Tags

Affirmative Action, Assimilation, Bretigne Shaffer, Diversity, Economic Mobility, Heterogeneity, Illegal Immigration, On the Banks, Rent Controls, Ryan McMaken, School Choice, Segregation, Sponsorship, Violent Victimization, War on Drugs

A heterogenious society and the successful assimilation of minorities are two very different things, as much as we might wish otherwise. Two populations within a region will come into contact, but conditions promoting real assimilation are complex. (I’m avoiding use of the term “diversity” because it has come to imply the successful assimilation of distinct groups.) While cultural differences can enrich the lives of both populations, sharp economic gaps between minority and majority populations (and even some cultural differences) will tend to slow the process of assimilation. This is often associated with social dysfunction, such as high crime and homicide rates, especially among the minority group. This is a fairly common phenomenon in countries with racial and ethnic minority or immigrant populations, as Ryan McMaken writes in a recent piece on international differences in heterogeneity and homicide rates.

Heterogeneity In the West

Countries in the Western Hemisphere tend to have relatively high immigrant and minority populations, as McMaken describes:

“… when considering the Americas, … nation-states are in most cases frontier states with populations heavily affected by immigration, a history of conflict with indigenous populations, and institutionalized chattel slavery that lasted until the 19th century. The factors are significant through the region, and the United States cannot be held apart in this regard from the Caribbean, Brazil, Colombia, and other states impacted by all these factors.

Importantly, these factors also make the Americas significantly different from Western Europe and other areas — Japan and Korea, for example — where the present situation is marked by much higher levels of cultural uniformity and quite different recent histories and current demographic trends.“

Homicides

McMaken questions popular theories of cross-country differences in homicide rates based on the degree of gun control and gun ownership rates. Homicides and violent victimization have been declining in the U.S. for many years even as gun ownership has soared. Furthermore, international comparisons are traditionally plagued by arbitrary country classifications and exclusions, as well as inconsistent definitions of homocide and gun ownership. However, McMaken points to other explanations for violent crime found to be fairly robust in the academic literature: poverty and population heterogeneity:

“… these factors contribute to lower levels of social cohesion, and thus higher levels of criminality and other socially-undesirable behaviors.“

McMaken cites research involving ethnic minority populations of Slavs in Germany, Italians in Argentina and the U.S., and Arabs in Europe, all of whom had crime rates far exceeding those in their countries of origin. The connection between heterogeneity and crime might have nothing to do with particular ethnic groups, though it seems all too easy for observers within individual countries to blame specific “others” for crime. It is a symptom of alienation from the majority as well as economic desperation and vulnerability to opportunities and threats arising from the underground economy. Illegal activities might truly provide the best alternatives available to low-skilled, minority job seekers. Needless to say, underground economic activity, such as the drug trade, involves high risk and often violence among users and between competing factions. This is an important source of the high crime and victimization that typifies many minority communities.

Despite declines since the 1970s, the U.S. still has a higher homicide rate than many other industrialized countries. Beyond the weakness cited above, such comparisons fail to control for other confounding effects, including the degree of heterogeneity across countries.

Policies

Heterogeneity poses a problem in the context of involuntary and often voluntary segregation of sub-cultures. If you don’t believe the “voluntary” part, take a close look at the different clusters of individuals in the cafeteria at almost any “diverse” university or corporate office. Judge for yourself. Differences in language, fertility, demographics, religion and cultural traditions may be noteworthy, but where crime is associated with effectively segregated minorities, there is usually a gap in economic status and mobility relative to society at large.

What policies can mitigate these conditions and their impact on crime? It would be nice to approach this question strictly from the perspective that heterogeneity is a given, but the degree of heterogeneity is, to some extent, an endogenous outcome. Restrictive immigration policies might leap to mind as a way of restraining heterogeneity, and there is little doubt that illegal immigrants are less likely to assimilate (many contend that their crime rate is low). Policies allowing less restricted flows of legal immigrants tend to be salutary if they are based on domestic economic need, economic potential, or compassion for those seeking asylum or a haven from political oppression. A legal immigrant receiving a welcome on new shores is more likely to assimilate successfully than an illegal immigrant, all else equal. Citizenship and language education are avenues through which assimilation might be encouraged. And there could be ways to improve sponsorships and even temporary visa programs so as to encourage assimilation.

What can be done to encourage more effective assimilation of all minorities? And what can be done to reduce the crime associated with unassimilated populations? One major corrective is a strong economy. Policies that encourage economic growth will lead to greater participation in markets and society, with consequent interaction and mixing of sub-cultures. Growth policies include low and non-distortionary taxes and light regulation.

The war on drugs also accounts for a major share of homicides, and that war interacts with non-assimilation in perverse ways. It is crippling to disadvantaged communities precisely because it creates risky “opportunities” in the underground economy. It also produces high levels of incarceration and dangerous forms of “cut” contraband. As I’ll discuss in my next post, ending the war on drugs would reduce violent crime and lead to safer drugs in relatively short order.

A short list of other policies that would foster assimilation and economic mobility would include: improved education: school choice and apprenticeship programs; better labor market outcomes: reduce the minimum wage or create sub-minimum wage categories to enhance opportunities to gain experience and skills; better housing: eliminate rent controls.

Assimilation is always more effective when it occurs “organically”. Affirmative action and forced diversity initiatives often fail to achieve effective assimilation. Beyond the obvious infringement on liberty, these policies may sow resentment among those who suffer reverse discrimination, and among those who witness it, to the probable detriment of efforts to eliminate bias. Even worse, these policies often put their intended beneficiaries into vulnerable, un-winnable situations: jobs or programs for which their skills are not adequate. There are undoubtedly excellent candidates among those placed in positions under quotas, but there is a likelihood that many will be unsuccessful in their roles.

Conclusion

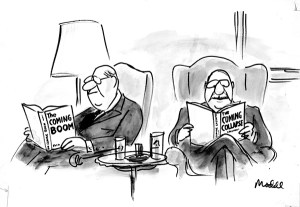

The anti-gun left is eager to attribute differences in homicide rates to the impact of gun control policies, but a close examination of the facts reveals better explanations. A prominent factor contributing to differences in homicide rates is the degree of heterogeneity across countries. Those with more homogeneous populations tend to have lower homicide rates and vice versa. But the problem is not merely heterogeneity, but the difficulty of economic and cultural assimilation of minority populations. These factors appear to lead to greater crime within many minority populations. The U.S. is not unique in its experience with high minority crime rates, but it is a relatively heterogenous nation. This is an important factor in explaining why the homicide rate tends to be higher in the U.S. than in other industrialized countries. To close, I’ll offer something cogent from Bretigne Shaffer’s On the Banks blog, in which she offers this quote from an individual named Michael Owen (the soccer player?):

“... we don’t really have a single America with a moderately high rate of gun deaths. Instead, we have two Americas, one of which has very high rates of gun ownership but very low murder rates, very comparable to the rest of the First World democracies such as those in western & northern Europe, Australia, New Zealand, Canada, Japan, South Korea. The other America has much lower rates of gun ownership but much, much higher murder rates, akin to violent third world countries.“