Tags

central planning, Donald Trump, Exclusivity of Benefits, infrastructure, Infrastructure Tax Credit, Lawrence Summers, Material Infrastructure, Private Infrastructure, Public goods, Public-Private Partnership, Randall O'Toole, Trump Infrastructure Plan, Tyler Cowen, User Fees, Walter Buhr

Material infrastructure is fixed plant and equipment providing services considered basic to the functioning of society. That definition leaves plenty of room for interpretation, however. For example, it does not limit the meaning of “infrastructure” to facilities necessary for the provision of “public goods”, for which benefits are non-exclusive. And it encompasses facilities used by firms in certain competitive markets, such as some forms of telecommunication. The character of infrastructure tends to change over time, as new technologies lead to changes in our way of life (e.g., the cellular network). That’s even more evident when infrastructure is defined more broadly, as Walter Buhr does in “What Is Infrastructure?” His definition of material infrastructure encompasses all facilities enabling “the activation or mobilization of the economic agents’ potentialities.”

Infrastructure ≠ Government

There is a popular fallacy that infrastructure is the exclusive province of government. Infrastructure often does provide some public, non-exclusive benefits, but the willingness of users to pay is the key test of private benefits. As it happens, most infrastructure needs can be met privately and partly, if not fully, supported by user fees. That follows from the high degree of exclusivity of benefits yielded by the infrastructure. Today, privately-owned infrastructure includes communication networks, power generation and distribution, some water and sewer systems, toll roads, ports, and landfills. The presumed monopolistic nature of some infrastructural services probably encourages the notion that infrastructure must be public, but that view is largely unjustified: the services may be “monopolized” only to the extent that the relevant market is defined narrowly, such as road travel, rather than transportation. Indeed, certain kinds of infrastructure functions in markets that are fairly competitive (e.g., wireless networks).

The great thing about most private infrastructure is that owner-operators have an incentive to put it up and keep it up. So it kind of takes care of itself. I say “kind of” because there is always a degree of public involvement, from land use and environmental approval to construction permits, to licensing, to spectrum auctions, to rate regulation, and many other varieties of oversight. Aside from those considerations, if there is a need for infrastructure that is commercially-viable, the project is likely to be proposed by private interests. The funds necessary to pay for construction can be raised from private investors, rather than taxpayers. It’s not at all strange to say that private infrastructure is highly advantageous from a public finance perspective.

There are risks to private infrastructure developers, but those risks are too often borne publicly. A new facility, be it a water treatment plant or a road, might not prove to be profitable once a new revenue stream or reduction in operating costs is realized. Given those circumstances, private interests might seek additional incentives from public authorities to ensure profitbility. To the extent that the shortfall is due to an error in pricing administered by a public regulatory authority, it might be reasonable to make adjustments in the owner-operator’s favor. However, to the extent that demand falls short of the owner-operator’s expectations, it might be better to let the firm fail. That would allow the assets to be sold at a discount to a new operator who can make the cheaper investment profitable. No bailouts!

Trumpian Infrastructure Incentives

The coming Trump Administration is known to have certain steps in mind for encouraging infrastructure development. While the tax plan that has been discussed has a few questionable features, any policy that reduces corporate tax rates would increase the return to existing and prospective private infrastructure, and the profitability of private operation of public infrastructure. In addition, a proposal mentioned explicitly by Trump is a corporate tax credit for infrastructure development.

Here is where a more precise definition of infrastructure would be helpful. Would traditional categories of infrastructure investment by power, telecommunication, and water treatment companies qualify automatically? Moreover, the long timelines required in the planning and installation of most infrastructure might make it difficult to distinguish between new plans and those already in the works. Will the administration establish a bright line between infrastructure investment and run-of-the-mill corporate spending on new plant and equipment? Perhaps any form of corporate investment will qualify. These are questions that remain unanswered as we await Trump’s inauguration.

There is another public-finance dimension of the Trump infrastructure credit. Public infrastructure projects, such as roads, are frequently difficult for governments to fund because they face limits on the debt they can issue. This is emphasized by Randall O’Toole in a recent piece on the Trump credit. Instead of issuing its own debt, a government can take advantage of a large private road builder’s ability to raise funds in the capital market, agreeing to compensate the contractor over time. Thus, taxpayers will be obligated to pay-off the contractor’s debt. The term “Public-Private Partnership” has been invoked in this connection.

Private Incentives Or Central Planning?

I am never averse to reduced tax rates to the extent that taxation always distorts economic incentives. However, selective targeting of tax benefits at certain industries, specific forms of business organization (like corporations), or specific activities like capital investment is overt central planning. Overriding market incentives in this way is not desirable. (Neither are proposals to subsidize exporters and penalize importers. Tyler Cowen at the Marginal Revolution provides some salient quotes from Lawrence Summers on this point.) At this stage, Trump’s tax plan looks like central planning gone berserk.

Ideally, private investment and private infrastructure should be judged on its real merits, not on the prejudices of a central authority. To that end, I believe the Trump Administration’s intent to roll back regulatory distortions is commendable. A case in point is nuclear power generation. Despite the constant outcry against the burning of fossil fuels, there has been little emphasis on encouraging investment in new nuclear capacity. The lengthy approval process and costly regulatory requirements discourage this zero-carbon form of energy production relative to other forms of energy investment.

Users Are the Cost-Causers

I should note that O’Toole speaks favorably of “targeting” certain kinds of public infrastructure, but I think his point is that private operation of infrastructure, if not ownership, will allow markets to do the targeting more efficiently than government ever could. In particular, he notes that politicians tend to prefer new projects to the maintenance and repair of existing infrastructure, independent of the actual merit. Would relying on private operation and user fees encourage better maintenance?

“Unlike infrastructure paid for out of tax dollars, user-fee-funded projects tend to be well maintained because the agencies that manage them know they have to keep them in good shape to continue earning revenues.“

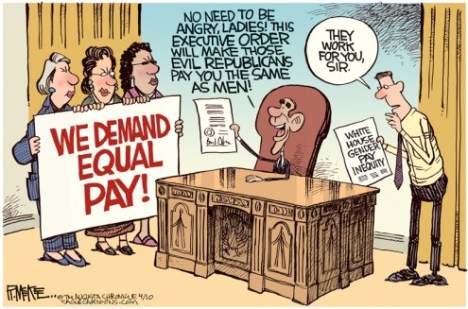

The cartoon above satirizes the consequences of providing free access to a costly facility. User fees encourage more rational patterns of use. For example, it is folly to think that projects like light rail can be financially viable when free alternatives exist. Specific highway routes under high demand must be priced in order for commuters to make rational decisions about the alternatives available to them, and for providers of transportation facilities, whether public or private, to rationally balance the resources dedicated to supporting various modes of travel.

Lower tax and regulatory burdens under the Trump infrastructure plan offer some encouragement for private development and operation of infrastructure projects. As a by-product, the plan might encourage greater reliance on user fees as a method of defraying the costs of infrastructure and promoting a more efficient allocation of resources toward infrastructure needs. However, there are unanswered questions about the details of the plan, and some of its heavy-handy features should be dispensed with.