Tags

Birth-Death Model, BLS, Core Inflation, CPI, Establishment Survey, Federal Funds Rate, Federal Open Market Committee, Federal Reserve, FOMC, Grateful Dead, Hard Landing, Household Survey, Inflation, Jerome Powell, Nonfarm Payrolls, PCE Deflator, PPI, Red Sea, Seasonal Adjustment, Soft Landing, Supply Shocks

When Federal Reserve Chairman Jerome Powell said “higher for longer” last year, it wasn’t about the Grateful Dead concerts he’s attended over the years. No, he meant the Fed might need to raise its short-term interest rate target and/or keep it elevated for an extended period to squeeze inflation out of the economy. As late as December, Powell said that additional rate hikes remain on the table. But short of that, the Fed might keep its current target rate steady until inflation is solidly in-line with its 2% objective. The obvious risk is that tight monetary policy might tip the economy into recession. The market, for its part, is pricing in several rate cuts this year.

Thus far, the release of key economic data for December 2023 has not settled the debate as to whether disinflation has truly paused short of the Fed’s goal. There were inauspicious signs from the labor market in December as well. These data releases don’t rule out a “soft landing”, but they indicate that recession risks are still with us in 2024. The Fed will face a dilemma if the economy weakens but inflation fails to abate, either due to residual stickiness or new supply shocks. The latter are unfolding even now with the shut down of Red Sea shipping.

Bad Employment Report

On the surface, the employment report from the Bureau of Labor Statistics (BLS) was strong relative to expectations, and the media reported it on that superficial level: nonfarm payrolls increased by 216,000 jobs, about 45,000 more than expected; unemployment was unchanged from November at 3.7%.

Unfortunately, the report contained several ominous signs:

1) Employment from the BLS Household Survey declined by 683,000 in December and is essentially flat since July. This discrepancy should be rather unsettling to anyone waving off the possibility of a recession.

2) The number of full-time workers decreased by 1.53 million in December, and the number of part-time workers increased by 762,000 as the holidays approached. Retail employment was not particularly strong however, and the big loss of full-time work stands in contrast to the “strong-report” narrative.

3) The number of multiple jobholders hit a record and increased by 556,000 over the past year. This might indicate trouble for some workers making ends meet.

5) The civilian labor force declined by 676,000. What accounts for the change in status among these former workers or job seekers?

6) From the BLS Establishment Survey, government hiring accounted for 24% of the nonfarm jobs filled in December. Social Services accounted for 10% of the new hiring and health care for 18%, both of which are heavily dependent on government.

7) Nonfarm payrolls were revised downward by a total of 71,000 for October and November. We’ve seen downward revisions for 10 of the past 11 months.

8) In total, initial monthly job reports in 2023 overstated the full-year gain in nonfarm employment after available revisions by 439,000.

Those are big qualifiers on the “stronger than expected” jobs report. Furthermore, I tend to discount new government jobs as a real engine of production possibilities, so the report didn’t offer much assurance about the economy’s momentum. In addition, there are estimates that the payroll gain was due to better weather than the seasonal adjustment factors indicate.

Fictional Payroll Gains?

Still other issues cast doubt on the BLS payroll numbers. First, they are based on a survey of employers that is not complete by the time of each month’s initial report. Second, the survey is heavily skewed toward employees of government and large corporations; the sample of small employers is light by comparison. Third, seasonal adjustments often swamp the unadjusted changes in payrolls.

Finally, the BLS uses a statistical model of business births/deaths to adjust the figures. This is intended to correct for a lag in survey coverage as new businesses are formed and others close. The net effect on the payroll estimate can be positive or negative. Unfortunately, it’s difficult for even the BLS to tell how much the birth/death model affects the headline nonfarm jobs figure in any particular month. Therefore, it’s tough to put much faith in the monthly reports, but we watch them anyway.

Stubborn Inflation

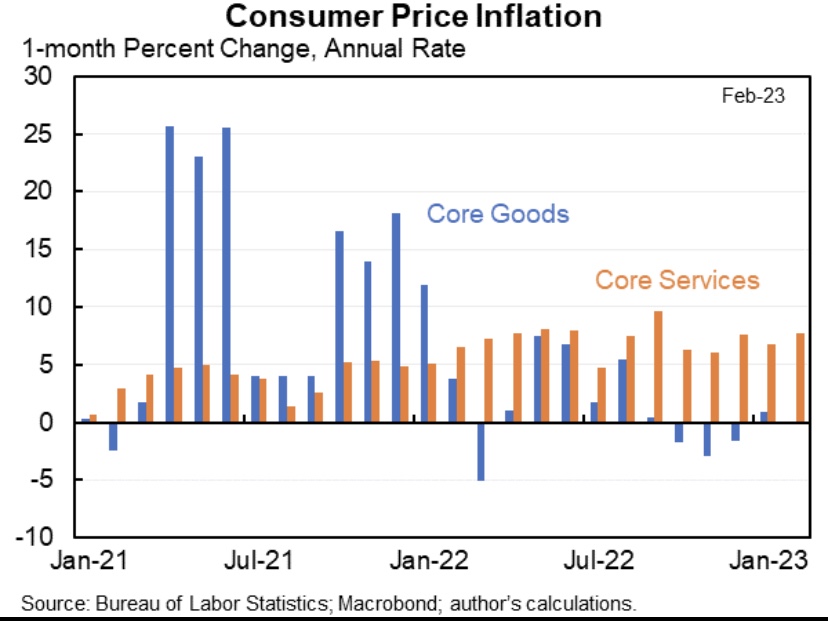

The Consumer Price Index (CPI) for December increased 0.3% over November and 3.4% year-over-year, slightly more than expectations of 0.2% and 3.2%, respectively. The “core” CPI (excluding food and energy prices) rose 3.9% year-over-year, more than the 3.8% expected. The core rate declined on a one-month and year-over-year basis, however, as did the median item in the CPI.

All CPI measures in the chart declined during 2023, though the core and median lagged the headline CPI (green line), which “flattened” somewhat during the last half of the year. So there appears to be some stickiness hindering disinflation in the CPI at this point, but the apparent “stickiness” has been confined to lagging declines in housing costs (also see here).

The Producer Price Index (PPI) reported a day later was thought to be benign. Like the CPI, disinflation in the core PPI has tapered:

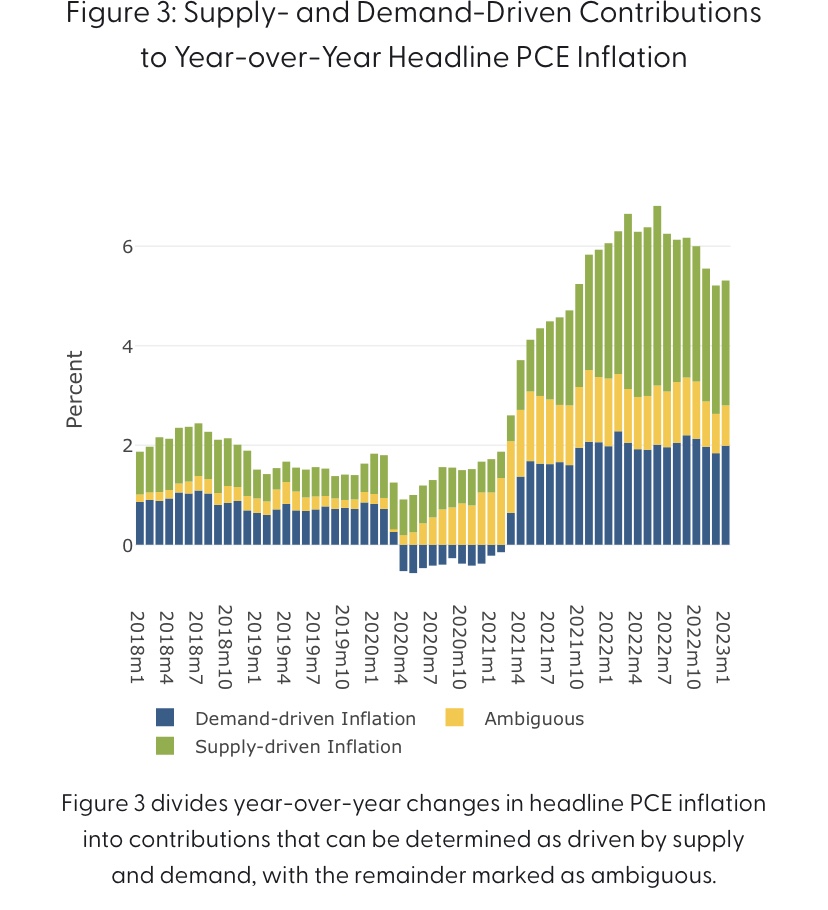

In this context, it should be noted that declines in the Fed’s preferred inflation gauge, the PCE deflator, have also undergone something of a pause, and the PCE weights housing costs much less heavily than the CPI.

The CPI and PPI reports don’t offer any reason for the Fed to reduce its target federal funds rate over the next couple of Federal Open Market Committee (FOMC) meetings. There are two more sets of monthly inflation reports before the meeting in late March, so things could change. But again, the Fed has given ample guidance that it might have to leave its target rate at the current level for an extended period.

The Market View

Markets had priced-in six cuts in the Fed funds rate target in 2024 prior to the CPI report, but traders began to discount that possibility in its immediate aftermath. However, members of the FOMC expected an average of three cuts in 2024, with more to come in 2025, whether or not that’s consistent with “higher for longer”. Inflation is hovering somewhat above the Fed’s goal, but getting the rest of the job done might be tough, and indeed, might imply “longer” if not “higher”.

But why did the market ever hold the expectation of six cuts this year? Traders must have anticipated an economic contraction, which would kick the Fed into rapid response mode. The employment report offered no assurance that such a “hard landing” will be avoided. A few more negative signals on the real economy without further progress on prices would provide quite a test of the Fed’s inflation-fighting resolve.