Tags

Barack Obama, Caronavirus, Chuck Jones, Donald Trump, Federal Reserve, Forbes, Great Recession, Joe Biden, Minority Unemployment, Minority Wage Growth, Monetary policy, NPR.org, Shovel-Ready Projects, Trump Economy

The “Trump economy” hasn’t been half bad, though one can’t attribute all of the results to the economic policies of his administration. In fact, the economy was growing when he took office, though it took several years after the Great Recession to recover under Barack Obama, and various sectors were showing strains before Trump took office. And yes, Obama inherited a very bad economy, but he went off the rails a few weeks ago in a pathetic attempt to take credit for ten-plus years of economic growth. Here is one of his tweets:

“Eleven years ago today, near the bottom of the worst recession in generations, I signed the Recovery Act, paving the way for more than a decade of economic growth and the longest streak of job creation in American history,”

The tweet was immediately ridiculed by Trump, as is his habit, but at best Obama received lukewarm support from his usually adoring media outlets. How interesting, however, that just a few days before Obama’s tweet, Chuck Jones, a regular Forbes contributor who really needn’t prove he’s an Obama hack, submitted a scorecard of economic performance covering President Trump’s first three years in office. It was an exercise in throwing shade at a series of good numbers. Then, a week later, Jones had the chutzpah to claim the Obama’s “shovel-ready” stimulus program of a decade ago, which proved anemic in its effects, was the proximate cause of healthy growth under Trump’s watch. Who gave him that idea?

Jones’ effort to diminish Trump’s economic accomplishments is music to the ears of leftists wistful for the days of Obama. They fancy Jones’ appearance in what they assume to be a right-leaning outlet as an enhancement to the credibility of his claims. Forbes, however, is certainly not the bastion of conservatism the Left would have you believe. Their model pays contributors who drive circulation, which has little to do with political alignment. To the extent that Jones is able to stroke the predilections of the Left, he probably can play well at that game.

The truth is it’s difficult to attribute variations in economic growth to different presidential administrations. This fairly well-balanced piece at NPR.org gives one very simple reason:

“Let’s stipulate that presidents of both parties often get more credit and blame for economic conditions than they deserve, given that much of what happens is outside their control.”

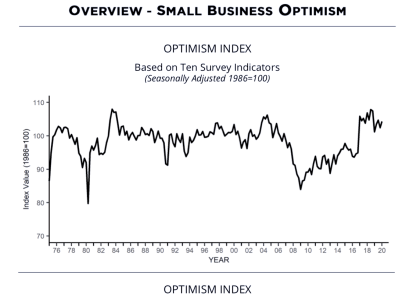

It is true that a new administration inherits economic conditions and policies from its predecessor. Trump inherited an economy that was growing, but there were plenty of strains, including sluggish wage growth, low labor force participation, weak business startups, and a languid housing sector, as this link makes clear. Moreover, economic expansions have lasted an average of only about five years in the post-WW2 era. The current expansion was about 90 months running at the time of Trump’s inauguration, a stage at which vulnerabilities might develop. But new policies often lead to new economic realities. In Trump’s case, that included tax cuts, and especially corporate tax cuts that spurred hiring and wage growth, and more liberalized regulation. Accommodative monetary policy by the Federal Reserve also provided an assist. As the chart at the top shows, Trump’s platform lifted small business enthusiasm considerably, which is a broad indicator of economic vibrancy. Of course, his trade initiatives have probably had negative effects thus far, but his way of negotiating new trade agreements might well end up making a positive contribution, on balance.

Now, the danger of a caronavirus pandemic is presenting major economic challenges. It’s unlikely to produce as many deaths as a bad flu season in the U.S., in part because the Trump Administration took quick action to limit domestic exposure. Nevertheless, the economic consequences of the virus and attempts to control its spread will be significant. At least the economy was strong when the shock occurred, so it is reasonable to expect a rebound if the outbreak runs its course over the next month or two.

The economic record since Trump took office has been impressive given the stage of the business cycle at which he took office. Not only that, but minority wage growth has surged, and minority unemployment has fallen substantially. Let’s face it: Obama and Joe Biden are eager to neutralize any plaudits a strong economy might earn Trump in an election year, but they shouldn’t embarrass themselves by trying to take credit for it, and Chuck Jones could do better than carrying their water.