Tags

Bernie Sanders, Charles Blahous, John Cochrane, Joseph Walker, Life Expectancy, Mahdi Barakat, Medicare For All, Mercatus Center, Obesity, Random Critical Analysis, SwedenCare

The U.S. spends a lot on health care, and our health care system is frequently criticized for poor health outcomes. The chart below is an example of evidence used to buttress this argument. It shows combinations of health care spending and life expectancy over time for the OECD countries. The U.S. appears to be a severe outlier and inferior to the other countries. A variation on this chart appeared on the home page of The Wall Street Journal this week. It accompanied (but was not part of) a good article by Joseph Walker in which he used 12 other charts in an effort to explain why the U.S. spends so much on health care. (Sorry, this link is probably gated.) Walker discusses several important cost factors, including third-party payments, tax treatment, and the deployment of expensive technology in the U.S. However, the claim that the U.S. is really an outlier is worth examining on other grounds.

The chart’s construction suggests that a reliable link should exist between health care spending and life expectancy, but there are several reasons to question whether that is the case. U.S. life expectancy has been held down historically by high rates of smoking, but reduced smoking rates should help moderate the U.S. life expectancy gap in coming years. Obesity in the U.S. is a more persistent problem, especially for the poor, and an even bigger contributor to low U.S. life expectancy than smoking at present. (See this report for evidence on the contributions of smoking and obesity to shorter life expectancy for older adults.) Other contributors to low life expectancy in the U.S. include high motor-vehicle deaths and homicides, the latter attributable in large part to the war on drugs. All of these factors contribute to higher health care spending and directly reduce life expectancy.

The status of the U.S. as an outlier in terms of health care spending is questioned on the Random Critical Analysis blog (RCA). The author’s detailed analysis includes the following points among many others of interest:

- Health care is a superior good: as income rises, spending on health care rises faster;

- The U.S. has a much higher standard of living than any of its peer nations;

- U.S. consumption spending relative to GDP is an “outlier”, like health care spending relative to GDP;

- Consumption is a stronger predictor of health care spending than income;

- Relative to consumption, health care spending in the U.S. is not an outlier, nor is spending on pharmaceuticals, physician/nursing compensation, and the levels of health price indices.

Take a look at the following sequence from the RCA blog linked above (the animation might not be visible on a phone):

So the argument that the U.S. health care system is inferior to peer countries based on cross-county spending comparisons and life expectancy, to the extent that it holds up at all, is subject to strong qualifications. Inferior lifestyle choices, diets, and lack of exercise might be problematic in the U.S., but the healthcare system cannot be faulted based on spending levels relative to other OECD countries.

In fact, the superiority of the U.S. health care system in many areas is not even in dispute. As Mahdi Barakat points out, wait times for care, cancer survival rates, and stroke mortality are all clearly better in the U.S. than in many peer countries:

“Lives are indeed saved by the many types of superior medical outcomes that are often unique to the US. This is not to mention the innumerable lives saved each year around the world due to medical innovations that are made possible through vibrant US markets.”

Barakat compares dubious progressive claims that up to 45,000 American lives are lost each year due to a lack of insurance with the likely incremental lives lost if various performance measures in the U.S. were equivalent to those in other countries:

- 25,000 additional female deaths per year with Canada’a wait times for care (no estimate for additional male deaths is given by Mahdi’s source);

- 64,000 additional stroke deaths each year with the UK’s overall stroke mortality;

- 72,000 additional cancer deaths each year with the UKs survival rates.

Theoretically, the national spending figures could be adjusted for the cost of queuing, i.e. wait times. While Obamacare certainly increased wait times in the U.S., the adjustment would likely reduce or eliminate the spending advantages that several OECD countries appear to have over the U.S.

The performance of health care systems in many countries with single-payer systems or universal care is subject to challenge, as some of the statistics offered by Barakat demonstrate. In “The Truth About SwedenCare“, Klaus Bernpaintner expresses his dismay at the romanticized view of health care in Sweden among so many Americans. His effort to convey the truth about Sweden’s stultifying health care bureaucracy is illuminating. There are few private physician practices in Sweden. Care is generally rationed and waits are lengthy, and it is delivered by disinterested, centrally-assigned providers.

“For non-emergency cases in Sweden, you must go to the public ‘Healthcare Central.’ This is always the starting point for anything from the common flu to brain tumors. You must go to your assigned Central, according to your healthcare district. Admission is by appointment only. Usually they have a 30-minute window every morning, when you call to claim one of the budgeted slots. Make sure to call early or they run out. Rarely will you get an appointment for the same day. You will be assigned a general practitioner, probably one you have never met before; likely one who does not speak fluent Swedish; and very likely one who hates his job. If you have a serious condition, you will be started on a path of referrals to experts. This process can take months.”

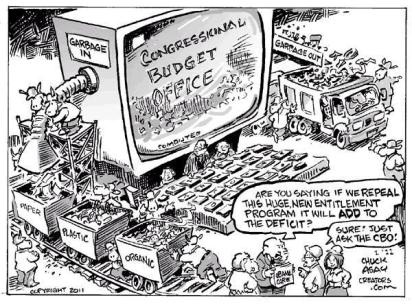

Bernpaintner calls this Sweden’s health care “bread line”, where people go to die. He mentions several other nightmarish features of health care in Sweden that Americans should hope to avoid. In particular, we should resist calls for a single-payer system, like Bernie Sanders’ Medicare-For-All proposal. An analysis by Charles Blahous of the Mercatus Center at George Mason University has shown that it would increase federal spending by $32.6 trillion over ten years. This estimate is basically in-line with others mentioned by Blahous. Much of the additional federal spending would represent a transition away from private spending, a process that would be massively disruptive. However, the study gives the plan the benefit of several doubts by accepting the assumptions made by Sanders: 1) a huge saving in prescription drug costs; 2) a huge saving in administrative costs; 3) providers will happily accept Medicare reimbursement levels; and 4) new immigrants will not be attracted by an essentially free health care program. Fat chance. But given all of these questionable assumptions, total health care spending would fall even as the government takes on the massive new outlays. Take away just fantasy #3 and total national health care spending would rise, a swing of $700 billion by 2031.

John Cochrane makes a useful distinction between two conceptions of universally-accessible coverage: one that all must use vs. one that all can use. (He calls them both forms of single-payer systems, though that usage sounds a bit awkward to me.) The voluntary form is preferable for several reasons: it can preserve choice in terms of coverage and providers; while the public-payer’s share must be funded, it demands little or nothing in the way of cross-subsidized pricing; and it does not imply that government must act as a single “price setter”. Cochrane warns of the possible consequences of a universally-mandated single payer:

“Not only is there some sort of single easy to access health care and insurance scheme for poor or unfortunate people, but you and I are forbidden to escape it, to have private doctors, private hospitals, or private insurance outside the scheme. Doctors are forbidden to have private cash paying customers. That truly is a nightmare, and it will mean the allocation of good medical care by connections and bribes.”

The presumption that universal health care will improve quality and save lives is unsupported by any real evidence. Its proponents incorrectly assume that the uninsured do not get care at all. Providers might go uncompensated, but the uninsured can often get needed care with more immediacy than they could with the lengthy wait times typical of many single-payer systems. The quality of care is likely to deteriorate under a single-payer system given the stresses placed on providers, the highly regulated conditions under which they would be forced to operate, and restricted treatment options. And of course a single-payer system would suspend the price mechanism and any semblance of competition in the health care marketplace.

The health care system in the U.S. has massive problems, but they were created and exacerbated by a series of governmental intrusions on the marketplace over many years. A flourishing market requires choice for consumers and competition between providers—in both health care delivery and insurance coverage. It also requires a roll-back of regulation on providers and insurers. But as Cochrane emphasizes, such a marketplace can exist apart from a voluntary, tax-funded payer-of-last-resort.