Tags

Bailout Barometer, Dodd-Frank, Federal Reserve Bank of Richmond, Financial Risk Taking, Holman Jenkins, Housing Bubble, John Ligon, Too big to fail

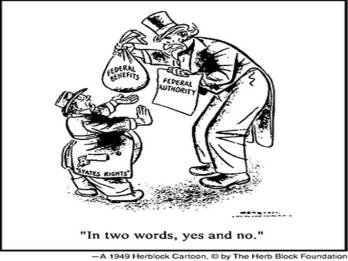

The federal government creates some artificial incentives for financial risk taking. These are mostly guarantees against losses, either explicit or implied by similar, past acts of loss indemnification, i.e, bailouts. Under this regime, successes accrue to private risk takers while failures are borne by taxpayers and others from whom resources are diverted by artificially low user costs. This is a huge source of waste, pure and simple.

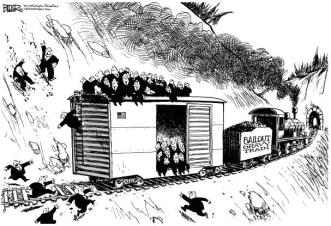

The financial crisis that began in 2007 featured bailouts of a variety of privately-owned institutions such as banks and insurers, as well as government-sponsored enterprises (GSEs: Fannie Mae and Freddie Mac). So-called financial reforms enacted in the wake of the crisis, especially those embodied in the Dodd-Frank Act, did nothing to eliminate the expectation that losses, should they occur, would be met by a rescue package.

“This approach to financial regulation, while a natural response to a market failure narrative, only increases the vulnerability of financial system to regulatory failure. Regulatory failure played an important role in the last crisis by concentrating resources in the housing sector, encouraging reliance on credit-rating agencies, and driving financial institutions to concentrate their holdings in mortgage-backed securities. Dodd-Frank gives regulators more authority and broad discretion to shape the financial sector and the firms operating within it.“

The Federal Reserve Bank of Richmond’s so-called “bailout barometer” shows the share of implicit and explicit federal guarantees on a large class of financial liabilities. It reached a total of 60% at the end of 2013. When losses are covered, who cares about risk? Did any of this change, as a lesson learned, after the last financial crisis? No. Instead, we have this:

“The 2010 Dodd-Frank law has certified various large institutions as “systemically important,” as prelude to burying them in costly regulation ostensibly for safety purposes but partly to divert lending to politically favored sectors. This hasn’t helped the economy. It probably hasn’t done much to make the financial system safer.“

That quote is from Holman Jenkins in “Bank Bashing: the Modern Nero’s Fiddle“. Jenkins accepts “too big to fail” (TBTF) and government guarantees as a reality, blaming the financial crisis on other aspects of government regulatory policy. And there is plenty of evidence that the government contributed in a number of ways, contrary to the usual media narrative. I don’t disagree, but federal guarantees have, and still do, distort risk-reward tradeoffs faced in the financial sector. And the guarantees don’t stop there: federal bailouts of large or politically-connected firms in other industries are now more commonplace and they will continue. Today, the expectation of federal bailouts even extends to other levels of government saddled with insolvent pension funds and other debts that can’t be paid.

Even now, the federal government is creating conditions that may lead to another financial crisis: in addition to the high bailout barometer, bank reserves are plentiful thanks to Federal Reserve policy, and the government seems eager to have those reserves invested in new mortgage lending. Here is John Ligon on this point:

“Two recent examples: Fannie Mae recently started a program guaranteeing loans with as little as 3 percent down payments, and, earlier this year, the Federal Housing Administration reduced by 50 basis points the annual mortgage insurance premiums it charges borrowers. …

A great irony, though, is that these affordable housing initiatives have had the exact opposite of their intended impact: These programs encourage higher levels of debt, increased housing prices (and lower affordability) in many markets, and greater risk within the overall housing finance system.”

There is no doubt that taxpayers will be called upon to cover losses should another financial bubble pop, whether that is in housing or other assets. The one-sided risk this creates represents a transfer of wealth to the financial sector. What’s worse is the contribution of government policy to the sort of economic instability this creates.