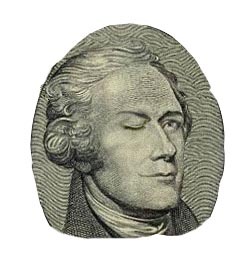

I know too well to take any history I get from the theatre with a grain of salt! Nevertheless, I’d really like to see Hamilton on Broadway. It’s a hugely successful musical by Lin-Manuel Miranda about the life of Alexander Hamilton, one of our nation’s founding fathers, inspired by the book Alexander Hamilton by Ron Chernow. I’ve heard much of the show’s music, infused with R&B and rap/hip-hop; it’s more appealing to me than I’d ever have expected of rap. The show has been nominated for a record 16 Tony Awards (the ceremony is tonight), and of course it’s a very hot ticket. The last time I checked, the cheapest seats available were about $650 each for the last row in the house, and that was about 45 days out! With a party of four, that’s a cool $2,600 for an evening of theatre. I think we’ll wait for the touring production to roll through the midwest next year.

In Hamilton, all of the founding fathers are cast as people of color, a controversial decision that led to a recent uproar over a casting notice encouraging non-white performers to audition for leads. The casting of the founding fathers is an interesting artistic decision. One writer, Spencer Kornhaber in The Atlantic, says that the “colorblind” casting:

“… is part of the play’s message that Alexander Hamilton’s journey from destitute immigrant to influential statesman is universal and replicable….“

That’s admirable, as far as it goes. I believe Kornhaber comes closer to Miranda’s true motivation for the casting decision a paragraph later:

“… movements like Black Lives Matter, and renewed calls for the consideration of reparations, are built on the idea that ‘all’ remains an unfulfilled promise—and that fulfillment can only come by focusing on helping the specific populations that suffer greatest from America’s many inequalities rooted in oppression. … While Hamilton does not explicitly take a side, the simple fact of its casting suggests which way it probably leans.“

In broad strokes, the following is true about the drafting of the U.S. Constitution and arguments over its adoption: Alexander Hamilton favored provisions that tipped power in favor of the central government at the expense of the states, while Thomas Jefferson favored more stringent limits on central powers and strong states’ rights, or federalism as it is commonly known. It’s also true that over the years, Hamilton’s constitutional legacy tended to receive little emphasis in historical narratives relative to Jefferson’s. In the musical, Hamilton is portrayed as a hero to those who would benefit from a powerful and benevolent central government, particularly slaves, while Jefferson is portrayed in less flattering terms. Miranda’s casting implies that the relative emphasis on federal power versus states rights would surely have been reversed had the founding fathers been people of color.

A friend of mine saw the show before it became quite so hot. His kids are “theatre kids”, as mine were up to a certain age. I have great respect for my friend’s intellect and I am sympathetic to his political orientation, which I’d describe as libertarian with strong Randian influences. Here is his brief review of Hamilton:

“I loved Hamilton — it was a great night of theater. I even like the music — which is rap/hip-hop style that I haven’t found enjoyable, at least until now. My biggest concern about the play is its portrayal of Jefferson and Madison, who don’t come off well. Jefferson is a party boy more interested in partying in Paris than in seriously running a new nation. Both are portrayed as instigators in digging up dirt on Hamilton to use against him politically. Yes, they would have benefited from Hamilton’s womanizing scandals, but did they actively seek out that kind of trash? The play says yes…

And of course the play takes the position, I’d argue, that nothing Jefferson writes or says can be taken seriously because he is a slaveholder….the Bank of the U.S. is regarded by the play as a wonderful creation, thanks to Hamilton.“

I’ve read a number of accounts confirming Miranda’s treatment of Jefferson in the show, and the influence it apparently has on viewers without much background in political thought, American history, and the U.S. Constitution. I’ve lost the link, but one writer quoted his teenage daughter as saying “That Jefferson, he’s the WORST!”

There are a number of historical inaccuracies in Miranda’s book of Hamilton. An important fact contradicting the show’s vilification of Jefferson is that he, Madison and Aaron Burr:

“…did not approach Hamilton about his affair [as represented in the show], it was actually James Monroe and Frederick Muhlenberg in 1792. Monroe was a close friend of Jefferson’s and shared the information of Hamilton’s affair with him. In 1796, journalist James Callendar broke the story of Hamilton’s infidelity. Hamilton blamed Monroe, and the altercation nearly ended in a duel. “

In no way did Chernow implicate Jefferson as a participant in blackmail against Hamilton over the affair with an “emotionally unstable” Maria Reynolds. That is entirely Miranda’s invention. His fictionalized Jefferson is a conniving devil, a disgraceful misrepresentation.

Let’s get one other thing out of the way: it is not reasonable to condemn individuals or their actions of 220 years ago outside the context of general attitudes and practices of that period. That’s not to condone those attitudes and practices, however. Last year, I quoted Warren Meyer on this point:

“Meyer mentions the recent incident involving Ben Affleck, who asked the host of a PBS documentary to omit any mention of a slave-owning Affleck ancestor:

‘So an ancestor held opinions about slavery we all would find horrifying today. But given the times, I can bet that pretty much every relative of Affleck’s of that era, slaveholder or no, held opinions (say about women) that we would likely find offensive today.’“

By all accounts, Chernow’s book about Hamilton is an excellent biography, but not without its faults. Charles Kessler states that Chernow relies on other biographies rather than original source material, and that Chernow misrepresents the attitudes of Jefferson and James Madison on commerce; like Hamilton, they viewed it as a “civilizing influence of the highest order“. I’m the first to vouch for the importance of well-functioning capital markets, but apparently Chernow is under the mistaken impression that capitalism itself is intricately tied to powerful banks, particularly central banks like the Federal Reserve! And Chernow exaggerates the difference in the views of Jefferson and Hamilton on the Constitution itself. Here is Kessler:

“A huge gulf remains between Hamilton’s loyalty to what he called a ‘limited Constitution’ and today’s ‘living Constitution,’ which seems capable of justifying virtually any activity that the federal government sees fit to undertake.“

Both Jefferson and Hamilton recognized that abolition would have represented a huge obstacle to forming a new nation. And there was the related problem, recognized by both men, of whether and how to compensate slave owners in the event of abolition. It should go without saying that a failure to reach an agreement between the colonies at the Constitutional Convention would not have led to abolition of slavery by other means. The contrary is implicit in any argument that the constitutional compromise was wholly unjust. It might have been hoped that forming a union would establish a framework within which dialogue on the issue could continue, though ultimately, a fractured union and a war was necessary to finally emancipate the slaves.

Yes, Jefferson held slaves and had a strong economic interest in keeping them. In his circle of wealthy landowners, slavery was considered a normal part of life. However, Jefferson also publicly advocated various plans to free slaves, one as early as 1779. Here is a clause from Jefferson’s rough draft of the Declaration of Independence, before it was revised by other members of the Committee of Five and by Congress, in reference to “his present majesty”, King George:

“he has waged cruel war against human nature itself, violating it’s most sacred rights of life & liberty in the persons of a distant people who never offended him, captivating & carrying them into slavery in another hemisphere, or to incur miserable death in their transportation thither. this piratical warfare, the opprobrium of infidel powers, is the warfare of [the] Christian king of Great Britain, determined to keep open a market where MEN should be bought & sold, he has prostituted his negative for suppressing every legislative attempt to prohibit or to restrain this execrable commerce ….“

While the clause was explicitly critical of trade in slaves, as distinct from ownership, it reveals the thinking of a man who was very progressive for his time. As for outright abolition, it is easy today to be critical of Jefferson’s proposals, which called for gradualism and, later, even deportation of freed slaves to Santo Domingo. Those proposals were based in part on fear shared by many authorities of an economic crisis and civil disorder if slaves were freed en masse. Jefferson certainly did not view slaves as equals to white men, but that was not unusual in those times; he did call for training them in certain skills as a condition of granting them freedom.

Hamilton’s record on slavery is not quite as heroic as Miranda’s musical would have you believe. He was highly ambitious and something of a social climber, so he was reluctant to air his views publicly regarding abolition. He married into a prominent New York slaveholding family, and there are records of his role in returning slaves captured by the British to their previous owners. From historian Michelle DuRoss (linked above):

“… when the issue of slavery came into conflict with his personal ambitions, his belief in property rights, or his belief of what would promote America’s interests, Hamilton chose those goals over opposing slavery. In the instances where Hamilton supported granting freedom to blacks, his primary motive was based more on practical concerns rather than an ideological view of slavery as immoral.“

Hamilton’s is known to have advocated manumission: freeing slaves who agreed to serve in the fight against the British. That position was a practical matter, as it would help in the war effort, and it might have played on the patriotic instincts of slaveowners who would otherwise insist on compensation. His mentor, George Washington, himself a reluctant slave owner, undoubtedly saw the practical value of manumission.

Hamilton’s real constitutional legacy came in two parts: first was his strong support for the Constitution during the ratification process and his (anonymous) contributions to The Federalist Papers. Later came his relatively broad interpretation of provisions granting certain powers to the federal government: the power to issue currency, the commerce clause and the “necessary and proper clause”. He also proposed a few ideas that were never adopted, such as lifetime terms in office for the president and members of the Senate. He did not propose any constitutional provision for the abolition of slavery or for granting full constitutional rights to slaves.

Hamilton was a major proponent of establishing a so-called national bank, known as the Bank of the United States when it was chartered in 1793. This allowed the new country to issue currency and was used as a way to eliminate war debts that were, by then, greatly diminished in value. Hamilton’s central bank meant great rewards to any investor who held the debt, especially those who had purchased the debt at a steep discount. Unfortunately, this was tantamount to monetizing government debt, or paying off debt by imposing an inflation tax (which reached 72% in the bank’s first five years of operation). The establishment of the bank also removed a major restraint on the growth of the federal government. Moreover, Hamilton was a protectionist, advocating tariffs on foreign goods and subsidies to domestic producers. It is little wonder that some have called him the “father of crony capitalism”.

Jefferson was quite possibly a bon vibrant in the best sense of the term, as opposed to the “party boy” depicted by Miranda. He was a man of great intellect, capable and actively conversant in philosophy, science and the practical arts. He wrote the Declaration of Independence, itself a forceful testimonial to natural rights. His constitutional legacy was powerful if indirect: he was a mentor to James Madison, who wrote the first draft of the Constitution. Jefferson was an advocate of majoritarian rule but also sought to protect individual rights against a tyranny of the majority. To that end, he advocated government limited in function to the protection of rights. In short, he was a classical liberal.

There were certainly contradictions between Jefferson’s philosophy and actions. Slaveholding was one, as already noted, but that was not unusual among southern aristocrats of the time, and Jefferson at least recognized the ethical dilemma and publicly offered policy solutions. But as a slaveholder, he made an odd spokesperson for the interests of the “yeoman farmer”, an agrarian individualist in the popular mind and a myth that persists to this day. Jefferson also advocated protectionist policies, such as an embargo on U.S. exports starting in 1807.

Yes, there were abolitionists at the time of our nation’s founding. Both Hamilton and Jefferson were quite sympathetic to the principle of abolition, but both recognized the practical difficulty of pushing it forward without endangering the founding of the nation, and both had personal and probably selfish reasons to avoid fighting that battle. The musical Hamilton glosses over this reality in the case of Hamilton himself, and at the same time condemns Jefferson. Miranda might just as well condemn Abraham Lincoln for his initial support of the original 13th (Corwin) Amendment in the early 1860s, which was never ratified. Ultimately, in 1865, a different 13th Amendment was ratified, accomplishing what would have been evident from the original text of the Constitution but for the so-called “three-fifths compromise”. That provision essentially counted a slave as 3/5s of a “free person” for purposes of apportioning representation and taxes, an idea originally proposed by Madison and revived by Alexander Hamilton himself!

I will still see the musical Hamilton when I get an opportunity. Lin-Manuel Miranda is a man of great talent, but he has misrepresented crucial facts about the Founders of the nation. Those interested in the truth, including those who teach our children, should not take it seriously as an account of history.