Tags

Association Health Plans, Avik Roy, Barack Obama, Bill Cassidy, Cost-Sharing Subsidies, Donald Trump, Exchange Markets, Health Status Insurance, Insurer subsidies, Jeffrey Tucker, John C. Goodman, John Cochrane, John McCain, Medicaid, Medicare, Obamacare, Patient Freedom Act, Pete Sessions, Pre-Existing Conditions, Short-Term Policies, Tax-Credit Subsidies, Universal Health Allowance

“… a government program that is ruined by permitting more choice is not sustainable.“

That’s Jeffrey Tucker on Obamacare. Conversely, coercive force is incompatible with a free society. Tucker, no fan of President Donald Trump, writes that the two recent executive orders on health coverage are properly framed as liberalization. The orders in question: 1a) eliminate federal restrictions on the sale of so-called association health insurance plans, including their availability across state lines; 1b) remove the three-month limitation on coverage offered under temporary policies; and 2) end insurer cost-sharing subsidies for policies sold to low-income (non-Medicaid) segments of the individual market.

The most immediately impactful of the three points above might be 1b. These temporary policies became quite popular after Obamacare took effect, at least until the Obama Administration placed severe restrictions on their duration and renewal in 2016 (see Avik Roy’s post in Forbes on this point). Trump’s first order rescinds that late-term Obama order. The short-term policies are likely to become popular once again, as things stand. Small employers can avoid many of the Obamacare rules and save significantly on premiums using temporary policies.

Association plans are already sold to small businesses having a “commonality of interest”, but Trump’s order would expand the allowable common interests and permit association plans to be sold across state lines. Avik Roy doubts that this will have a large impact, but to the extent that association plans avoid both state and federal benefit mandates, they could prove to be another important source of more affordable coverage for employees than the Obamacare exchanges. In any case, as Tucker says:

“In the words of USA Today: the executive order permits a greater range of choice ‘by allowing more consumers to buy health insurance through association health plans across state lines.’ … The key word here is ‘allowing’– not forcing, not compelling, not coercing. Allowing.

Why would this be a problem? Because allowing choice defeats the core feature of Obamacare, which is about forcing risk pools to exist that the market would otherwise never have chosen. … The tenor of the critics’ comments on this move is that it is some sort of despotic act. But let’s be clear: no one is coerced by this executive order. It is exactly the reverse: it removes one source of coercion. It liberalizes, just slightly, the market for insurance carriers.“

The elimination of insurer cost-sharing subsidies might sound like the most draconian aspect of the orders. Those subsidies were designed to keep the cost of coverage low for consumers with low incomes, but the subsidies are illegal because the allocation of funds was never authorized by Congress. And contrary to what has been alleged, eliminating the insurer subsidies will have virtually no impact on low-income consumers. First, a large percentage of them are on Medicaid to begin with, not the exchanges. Second, tax-credit subsidies for low-income consumers are still in place for exchange plans, and they will scale based on the premium charged for the “silver” plan (also see Avik Roy’s link above). Taxpayers will be on the hook for those increased subsidies, as they were for the insurer cost-sharing payments.

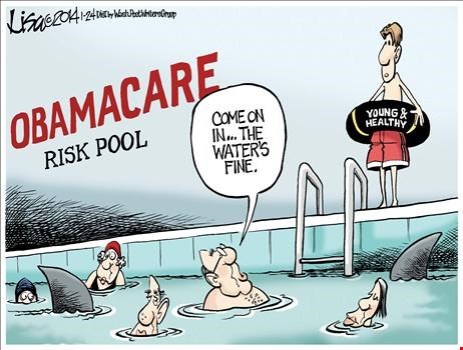

The exchange market will be weakened by the executive orders, but it has been in a prolonged decline since its inception. Relatively healthy consumers will have opportunities to buy more competitive coverage through short-term policies or association plans, so they are now more likely to exit the risk pool. Higher-income, unsubsidized consumers are likely to pay more for coverage on the exchanges, particularly those with pre-existing conditions. As premiums rise, some of the healthy will simply forego coverage, paying the penalty instead (if it is enforced). Of course, the exchange risk pool was already risky, coverage options have thinned, and premiums have been rising, but the deterioration of conditions on the exchanges will likely be hastened under Trump’s executive orders.

Dismantling some of the restrictions on health insurance choice, which were imposed by executive order under President Obama, could prove to have been a stroke of genius on Trump’s part. As a negotiating ploy, Trump just might have maneuvered Republicans and Democrats into a position from which they can agree … on something. The new orders certainly give emphasis to the deterioration of the exchange markets. The insurers probably viewed the cost-sharing subsidies as a better deal for themselves than having to recoup costs via risky and controversial rate increases, so they are likely to pressure Congress for relief. And higher-income consumers with pre-existing conditions will face higher premiums but won’t have new choices. They will be a vocal constituency.

Democrats just don’t have any ideas with legs, however: single-payer and Medicare-for-all are increasingly viewed as politically unacceptable alternatives by most observers. As John C. Goodman notes at the last link, Medicare is already an actuarial and financial nightmare. Another program of the like to replace existing coverage that most voters would like to keep is not a position likely to win elections. Here is Goodman:

“So, the Democrats’ dilemma is: (1) they are not getting any electoral advantage from Obamacare, (2) they can’t afford to criticize it for fear of upsetting their base and (3) they don’t have an acceptable solution in any event.“

So perhaps we have conditions that might foster a compromise, at least one that could win enough votes to fix the insurance markets. Goodman contends that a plan originally attributable to John McCain, and now in the form of the Pete Sessions/Bill Cassidy-sponsored Patient Freedom Act, could be the answer. It would create something like a Universal Basic Health Allowance, in the form of a tax credit, funded by eliminating all current federal spending on health care (excluding Medicare and Medicaid). Those with pre-existing conditions would purchase coverage the same way as others, but the plan would give insurers a strong incentive to retain them. According to Goodman, a “health status risk adjustment” would assure actuarially-fair pricing by forcing an existing insurer to pay the adjustment to a new insurer when sick individuals change their insurance plans.

The Sessions/Cassidy plan (and Goodman) describes a particular implementation of a more general concept called health status insurance, a good explanation of which is offered by John Cochrane:

“Market-based lifetime health insurance has two components: medical insurance and health-status insurance. Medical insurance covers your medical expenses in the current year, minus deductibles and copayments. Health-status insurance covers the risk that your medical insurance premiums will rise. If you get a long-term condition that moves you into a more expensive medical insurance premium category, health-status insurance pays you a lump sum large enough to cover your higher medical insurance premiums, with no change in out-of-pocket expenses.“

It would be a miracle if Congress can successfully grapple with the complexities of health care reform in the current legislative session. However, Trump’s executive orders have improved the odds that some kind of agreement can be negotiated to address the dilemma of the failing exchanges and coverage for pre-existing conditions. Let’s hope whatever they negotiate will leverage consumer choice and free markets. Trump’s orders are a step, but only one step, in reestablishing the patient/insured as a key decision maker in the allocation of health care resources.