Tags

Allocation of Resources, Don Boudreaux, Foregone Alternatives, Frederic Bastiat, Luddites, Minimum Wage, Opportunity Costs, Price Ceilings, Price Controls, Price floors, Rent Control, Scientism, Unintended Consequences, What is Not Seen

Every action has a cost. When you’re on the hook, major decisions are obviously worth pondering. But major societal decisions are often made by agents who are not on the hook, with little if any accountability for long-term consequences. They have every incentive to discount potential downside effects, especially in the distant future. Following Frederic Bastiat, Don Boudreaux writes of three levels of “What Is Not Seen” as a consequence of human decisions, which I summarize here:

- Immediate foregone alternatives: Possession, use and enjoyment of X is not seen if you buy Y.

- Resources not directed to foregone alternatives: The reduction in X inventory is not seen, compensating production of X is not seen, and extra worker hours, capital use and flow of raw materials needed for X production are not seen.

- The future implied by foregone alternatives: Future impacts can take many forms. X might have been a safer or healthier alternative, but those benefits are unseen. X might have been lower quality, so the potential frustration and repairs are unseen. X might have been less expensive, but the future benefits of the money saved are unseen. All of these “unseens” have implications for the future world experienced by the decision-maker and others.

These effects take on much more significance in multiples, but (2) and (3) constitute extended unseen implications for society at large. In multiples, the lost (unseen) X production and X labor-hours, capital and raw materials are more obvious to the losers in the X industry than the winners in the Y industry, but they matter. In the future, no vibrant X industry will not be seen; the resources diverted to meet Y demand won’t be seen at new or even old X factories. X might well vanish, leaving only nontransformable detritus as a token of its existence.

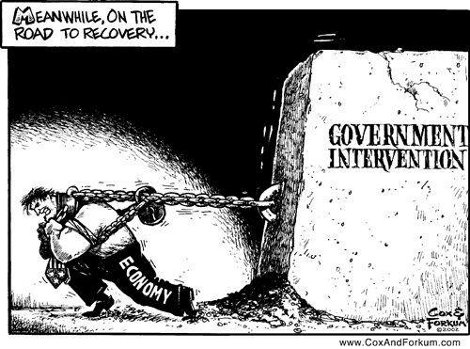

Changes in private preferences or in production technologies create waves in the course of the “seen” reality and the “unseen” world foregone. Those differences are caused by voluntary, private choice, so gains are expected to outweigh losses relative to the “road not traveled”. That’s not a given, however, when decisions are imposed by external authorities with incentives unaligned with those in their thrall. For that reason, awareness of the unseen is of great importance in policy analysis, which is really Boudreaux’s point. Here is an extreme example he offers in addressing the far-reaching implications of government intrusions:

“Suppose that Uncle Sam in the early 20th century had, with a hypothetical Ludd Act, effectively prohibited the electrification of American farms, businesses, and homes. That such a policy would have had a large not-seen element is evident even to fans of Bernie Sanders. But the details of this not-seen element would have been impossible today even to guess at with any reliability. Attempting to quantify it econometrically would be an exercise in utter futility. No one in a 2015 America that had never been electrified could guess with any sense what the Ludd Act had cost Americans (and non-Americans as well). The not-seen would, in such a case, loom so large and be so disconnected to any known reality that it would be completely mysterious.“

Price regulation provides more familiar examples. Rent controls intended to “protect” the public from landlords have enormous “unintended” consequences. Like any price regulation, rent controls stifle exchange, reducing the supply and quality of housing. Renters are given an incentive to remain in their units, and property owners have little incentive to maintain or upgrade their properties. Deterioration is inevitable, and ultimately displacement of renters. The unseen, lost world would have included more housing, better housing, more stable neighborhoods and probably less crime.

A price floor covered by Boudreaux is the minimum wage. The fully predictable but unintended consequences include immediate losses in some combination of jobs, hours, benefits, and working conditions by the least-skilled class of workers. Higher paid workers feel the impact too, as they are asked to perform more (and less complex) tasks or are victimized by more widespread substitution of capital for labor. Consumers also feel some of the pain in higher prices. The net effect is a reduction in mutually beneficial trade that continues and may compound with time:

“As the time span over which obstructions to certain economic exchanges lengthens, the exchanges that would have, but didn’t, take place accumulate. The businesses that would have been created absent a minimum wage – but which, because of the minimum wage, are never created – grow in number and variety. The instances of on-the-job worker training that would have occurred – but, because of the minimum wage, didn’t occur – stack up increasingly over time.“

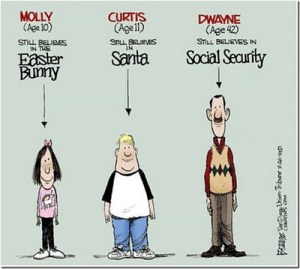

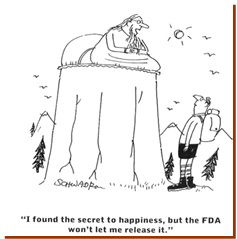

Regulation and taxation of all forms have such destructive consequences, but policy makers seldom place a heavy weight on the unobserved counterfactual. Boudreaux emphasizes the futility of quantifying the “unseen” effects these policies:

“… those who insist that only that which can be measured and quantified with numerical data is real must deny, as a matter of their crabbed and blinding scientism, that such long-term effects … are not only not-seen but also, because they are not-seen, not real.“

The trade and welfare losses of coercive interventions of all types are not hypothetical. They are as real as the losses caused by destruction of property by vandals. Never again can the owners enjoy the property as they once had. Future pleasures are lost and cannot be observed or measured objectively. Even worse, when government disrupts economic activity, the cumulative losses condemn the public to a backward world that they will find difficult to recognize as such.