Tags

Biden Administration, CARES Act, corporate taxes, Double Taxation, infrastructure, Justin Wolfers, Loopholes, OECD, Offshoring, Pandemic, Pass-Through Income, Phil Kerpen, Renewable Energy Credits, Research and DEvelopment, Statutory Rates, Tax Foundation

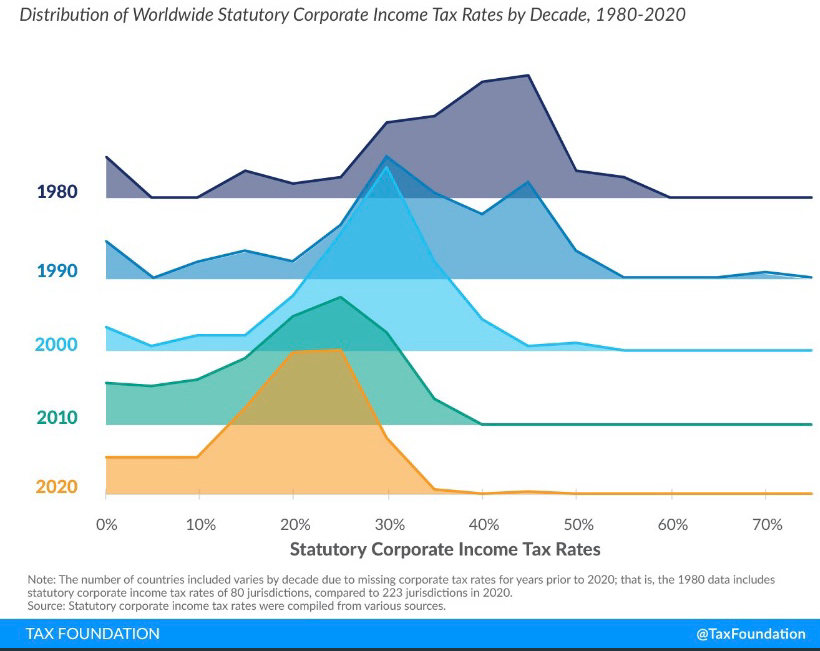

I recently wrote on this blog about the damaging impact of corporate taxes on workers, consumers, and U.S. competitiveness. Phil Kerpen tweeted the chart above showing the dramatic reduction in the distribution of corporate tax rates across the world from 1980 through 2020. Yes, yes, Joe Biden’s posture as a fair and sensible leader aside, most countries place great emphasis on their treatment of business income and their standing relative to trading partners.

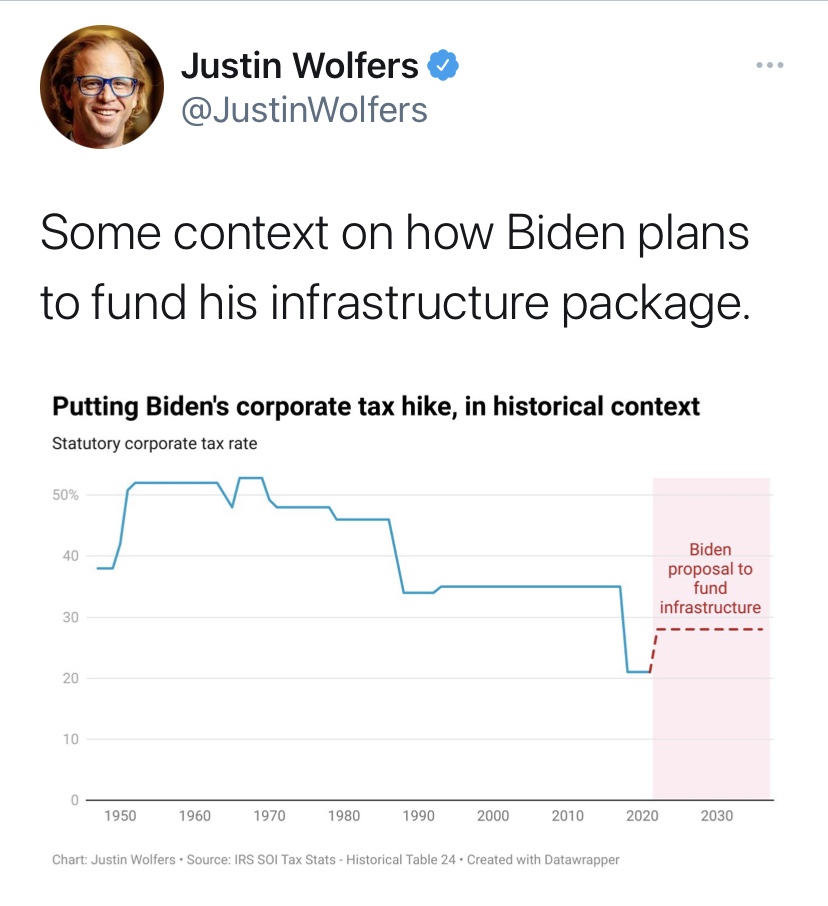

Kerpen’s tweet was a response to this tweet by economist Justin Wolfers:

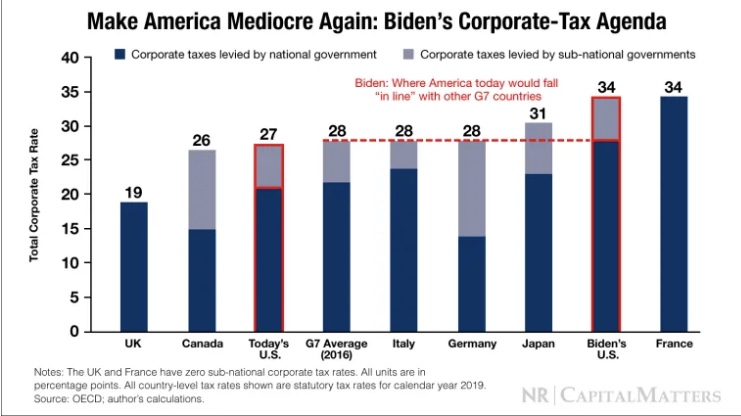

Apparently, Wolfers wishes to emphasize that Biden’s plan, which raises the statutory corporate rate from 21% to 28%, does not take the rate up to the level of the pre-Trump era. Fair enough, but compare Wolfers’ chart with Kerpen’s (from the Tax Foundation) and note that it would still put the U.S. in the upper part of the international distribution without even considering the increment from state corporate tax rates. Also note that the U.S. was near the top of the distribution in 1980, 2000, and 2010. In fact, the U.S. had the fourth highest corporate tax rate in the world in 2017, before Trump’s tax package took effect. Perhaps Biden’s proposed rate won’t be the fourth highest in the world, but it will certainly worsen incentives for domestic U.S. investment, the outlook for wage growth, and consumer prices.

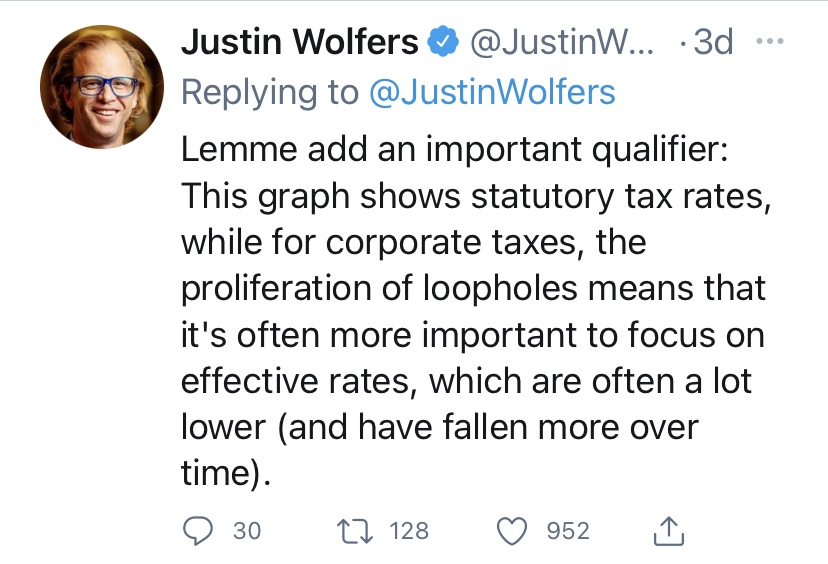

And in the same thread, Wolfers said this:

That’s certainly true, but let’s talk about those “loopholes”. First, much of U.S. corporate income is “passed though” to the returns of individual owners, so corporate taxes understate the true rate of tax paid on corporate income. Let’s also remember that the corporate tax represents a double taxation of income, and as a matter of tax efficiency it would be beneficial to consolidate these taxes on individual returns.

Beyond those consideration, the repeal of any corporate tax deduction or credit would have its own set of pros and cons. As long as there is a separate tax on corporate income, there is an economic rationale for most so-called “loopholes”. Does Wolfers refer to research and development tax credits? Maybe he means deductions on certain forms of compensation, though it’s hard to rationalize treating any form of employee compensation as income taxable to the business. Then there are the massive tax subsidies extended for investments in renewable energy. Well, good for Wolfers if that last one is his gripe! The CARES Act of 2020 allowed publicly-traded companies to use losses in 2020( presumably induced by the pandemic) to offset income in prior years, rather than carrying them forward. Did Wolfers believe that to be inappropriate? I might object to that too, to the extent that the measure allows declining firms to use COVID to cloak inefficiencies. Does he mean the offshoring of income to avoid U.S. corporate taxes? Might that be related to relative tax rates?

In any case, Wolfers can’t possibly imagine that the U.S. is the only country allowing a variety of expenses to be deducted against corporate income, or credits against tax bills for various activities. So, a comparison of statutory tax rates is probably a good place to start in assessing the competitive thrust of tax policy. But effective tax rates can reveal much more about the full impact of tax policy. In 2011, a study showed that the U.S. had the second highest effective corporate tax rate in the world. Today, among developed countries, the OECD puts the U.S. roughly in the middle of the pack, close to Germany but higher than Canada, Mexico and Japan, and lower than the UK. This article from 2019 reaches the same conclusion, though the rankings and rates differ from the OECD’s calculations. So it’s not as if the U.S. is the only country to offer tax incentives, or “loopholes” in Wolfers’ preferred terminology.

The corporate tax hikes proposed by the Biden Administration are intended to fund the massive outlays in the so-called infrastucture bill, which of course has very little to do with real infrastructure. Both the tax and spending proposals are bad policy. So far, however, passage of the bill is not a given. Let’s hope all of the Republicans and at least one Democrat senator have the sense to vote it down, but I’m not optimistic. The best hope for resistance among Democrats is Joe Manchin of West Virginia, but even he has signaled his support. Biden’s appointment of Gayle Manchin to a key administration post couldn’t have hurt.