If you hope for government to solve economic problems, try to maintain some perspective: the state has unique abilities to botch it, and its power to distort and degrade the economy in the process of “helping” is vast. Government spending at all levels copped about 18% of the U.S. economy’s final output in 2014, but the public sector’s impact is far more pervasive than that suggests. Private fixed investment in new structures and equipment accounted for only about 16% of Gross Domestic Product (GDP); the nonresidential portion of fixed investment was less than 13% of GDP. I highlight these two components of GDP because no one doubts the importance of capital investment as a determinant of the economy’s productive capacity. But government is a larger share of spending, it can divert saving away from investment, and it creates a host of other impediments to productivity and efficient resource allocation.

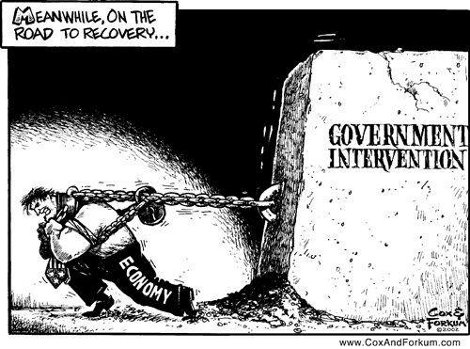

The private economy is remarkable in its capacity to satisfy human wants. The market is a manifestation of spontaneous order, lacking the conscious design of any supreme authority. It is able to adjust to dynamic shifts in desires and resource constraints; it provides reliable feedback in the form of changing prices to modulate and guide the responses of participants through all stages of production. Most forms of government activity, however, are not guided by these signals. Instead, the state imposes binding and sometimes immediate constraints on the decisions of market participants. The interference takes a number of forms, including price controls, but they all have the power to damage the performance and outcomes of markets.

The productive base at each stage of the market process is a consequence of the interplay of perceived business opportunities and acts of saving or deferred consumption. The available flow of saving depends on its rewards, which are heavily influenced by taxes and government intervention in financial markets. It’s worth noting here that the U.S. has the highest corporate tax rates in the developed world, as well as double taxation of corporate income paid out to owners. In addition, the tax system is used as a tool to manipulate the allocation of resources, drawing them into uses that are politically favored and punishing those in disfavor. The damaging impact is compounded by the fact that changes in taxes are often unknown ex ante. This adds a degree of political risk to any investment decision, thus discouraging capital spending and growth in the economy’s productive base.

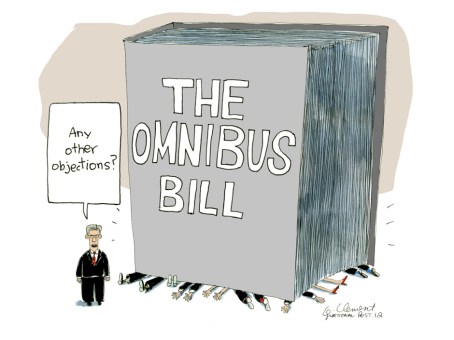

The government is also a massive and growing regulator of economic activity. Over 100,000 new regulatory restrictions were added to the Code of Federal Regulations between 2008 and 2012. Regulation can have prohibitive compliance costs and may forbid certain efficiencies, often based on flimsy or nonexistent cost/benefit comparisons. It therefore damages the value and returns on embedded capital and discourages new investment. It is usually uneven in its effects across industries and it typically reduces the level of competition in markets because small firms are less capable of surviving the costs it imposes. Innovation is stifled and prices are higher as a result.

From a philosophical perspective, even the best cost/benefit comparisons are suspect as tools for evaluating government intervention. Don Boudreaux quotes Anthony de Jasay’s The State on this point:

“What could be more innocuous, more unexceptional than to refrain from intervening unless the cost-benefit comparison is favourable? Yet it treats the balancing of benefits and costs, good and bad consequences, as if the logical status of such balancing were a settled matter, as if it were technically perhaps demanding but philosophically straightforward. Costs and benefits, however, stretch into the future (problems of predictability) and benefits do not normally or exclusively accrue to the same persons who bear the costs (problems of externality). … Treating it as a pragmatic question of factual analysis, one of information and measurement, is tacitly taking the prior and much larger questions as having been somehow, somewhere resolved. Only they have not been.“

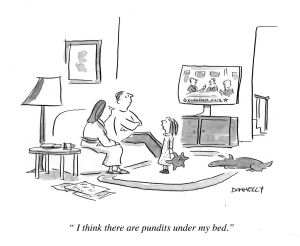

Poorly-executed and inappropriate stabilization policy is another way in which government distorts decisions at all stages of production. There are many reasons why these policies tend to be ineffective and potentially destructive, especially in the long run. Keynesian economics, based on ideas articulated by John Maynard Keynes, offers prescriptions for government action during times of instability. That means “expansionary” policy when the economy is weak and “contractionary” policy when it is strong. At least that is the intent. This framework relies on the notion that components of aggregate demand determine the economy’s output, prices and employment.

The major components of GDP in the National Income and Product Accounts are consumer spending, private investment, government spending, and net foreign spending. In a Keynesian world, these are treated as four distinct parts of aggregate “demand”, and each is governed by particular kinds of assumed behavior. Supply effects are treated with little rigor, if at all, and earlier stages of production are considered only to the extent that their value added is included, and that the finished value of investment (including new inventories) is one of the components of aggregate demand.

Final spending on goods and services (GDP) may be convenient because it corresponds to GDP, but that is simply an accounting identity. In fact, GDP represents less than 45% of all transactions. (See the end note below.) In other words, intermediate transactions for raw materials, business-to-business (B2B) exchange of services and goods in a partly fabricated state, and payments for distributional services are not counted, but they exceed GDP. They are also more variable than GDP over the course of the business cycle. Income is generated and value is added at each stage of production, not only in final transactions. To say that “value-added” is counted across all stages is a restatement of the accounting identity. It does not mean that those stages are treated behaviorally. Technology, capital, employees, and complex decision-making are required at each stage to meet demands in competitive markets. Aggregation at the final goods level glosses over all this detail.

The focus of the media and government policymakers in a weak economy is usually on “underconsumption”. The claim is often heard that consumer spending represents “over two-thirds of the economy”, but it is only about one-third of total transactions at all levels. It is therefore not as powerful an engine as many analysts assert. Government efforts to stimulate consumption are often thwarted by consumers themselves, who behave in ways that are difficult for models to capture accurately.

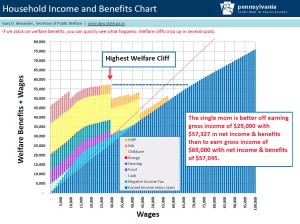

Government spending to combat weakness is another typical prescription, but such efforts are usually ill-timed and are difficult to reverse as the economy regains strength. The value of most government “output” is not tested in markets and it is not subject to competitive pressure, so as the government absorbs additional resources, the ability of the economy to grow is compromised. Programmatic ratcheting is always a risk when transfer payments are expanded. (Fixed programs that act as “automatic stabilizers”, and that are fiscally neutral over the business cycle, are less objectionable on these grounds, but only to the extent that they are not manipulated by politicians or subject to fraud.) Furthermore, any measure that adds to government deficits creates competition for the savings available for private capital investment. Thus, deficits can reduce the private economy’s productive capacity.

Government investment in infrastructure is a common refrain, but infrastructure spending should be tied to actual needs, not to the business cycle. Using public infrastructure spending for stabilization policy creates severe problems of timing. Few projects are ever “shovel-ready”, and rushing into them is a prescription for poor management, cost overruns and low quality.

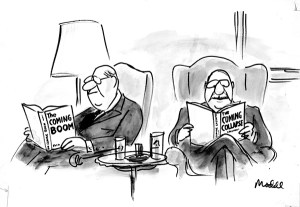

Historically, economic instability has often been a consequence of poorly-timed monetary policy actions. Excessive money growth engineered by the Federal Reserve has stimulated excessive booms and inflation in the prices of goods and assets. These boom episodes were followed by market busts and recessions when the Fed attempted to course-correct by restraining money growth. Booms tend to foster misjudgments about risk that end in over-investment in certain assets. This is especially true when government encourages risk-taking via implicit “guarantees” (Fannie Mae and Freddie Mac) and “too-big-to-fail” promises, or among individuals who can least afford it, such as low-income homebuyers.

Given a boom-and-bust cycle inflicted by monetary mismanagement, attempts to stimulate demand are usually the wrong prescription for a weak economy. Unemployed resources during recessions are a direct consequence of the earlier malinvestment. It is better to let asset prices and wages adjust to bring them into line with reality, while assisting those who must transition to new employment. The best prescription for instability is a neutral stance toward market risks combined with stable policy, not more badly-timed countercyclical efforts. The best prescription for economic growth is to shrink government’s absorption of resources, restoring their availability to those with incentives to use them optimally.

The more that central authorities attempt to guide the economy, the worse it gets. The torpid recovery from the last recession, despite great efforts at stimulus, demonstrates the futility of demand-side stabilization policy. The sluggishness of the current expansion also bears witness to the counterproductive nature of government activism. It’s a great credit to the private market that it is so resilient in the face of long-standing government economic and regulatory mismanagement. A bureaucracy employing a large cadre of technocrats is a “luxury” that only a productive, dynamic economy can afford. Or can it?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

A Note On Output Measures

More complete aggregations of economic activity than GDP are gross output (GO) and gross domestic expenditures (GDE). These were developed in detail by economist Mark Skousen in his book “The Structure of Production“, published in 1990. GO includes all final transactions plus business-to-business (B2B) transactions, while GDE adds the costs of wholesale and retail distribution to GO. Or as Skousen says in this paper:

“GDE is defined as the value of all transactions (sales) in the production of new goods and services, both finished and unfinished, at all stages of production inside a country during a calendar year.“

GO and GDE show the dominance of business transactions in economic activity. GDE is more than twice as large as GDP, and B2B transactions plus business investment are twice the size of consumer spending. According to Skousen, GDE varies with the business cycle much more than GDP. Many economic indicators focus on statistics at earlier stages of production, yet real final spending is often assumed to be the only measure of transactions that matters.