Tags

Brendan O'Neil, Club of Rome, Fr. Robert Sirico, Free Markets, Green Theology, IPCC, John Hinderaker, Limits to Growth, Matt Ridley, Papal encyclical, Patrick J. Michaels, Politics of Science, Prometheus, Thomas Malthus, Tim Ball

The Papal Encyclical published last week has generated controversy for venturing into areas about which Pope Francis, and for that matter the Catholic Church, has absolutely no authority or expertise. Pope Francis has noble aims. His compassion for the poor is admirable and even poignant. Nevertheless, the Pope errs in his assessment of scientific, technological and economic issues, and he fails to reference or consider mountains of evidence that contradict the views that dominate this encyclical. It should come as no surprise that he has been swept along by the Leftist orthodoxy, of which he has long been a part.

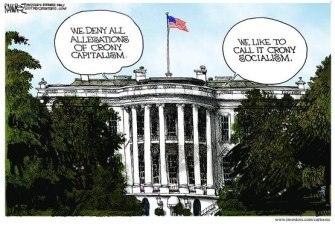

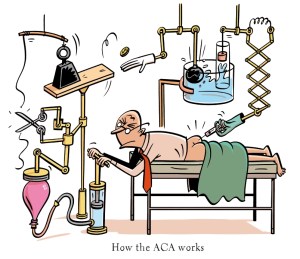

On one hand, Pope Francis expresses a viewpoint that is almost universally shared: that we are stewards of the natural world and have a moral obligation to treat it well for the benefit of others now and in the future. However, he also believes in the unproven proposition of anthropomorphic global warming (AGW), that human activities are causing global temperatures to rise inexorably. He takes the questionable view that ongoing technological advances will benefit only the rich, leaving the poor behind in increasingly desperate circumstances. And he recklessly questions the morality of free markets and capitalism, asserting that they benefit only the rich and work against the interests of the broader masses.

One of the most interesting pieces of commentary on the Encyclical appeared in The Wall Street Journal, entitled “The Pope’s Green Theology“, written by Fr. Robert Sirico, a Catholic priest. (If the link doesn’t work, Google “wsj Sirico Green Theology”.)

“… capitalism has spurred the greatest reduction in global poverty in world history: The number of people living on $1.25 a day fell to 375 million in 2013 from 811 million in 1991, according to the International Labor Office. This is only one statistic among reams of evidence that vindicate capitalism. An honest debate among experts will lay this canard to rest.

The encyclical unwisely concedes too much to the secular environmental agenda, for example, by denigrating fossil fuels. But it also voices moral statements dismissing popular, ill-conceived positions. The repeated lie that overpopulation is harming the planet—expressed by even some of the advisers for the Vatican—is soundly rejected.“

Much of the evidence on global temperatures contradicts the Pope’s position, yet he sides with the groupthink of the environmental Left based on model predictions that have been consistently wrong over several decades. The models have drastically over-predicted global temperature trends, even before the “pause” in warming that began in the late 1990s.

It is rather early in the game for the Catholic Church to take such an unequivocal position on an issue as far afield from matters of religious faith as climate science. As Dr. Tim Ball notes, the Catholic Church has not always bet well on science, going back to its denunciation of Galileo almost 400 years ago. Apparently, any lessons learned from that episode about the process of scientific inquiry have been forgotten. Matt Ridley has a great (if lengthy) essay on the politics of science and the damage that politicized climate science has done to the cause of real understanding:

“Expertise, authority and leadership should count for nothing in science. The great Thomas Henry Huxley put it this way: ‘The improver of natural knowledge absolutely refuses to acknowledge authority, as such. For him, scepticism is the highest of duties; blind faith the one unpardonable sin.’ Richard Feynman was even pithier: ‘Science is the belief in the ignorance of experts.’”

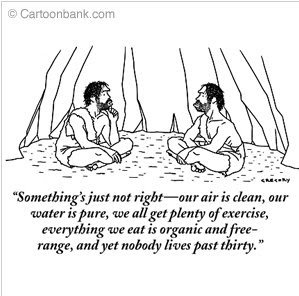

Climate science is really in its infancy. Recorded history of the climate is in its infancy as well. The scant evidence of global warming during the 20th century is well within the range of natural variation estimated for the past 8,000 years, according to a study by a former lead author for the Intergovernmental Panel On Climate Change (IPCC). For the Pope, or anyone else, to make strong claims about “the science”, or to prescribe draconian limits on individual liberty in an effort to plan “the climate”, is hubris of the first order. That’s ironic given the Pope’s condemnation of what he characterizes as mankind’s Promethean hubris, as if making the world more livable was sinful. The Encyclical condemns technological progress, going so far as to denigrate the use of air conditioning. That attitude is driven by objections to energy use; nevertheless, the Pope reveals a deep mistrust of technology and betrays the soul of a Luddite.

Patrick J. Michaels of CATO’s Center for the Study of Science wrote about the Pope’s climate views and the morality of “dense energy” in April:

“Abundant and dependable energy frees mankind from a menial existence, allowing us to use our given talents for the greater good. The mental capital of the poor in the underdeveloped world is untapped without dense energy. The burning of dung for cooking is a major cause of early death from pulmonary disease. The massive deforestation that must occur without dense energy amplifies floods from ubiquitous tropical downpours.“

Here is a link to some very sarcastic commentary from Brendan O’Neil at Reason on the Pope’s “Dotty Green Theology“. O’Neil mentions the tyrannical fantasies dancing in the minds of some on the environmental Left:

“Christianity’s end-of-worldism is getting a new airing in the apocalypse obsession of greens, who warn of an eco-unfriendly End of Days. Its promise of Godly judgement for our wicked ways has been replaced by greens’ promise that we’ll one day be judged for our planetary destructiveness. A leading British green has fantasised about ‘international criminal tribunals’ for climate-change deniers, who will be ‘partially but directly responsible for millions of deaths.'”

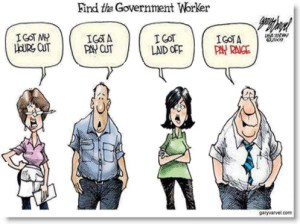

Let’s hope the Pope isn’t on board with that, though he did propose that a worldwide governing body take charge of environmental issues. Please, no favors! John Hinderaker, in the context of the Encyclical, discusses the regressive impact of policies that raise energy prices. That’s consistent with the Pope’s green objectives. Hinderaker cites figures showing that those earning less than $30,000 per year in the U.S. spend 23% of their after-tax income on energy, compared to just 7% for those earning $50,000 or more.

It is extremely late in the game for the Pope to inveigh against capitalism, with all evidence pointing to the long-term success of free markets in lifting the poor from the depths of privation. In fact, the Encyclical is strongly reminiscent of the Malthusian “Limits to Growth” published by the Club of Rome. That “study” contained what has proven to be among the worst collections of prognostications of all time, and the Club persists in purveying doom and gloom to this day.

I have written before on Sacred Cow Chips about Pope Francis’ statist, anti-market inclinations. From that post:

“… it is not just the secular Left that fails to recognize the inherent conflict between big government and religious liberty. Pope Francis himself seems oblivious to the dangerous implications of big government for religious freedom. His apostolic exhortation for greater reliance on the state to care for the poor simultaneously embraces socialism and condemns capitalism. I take no issue in principle with the provision of a social safety net, but the Pope should be more results-oriented in assessing different forms of social organization and their impacts on poverty. Big government typically fails to achieve the kinds of humane objectives usually espoused by the Left. The sad ‘road to serfdom’ has played out too many times in the past.“