Tags

Acquired Immunity, Cause of Desth, CDC, Covid-19, Death Certificates, Deferred Care, Excess Deaths, Influenza, Kyle Smith, Life Expectancy, Mortality Rates, Overdoses, Peter B.Bach, STAT News, Suicide, Vaccinations, Zero Hedge

The CDC choked on a new analysis estimating COVID-19’s impact on U.S. life expectancy as of year-end 2020: they reported a decline of a full year, which is ridiculous on its face! As explained by Peter B. Bach in STAT News, the agency assumed that excess deaths attributed to COVID in 2020 would continue as a permanent addition to deaths going forward. Please forgive my skepticism, but isn’t this too basic to qualify as an analytical error by an agency that subjects its reports to thorough vetting? Or might this have been a deliberate manipulation intended to convince the public that COVID will be an ongoing public health crisis. Of course the media has picked it up; even Zero Hedge reported it uncritically!

Bach does a quick calculation based on 400,000 excess deaths attributed to COVID in 2020 and 12 life-years lost by the average victim. I believe the first assumption is on the high side, and I say “attributed to COVID” as a reminder that the CDC’s guidance for completing death certificates was altered in the spring of 2020 specifically for COVID and not other causes of death. Furthermore, if our objective is to assess the impact of the virus itself, under no circumstances should excess deaths induced by misguided lockdown policies enter the calculation (though Bach entertains the possibility). Bach arrives at a reduction in average life of 5.3 days! Of course, that’s not intended to be a projection, but it is a reasonable estimate of COVID’s impact on average lives in 2020.

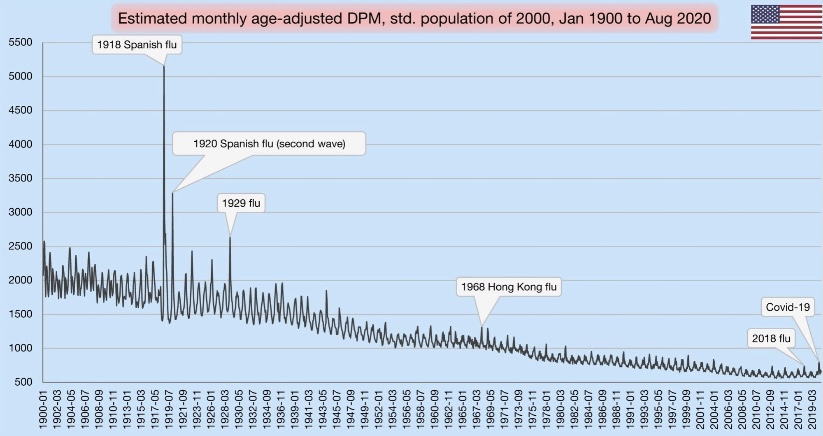

The CDC’s projection essentially freezes death rates at each age at their 2020 values. We will certainly see more COVID deaths in 2021, and the virus is likely to become endemic. Even with higher levels of acquired immunity and widespread vaccinations, there will almost certainly be some ongoing deaths attributable to COVID, but they are likely to be at levels that will blend into a resumption of the long decline in mortality rates, especially if COVID continues to displace the flu in its “ecological niche”. I include the chart at the top to emphasize the long-term improvement in mortality (though the chart shows only a partial year for 2020, and there has been some flattening or slight backsliding over the past five years or so). As Bach says:

“Researchers have regularly demonstrated that life expectancy projections are overly sensitive to evanescent events like pandemics and wars, resulting in considerably overestimated declines. … And yet the CDC published a result that, if anything, would convey to the public an exaggerated toll that Covid-19 took on longevity in 2020. That’s a problem.”

There were excess deaths from other causes in 2020, which Bach acknowledges. Perhaps 100,000 or more could be attributed to lockdowns and their consequences like economically-induced stress, depression, suicide, overdoses, and medical care deferred or never sought. The Zero Hedge article mentioned above discusses findings that lockdowns and their consequences, such as unemployment spells and lost education, will have ongoing negative effects on health and mortality for many years. The net effect on life expectancy might be as large as 11 to 12 days. Again, however, I draw a distinction between deaths caused by the disease and deaths caused by policy mistakes.

The CDC’s estimate should not be taken seriously when, as Kyle Smith says, there is every indication that the battle against COVID is coming to a successful conclusion. Public health experts have not acquitted themselves well during the pandemic, and the CDC’s life expectancy number only reinforces that impression. Here is Smith:

“We have learned a lot about how the virus works, and how it doesn’t: Outdoor transmission, for the most part, hardly ever happens. Kids are at very low risk, especially younger children. Baseball games, barbecues, and summer camps should be fine. Some pre-COVID activities now carry a different risk profile — notably anything that packs crowds together indoors, so Broadway theater, rock concerts, and the like will be just about the last category of activity to return to normal.”

But return to normal we should, and yet the CDC seems determined to poop on the victory party!