Tags

Community Rating, Consumer Sovereignty, Death Spiral, Eugene Volokh, Health Insurance Options, Health Status Insurance, Individual Mandate, John C. Goodman, John Cochrane, Obamacare, Pre-Existing Conditions, Premium Subsidies, Tax Subsidies

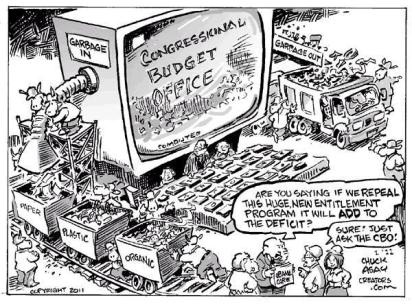

The latest blow to Obamacare went down just before the holidays when a federal judge in Texas ruled that the individual mandate was unconstitutional. The decision will be appealed, so it will have no immediate impact on the health-care law or insurance markets. But as Eugene Volokh noted, the mandate itself became meaningless from an enforcement perspective after the repeal of the penalty tax for non-coverage in 2017, despite the fact that some individuals might still opt for coverage out of “respect for the law”. What will really matter, when and if the decision is upheld, is the nullification of the complex web of regulations created by Obamacare, officially known as the Affordable Care Act or ACA. Perhaps most important among these is the requirement that buyers in good health and those in poor health must be charged the same price for coverage. That is “community rating” and it is the chief reason for the escalation of insurance premiums under Obamacare.

One Size Misfits All

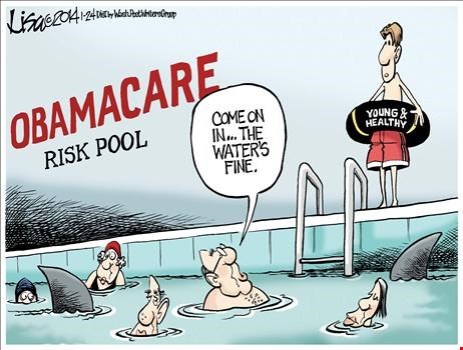

Community rating means that everyone pays the same premium regardless of health. Those in good health must pay higher than actuarially fair premiums to subsidize the sick or high-risk with premiums that are less than actuarially fair. Two provisions of the ACA were intended to make this work: first, the individual mandate required everyone to remain in the game (and paying the subsidies) rather than going uninsured and paying the “tax” penalty. But the penalty was so light that many preferred it to actually buying insurance. Now, of course, the penalty has been repealed. Second, individuals with incomes below 250% of poverty line receive premium subsidies from the federal government to offset the high cost of coverage. That means low-income buyers do not have to confront the high premiums, which was hoped to keep them in the game.

Community rating caused premiums in the individual insurance market to increase dramatically. This was compounded by the law’s minimum coverage requirements, which are more comprehensive than many consumers would have preferred. Lots of younger, healthier consumers opted out while the sick opted in, or even worse, opted in only when they became sick. This deterioration in the “risk pool” is the so-called insurance “death spiral”. The pool of insureds becomes increasingly risky, premiums escalate, more healthy consumers opt out, and the process repeats. At the root of it is the distortion in the way that risk is priced by community rating.

Tailored Coverage

The coverage and pricing of risk is better left to markets. That means consumers and insurers will reach agreement on policy provisions that are mutually beneficial ex ante. Insurers will offer to cover risks up to the point at which the expected marginal cost of underwriting is equal to value, or the buyer’s willingness to pay. An insurer who offers unattractive policies or charges too much will find its business undercut by competitors. But when risk is priced by government fiat and community rating, this natural form of market information discovery is impossible.

Tax vs. Premium Subsidies

Many in the high-risk population will be unable to afford coverage in the absence of community rating. There are only two general options: they pay what they can for care but otherwise go without insurance coverage, accepting charity care if they are willing; or, taxpayers pay, as under Medicaid. Most lack coverage because they simply cannot afford it, even when they earn too much to qualify for Medicaid.

That situation can be resolved in the long-term (as I’ll describe below), but an overhang of individuals with pre-existing conditions in need of subsidies will persist for a period of years. Under Obamacare, subsidies were paid by charging higher premia to healthy individuals through community rating. Again, that distorted signals about risk and value, creating unhealthy incentives among insurance buyers. The death spiral is the outcome. Subsidies funded by general taxation do not create these price distortions, however, and should be relied upon for assisting the high-risk population, at least those who are determined to qualify.

Health Status Insurance

The overhang of individuals with pre-existing conditions requiring subsidies can never be eliminated entirely—every day there are children born with critical, unanticipated health needs. However, the overhang can shrink drastically over time under certain conditions. A development that is already receiving meaningful attention in the market is the sale of health insurance options, as described by John Cochrane. I have written about this method of protecting future insurability here.

Cochrane raises the subject within the context of new HHS rules allowing insurance companies to offer “temporary” insurance coverage up to a year, but with guaranteed renewability through a total of 36 months of coverage. Unfortunately, if you get sick before the end of the 36th month, you’ll have to give up your policy and pay more elsewhere. But Cochrane speculates:

“Unless, perhaps, they really are letting insurance companies offer the right to buy health insurance as a separate product, and that can have as long a horizon as you want? If they haven’t done that, I suggest they do so! I don’t think the ACA forbids the selling of options on health insurance of arbitrary duration.”

Cochrane links to this earlier article in which John C. Goodman discusses the ruling allowing the sale of temporary plans:

“The ruling pertains to ‘short-term, limited duration’ health plans. These plans are exempt from Obamacare regulations, including mandated benefits and a prohibition on pricing based on expected health expenses. Although they typically last up to 12 months, the Obama administration restricted them to 3 months and outlawed renewal guarantees that protect people who develop a costly health condition from facing a big premium hike on their next purchase.

The Trump administration has now reversed those decisions, allowing short-term plans to last up to 12 months and allowing guaranteed renewals up to three years. The ruling also allows the sale of a separate plan, call ‘health status insurance,’ that protects people from premium increases due to a change in health condition should they want to buy short-term insurance for another 3 years.”

That is far from permanent insurability, but the concept has nevertheless taken hold. An active market in health status insurance would reduce the pre-existing conditions problem to a bare minimum. The financial risks of deteriorating health would be underwritten in advance. Once stricken with illness, those unlucky individuals would then have coverage at standard rates by virtue of the earlier pooling of the risk of future changes in health status. At standard rates, relatively few high-risk individuals would require subsidies in order to afford coverage .

Will healthy, temporarily insured or uninsured individuals buy these options? Some, but not all, so subsidies will never disappear entirely. Still, the population of uninsured individuals with pre-existing conditions will shrink drastically. In the meantime, a healthy market for health insurance coverage should flourish, reestablishing the authority of the consumer over the kind of health care coverage they wish to purchase and the kinds of financial risks they are willing to bear.