Tags

Capitalization, COBRA, Community Rating, Cronyism, Death Spiral, Economies of Scale, Health Insurance, Medical Loss Ratio, Monopsony, Obamacare, Premium Subsidies, Profit, Profit Motive, Single-Payer System

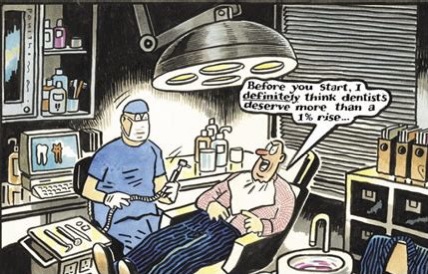

My dentist said, “Oh well, these days it’s really only about whether the insurance company makes a profit….” A giant appliance was in my mouth at the time, propping it open, so I couldn’t respond. But I made a mental note because it reminded me of the hypocrisy so common in how people regard the concept of profit. That’s especially true of the Left, and I happen to know that my dentist, whom I personally like very much, stands well to my left.

Profit Is Income

It’s worth pointing out that profit is merely compensation. My dentist collects revenue, often paid to him by insurers. If he runs an efficient practice, then he earns an income after paying staff, office rent, various suppliers, and for equipment, including interest on any debt outstanding. You wouldn’t be wrong to call that profit, and he does pretty well for himself, but somehow he thinks it’s different.

My dentist probably feels locked into an adversarial position with my insurer, and of course he is in the short run. He says his price is $750; the insurer says, “Sorry Charlie, you get $250”. So as far as he’s concerned, it’s a zero-sum game. Not so in the long run, however. He needs to partner with insurers to get and keep patients, so the exchange is mutually beneficial. And while he might do some picking and choosing among insurers, he’s essentially a price taker. His “price” of $750 is something of a fiction, as he’s clearly willing to do the work for the insurer’s reimbursement.

I think the key qualitative difference between my dentist’s income and that of any wage earner is that his income is always at risk. After all, profit is often regarded as a return to entrepreneurial risk-taking. As it happens, he’s taking a loss on my new crown because it cracked as soon as he put it in. Then, he had to start from scratch with new impressions, after painstakingly removing the cemented, cracked pieces with what felt like a tiny circular saw.

Middling Profitability

But what about those profit-hungry health insurers? In fact, they are not known for outrageously high profits, and their earnings are typically not valued as highly by the market as those of other industries, dollar for dollar. Competition helps restrain pricing and enhance performance, of course. And since the advent of Obamacare, profits have been subject to a loose “cap” (more on that below).

The profitability of health insurers improved in 2020, however, because so many tests and elective procedures were postponed or foregone due to the coronavirus pandemic. That also prompted the government to make more generous subsidies available to consumers to pay COBRA insurance premiums.

Profits Drive Efficiency

I’ll put aside concerns about the crony capitalism inherent in the health system-insurer-regulator nexus, at least for a moment. The profit motive is the fundamental driver of efficiency in the production of insurance contracts and pooling of risks, as well as efficient servicing and administration of those contracts. Absent the possibility of profit, these tasks would become mere bureaucratic functions with little regard for cost and resource allocation. Furthermore, managing risk requires a deep pool of capital to ensure the ability of the insurer to meet future claims. Reinvestment and growth of the enterprise also requires capital. That capital is always at risk and it is costly because its owners demand a return as fair compensation.

Poor Alternatives

Eliminating profit from the insurance function implies that resources must be put at risk without compensation. That’s one of the reasons why non-profit insurers, over the years, have tended to be thinly capitalized and unstable, or limited in their offerings to “health maintenance” benefits, like primary or preventative care, as opposed to insuring against catastrophic events. Capital grants to non-profits (private or governmental) usually come with strings attached, which can severely limit the effectiveness of the capital for meeting existing or future needs of the operation. Growth requires reinvestment, so a profit margin must be earned in order to grow with internal funds. Where non-profits are concerned, you can call the “margin” whatever you want, but it is functionally equivalent to a profit margin.

On the other hand, insurance provided by the public sector puts the taxpayer at risk, and the potential liability to taxpayer “capital” is never rewarded nor indemnified. But it is not free. Now, you might insist that we’d all benefit from government-sponsored health insurance because of the broader risk pool. The problem with that perspective is that it turns the pricing of risk into a political exercise. We’ve already seen the destructive effects of community rating. Younger, healthier, but budget-constrained individuals tend to opt out due to excessive premiums, leading to a systemic “death spiral” of the pool.

Administrative Costs

A puzzling contention is that private insurers drive up administrative costs, presumably when compared to a single-payer system. Obamacare regulations limit the so-called Medical Loss Ratio of a health plan. To simplify a bit, this requires rebates to customers if premiums exceed claims by a certain threshold, which varies across individual, small, and large group markets. This regulation obviously places a loose cap on profits. It is also arbitrary and probably has hampered competition in the individual market. And of course there have always been suspicions that the ratio can be “gamed”.

Nevertheless, under a single-payer system, it would be shocking if economies of scale were sufficient to reduce administrative costs to levels below those incurred by private insurers (especially if we exclude profit!). After all, scale is seldom a prescription for government efficiency, and that’s largely due to the absence of a profit motive and any semblance of competition! What administrative savings might be achieved by a monopsony public payer are likely to derive mainly from “one-size-fits-all” decision-making and product design, with little heed to consumer preferences and choice.

I’ll Take the Profit-Maker’s Coverage

There is plenty to criticize about the health insurance industry. In important ways, it has already succeeded in shifting risks to taxpayers with the help of its policy-making cronies. The insurers are further protected by a flow of government premium subsidies to the individual market; and the largest insurers have benefitted from Obamacare regulations, which encourages increased market power by large hospital networks, which are happy to negotiate charges that benefit themselves and insurers. All else equal, however, I’d rather have a few choices from profit-making health insurers than a single, community-rated choice from the government. I’d rather see risk priced correctly, with direct subsidies made available to individuals in high-risk segments unable to afford their premiums. And I’d rather see less government involvement in health care delivery and insurance. We’d all be better off, including my dentist!