Tags

Artificial Intelligence, Automation, Bryan Caplan, Cash vs. In-Kind Aid, Don Boudreaux, Earned Income Tax Credit, Forced Charity, Guaranteed Income, Incentive Effects, Mises Wire, Nathan Keeble, Permanent Income Hypothesis, Subsidies, Tax Cliff, UBI, Universal Basic Income

Praise for the concept of a “universal basic income” (UBI) is increasingly common among people who should know better. The UBI’s appeal is based on: 1) improvement in work incentives for those currently on public aid; 2) the permanent and universal cushion it promises against loss of livelihood; 3) the presumed benefits to those whose work requires a lengthy period of development to attain economic viability; and 4) the fact that everyone gets a prize, so it is “fair”. There are advocates who believe #2 is the primary reason a UBI is needed because they fear a mass loss of employment in the age of artificial intelligence and automation. I’ll offer some skepticism regarding that prospect in a forthcoming post.

And what are the drawbacks of a UBI? As an economic matter, it is outrageously expensive in both budgetary terms and, more subtly but no less importantly, in terms of its perverse effects on the allocation of resources. However, there are more fundamental reasons to oppose the UBI on libertarian grounds.

Advocates of a UBI often use $10,000 per adult per year as a working baseline. That yields a cost of a guaranteed income for every adult in the U.S. on the order of $2.1 trillion. We now spend about $0.7 trillion a year on public aid programs, excluding administrative costs (the cost is $1.1 trillion all-in). The incremental cost of a UBI as a wholesale replacement for all other aid programs would therefore be about $1.4 trillion. That’s roughly a 40% increase in federal outlays…. Good luck funding that! And there’s a strong chance that some of the existing aid programs would be retained. The impact could be blunted by excluding individuals above certain income thresholds, or via taxes applied to the UBI in higher tax brackets. However, a significant dent in the cost would require denying the full benefit to a large segment of the middle class, making the program into something other than a UBI.

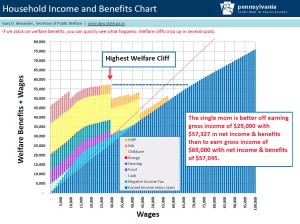

Nathan Keeble at Mises Wire discusses some of the implications of a UBI for incentives and resource allocation. A traditional criticism of means-tested welfare programs is that benefits decline as market income increases, so market income is effectively taxed at a high marginal rate. (This is not a feature of the Earned Income Tax Credit (EITC).) Thus, low-income individuals face negative incentives to earn market income. This is the so-called “welfare cliff”. A UBI doesn’t have this shortcoming, but it would create serious incentive problems in other ways. A $1.4 trillion hit on taxpayers will distort work, saving and investment incentives in ways that would make the welfare cliff look minor by comparison. The incidence of these taxes would fall heavily on the most productive segments of society. It would also have very negative implications for the employment prospects of individuals in the lowest economic strata.

Keeble describes another way in which a UBI is destructive. It is a subsidy granted irrespective of the value created by work effort. Should an individual have a strong preference for leisure as opposed to work, a UBI subsidy exerts a strong income effect in accommodating that choice. Or, should an individual have a strong preference for performing varieties of work for which they are not well-suited, and despite having a relatively low market value for them, the income effect of a UBI subsidy will tend to accommodate that choice as well. In other words, a UBI will subsidize non-economic activity:

“The struggling entrepreneurs and artists mentioned earlier are struggling for a reason. For whatever reason, the market has deemed the goods they are providing to be insufficiently valuable. Their work simply isn’t productive according to those who would potentially consume the goods or services in question. In a functioning marketplace, producers of goods the consumers don’t want would quickly have to abandon such endeavors and focus their efforts into productive areas of the economy. The universal basic income, however, allows them to continue their less-valued endeavors with the money of those who have actually produced value, which gets to the ultimate problem of all government welfare programs.“

I concede, however, that unconditional cash transfers can be beneficial as a way of delivering aid to impoverished communities. This application, however, involves a subsidy that is less than universal, as it targets cash at the poor, or poor segments of society. The UBI experiments described in this article involve private charity in delivering aid to poor communities in underdeveloped countries, not government sponsored foreign aid or redistribution. Yes, cash is more effective than in-kind aid such as food or subsidized housing, a proposition that economists have always tended to support as a rule. The cash certainly provides relief, and it may well be used as seed money for productive enterprises, especially if the aid is viewed as temporary rather than permanent. But that is not in the spirit of a true UBI.

More fundamentally, a UBI is objectionable from a libertarian perspective because it involves a confiscation of resources. In “Why Libertarians Should Oppose the Universal Basic Income“, Bryan Caplan makes the point succinctly:

“Forced charity is unjust. Individuals have a moral right to decide if and when they want to help others….

Forcing people to help others who can’t help themselves… is at least defensible. Forcing people to help everyone is not. And for all its faults, at least the status quo makes some effort to target people who can’t help themselves. The whole idea of the Universal Basic Income, in contrast, is to give money to everyone whether they need it or not.”

Later, Caplan says:

…libertarianism isn’t about the freedom to be coercively supported by strangers. It’s about the freedom to be left alone by strangers.“

Both Keeble and Caplan would argue that the status quo, with its hodge-podge of welfare programs offering tempting but rotten incentives to recipients, is preferable to the massive distortions that would be created by a UBI. The mechanics of such an intrusion are costly enough, but as Don Boudreaux has warned, the UBI would put government in a fairly dominant position as a provider:

“… such an income-guarantee by government will further fuel the argument that government is a uniquely important and foundational source of our rights and our prosperity – and, therefore, government is uniquely entitled to regulate our behavior.“