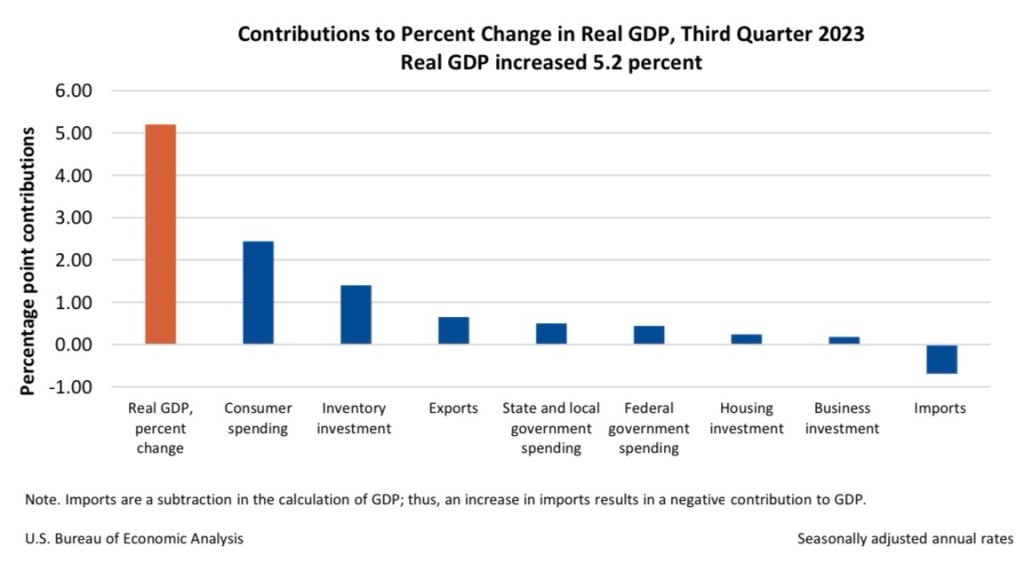

Economic growth is still strong. Real GDP in the third quarter grew at an astonishing 5.2% annual rate. A bulge in inventories accounted for about a quarter of the gain, which might lead to some retrenchment in production plans. Government spending also accounted for roughly a quarter, which corresponds to a literal liability as much as a dubious gain in real output. Unfortunately, fiscal policy is working at cross purposes to the current thrust of monetary policy. Profligate spending and burgeoning budget deficits might artificially prop up the economy for a time, but it adds to risks going forward, not to mention uncertainty surrounding the strength and timing in the effects of tight money.

Consumers accounted for almost half of the third quarter growth despite a slim 0.1% increase in real personal disposable income. That reinforces the argument that consumers are depleting their pandemic savings and becoming more deeply indebted heading into the holidays.

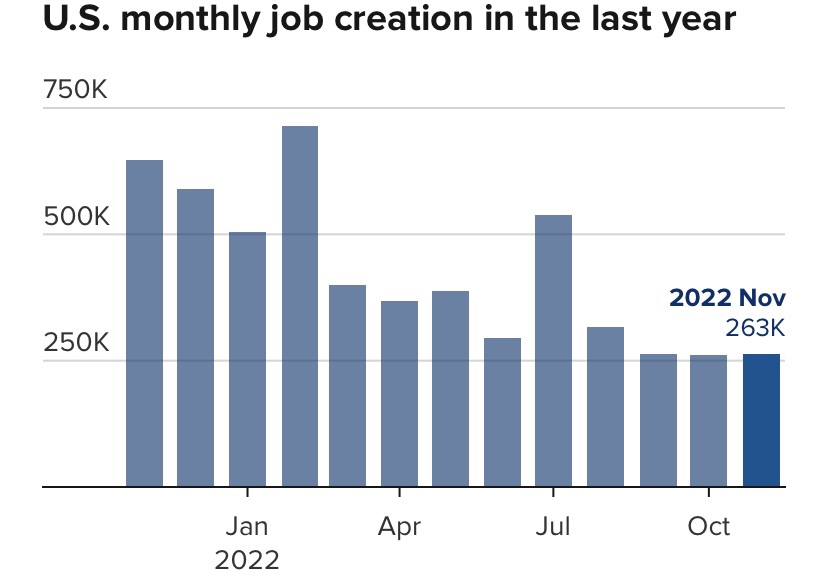

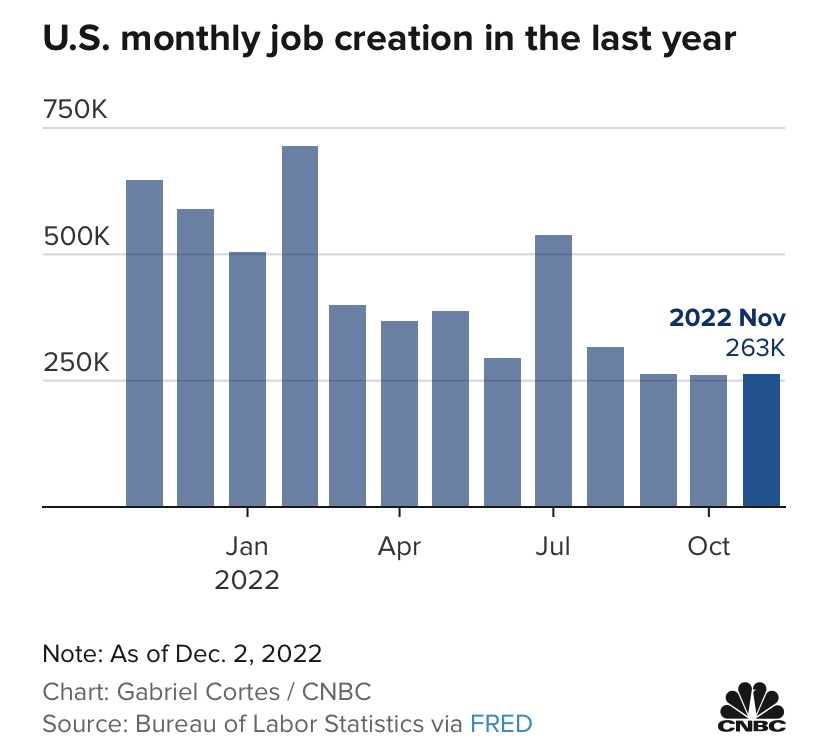

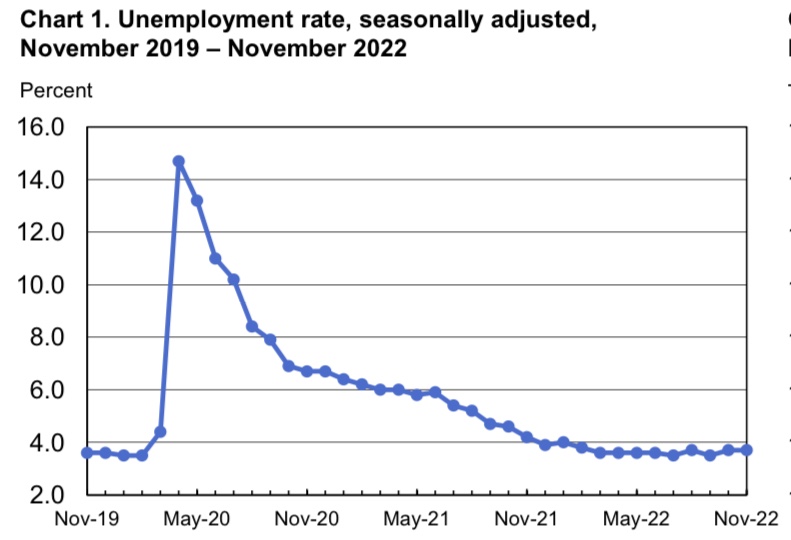

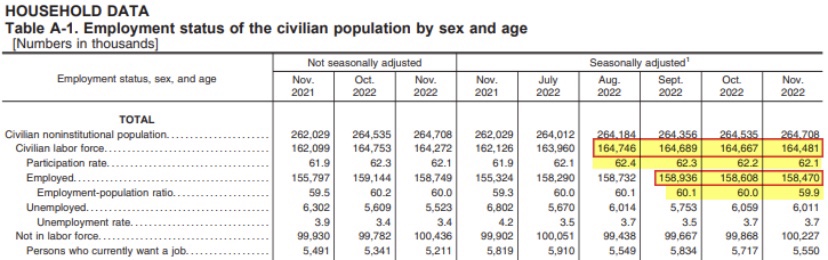

The economy continues to produce jobs at a respectable pace. The November employment report was slightly better than expected, but it was buttressed by the return of striking workers, and retail and manufacturing jobs declined. Still, the unemployment rate fell slightly, so the labor market has remained stronger than expected by most economists.

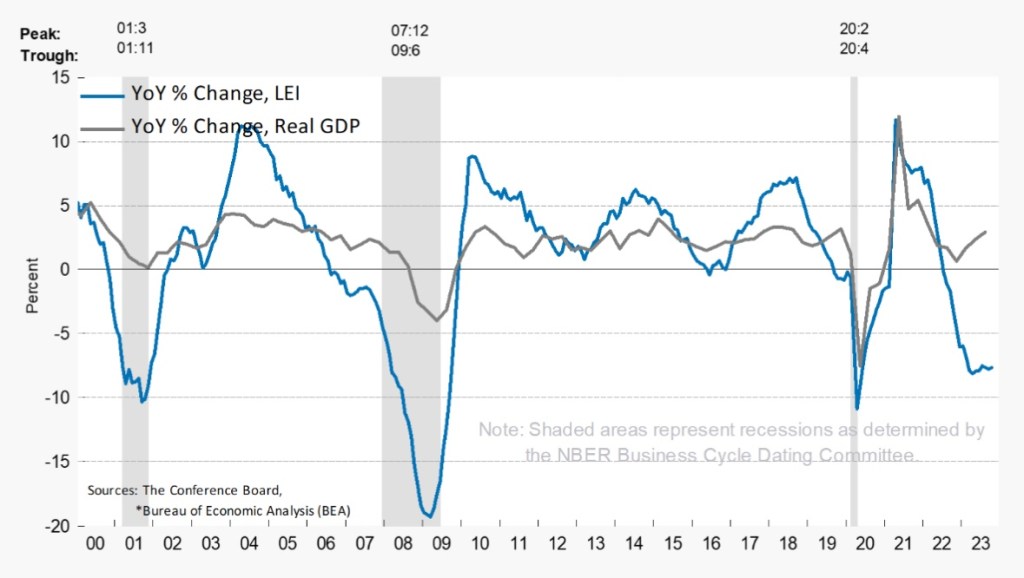

Consumer sentiment had been in the dumps until the University of Michigan report for December, which erased four months of declines. The expectations index is one component of the leading economic indicators, which has been at levels strongly suggesting a recession ahead for well over a year now. See the chart below:

But expectations improved sharply in November, and that included a decline in inflation expectations.

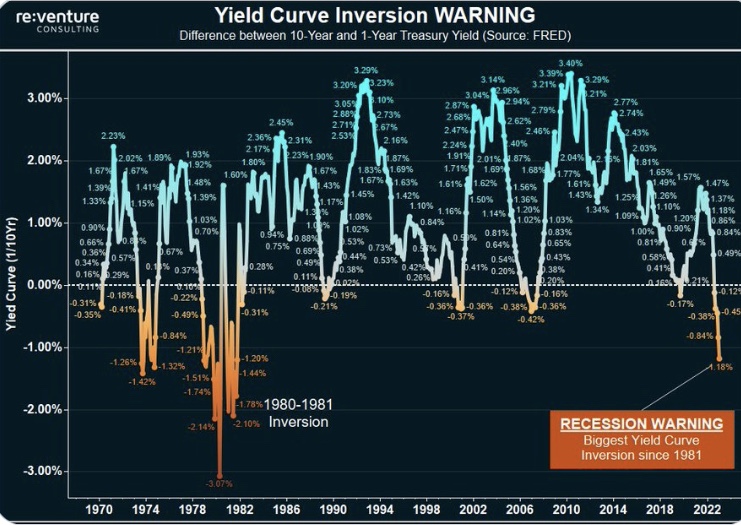

Another component of the LEI is the slope of the yield curve (measured by the difference between the 10-year Treasury bond yield and the federal funds rate). This spread has been a reliable predictor of recessions historically. The 10-year bond yield has declined by over 90 basis points since mid-October, a sign that bond investors think the inflation threat is subsiding. However, that drop steepened the negative slope of the yield curve, meaning that the recession signal has strengthened.

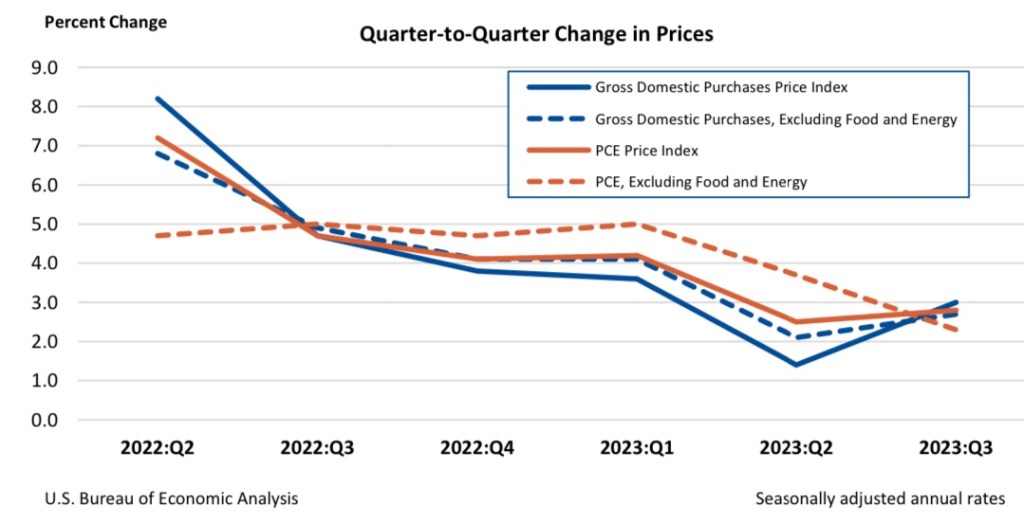

Disinflation, But Still Inflation

Inflation measures have been slowing, and the Fed’s “target” inflation rate of 2% appears within reach. In the Fed’s view, the most important inflation gauge is the personal consumption expenditures deflator excluding food and energy prices (the “core” PCE). The next chart shows the extent to which it has tapered over the past two quarters. While it’s encouraging that inflation has edged closer to the Fed’s target, it does not mean the inflation fight is over. Still, the decision taken at the December meeting of the Fed’s Open Market Committee (FOMC) to leave its interest rate target unchanged is probably wise.

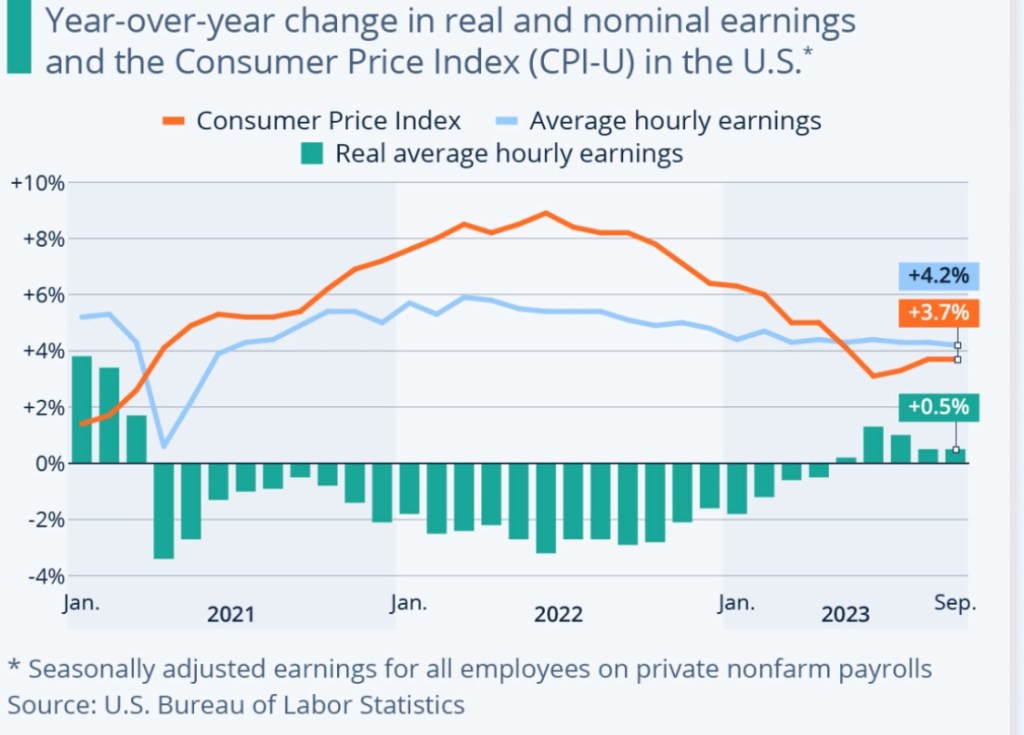

Real wages declined during most of the past three years with the surge in price inflation (see next chart). Some small gains occurred over the past few months, but the earlier declines reinforce the view that consumers need to tighten their belts to maintain savings or avoid excessive debt.

Has Policy Really Been “Tight“?

The prospect of a hard landing presupposes that policy is “tight” and has been tight for some months, but there is disagreement over whether that is, in fact, the case. Scott Sumner, at the link above in the second paragraph, is skeptical that policy is “tight” even now. That’s despite the fact that the Fed hiked its federal funds rate target 11 times between March 2022 and July 2023 (by a total of 5.25%). The Fed waited too long to get started on its upward rate moves, which helps explain the continuing strength of the economy right now.

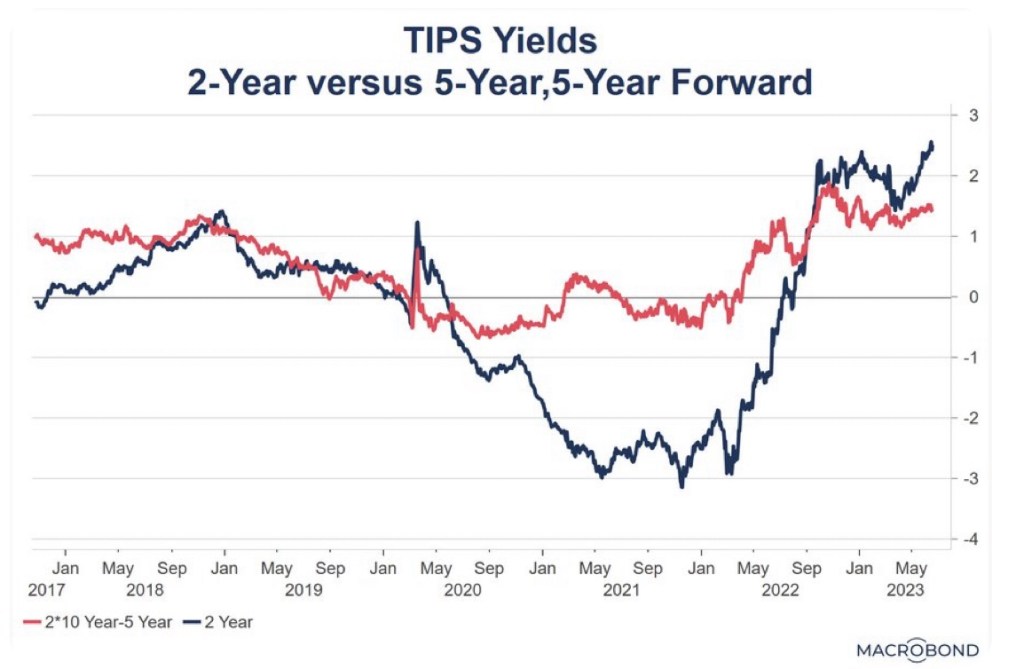

The real fed funds rate turned positive (arguably) as early as last winter as the rate rose and as expected inflation began to decline. There is also solid evidence that real interest rates on the short-end of the maturity spectrum are higher than “neutral” real rates and have been for well over a year (see chart below). If the Fed leaves its rate target unchanged over the next few months, assuming expected inflation continues to taper, the real rate will rise passively and the Fed’s policy stance will have tightened further.

Another view is that the Fed’s policy became “tight” when the monetary aggregates began to decrease (April 2022 for M2). A few months later the Fed began so-called “quantitative tightening” (QT—selling securities to reduce its balance sheet). Thus far, QT has reversed only a portion of the vast liquidity provided by the Fed during the pandemic. However, markets do grow accustomed to generous ongoing flows of liquidity. Cutting them off creates financial tensions that have real economic effects. No doubt the Fed’s commitment to QT established some credibility that a real policy shift was underway. So it’s probably fair to say that policy became “tight” as this realization took hold, which might place the date demarcating “tight” policy around 15 – 18 months ago.

Back to the Lags

Again, changes in monetary policy have a discernible impact only with a lag. The broad range of timing discussed among monetary experts (again, going back to Milton Friedman) is 9 – 24 months. We’re right in there now, which adds to the conviction among many forecasters that the onset of recession is likely during the first half of 2024. That’s my position, and while the tapering of inflation we’ve witnessed thus far is quite encouraging, it might take sustained monetary restraint before we’re at or below the Fed’s 2% target. That also increases the risk that we’ll ultimately suffer through a hard landing. In fact, there are prominent voices like hedge fund boss Bill Ackman who predict the Fed must begin to cut the funds rate soon to avoid a hard landing. Jamie Diamond, CEO of JP Morgan, says the U.S. is headed for a hard landing in 2024.

Looking Forward

If new data over the next few months is consistent with a “soft landing” (and it would take much more than a few months to be conclusive), or especially if the data more strongly indicate an incipient recession, the Fed certainly won’t raise its target rate again. The Fed is likely to begin to cut the funds rate sometime next year, and sooner if a recession seems imminent. Otherwise, my guess is the Fed waits at least until well into the second quarter. The average of FOMC member forecasts at the December meeting works out to three quarter-point rate cuts by year-end 2024. When the Fed does cut its target rate, I hope it won’t at the same time abandon QT, the continuing sales of securities from its currently outsized portfolio. Reducing the Fed’s holdings of securities will restrain money growth and give the central bank more flexibility over future policy actions. QT will also put pressure on Congress and the President to reduce budget deficits.