Tags

Agrivoltaics, AI Energy Demand, Battery Technology, Energy Density, Intermittency, Matt Ridley, Nuclear power, Solar Farms, Subsidies, Wind Power

There is no better example of environmental degradation and waste than the spread of solar farms around the world, spurred on by short-sighted public policy and abetted by a subsidy-hungry investors. As a resource drain, wind farms are right up there, but I’ll focus here on the waste and sheer ugliness of solar farms, inspired by a fine article on their inefficiency by Matt Ridley.

What An Eyesore!

On a drive through the countryside you’ll see once bucolic fields now blanketed with dark solar panels. Hulking windmills are bad enough, but the panels can obliterate an entire landscape. If this objection strikes you as superficial, then your sensibilities run strangely counter to those of traditional environmentalists. It would be a bit less aesthetically offensive if solar farms actually solved a problem, but they don’t, and they impose other costs to boot.

Paltry Power

In terms of power generation, solar collection panels represent an inefficient use of land and other resources. Solar power has very low energy density relative to other sources. As Ridley says:

“Solar power needs around 200 times as much land as gas per unit of energy and 500 times as much as nuclear. Reducing the land we need for human civilisation is surely a vital ecological imperative. The more concentrated the production, the more land you spare for nature.“

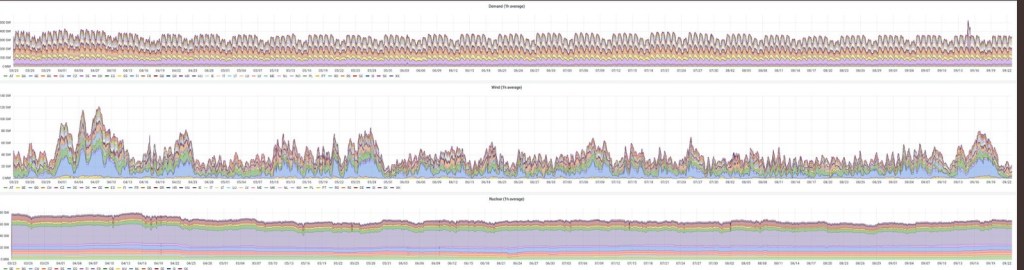

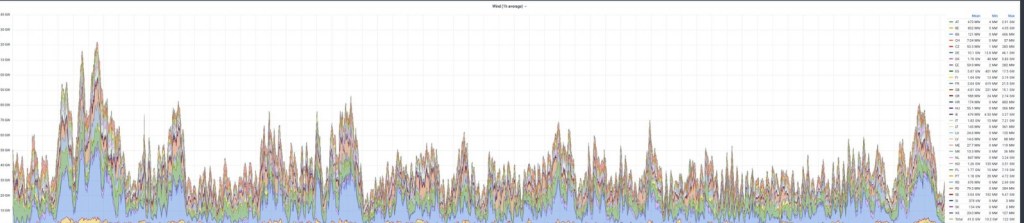

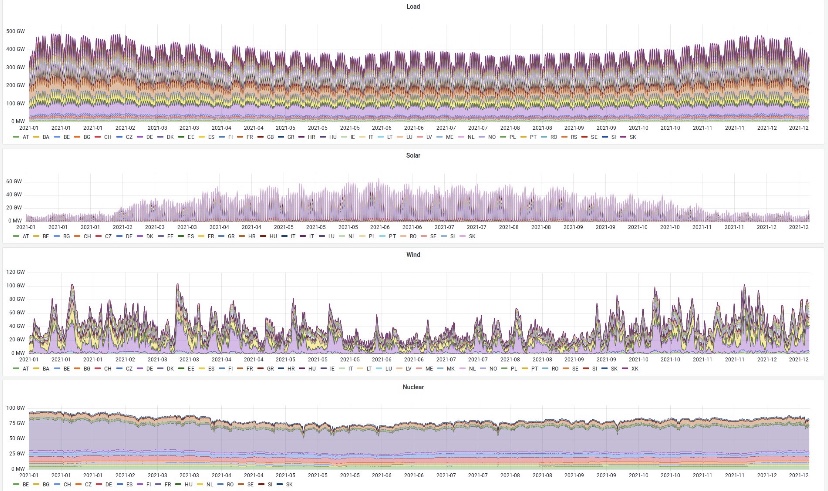

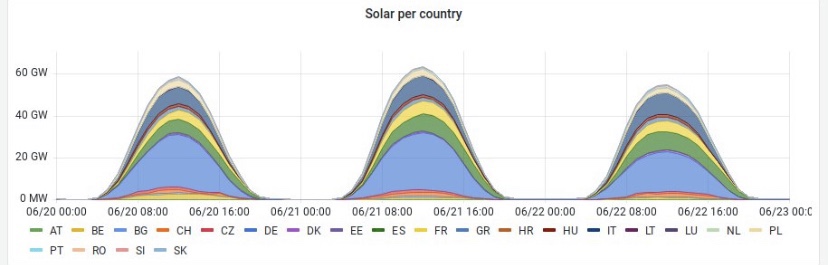

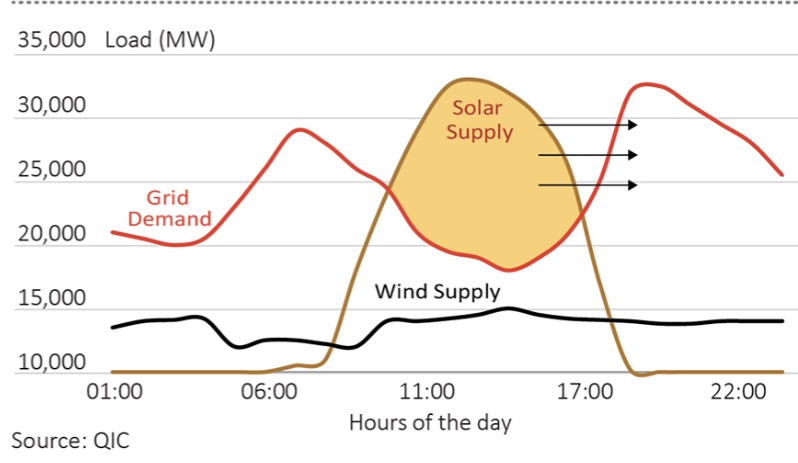

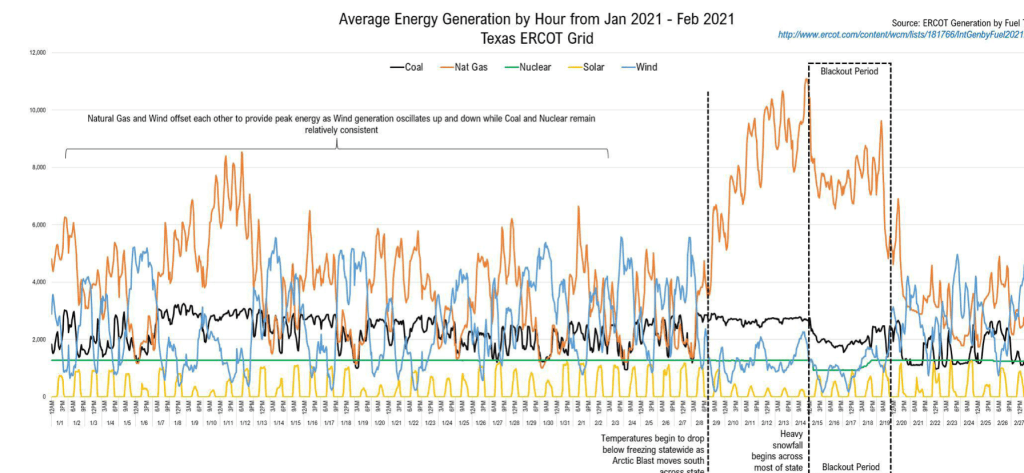

The intermittency of solar power means that its utilization or capacity factor is far less than nameplate capacity, yet the latter is usually quoted by promoters and investors. The mismatch in timing between power demand and power generated by solar will not be overcome by battery technology any time soon.

And yet governments coerce taxpayers in order to create artificially high returns on the construction and operation of solar farms, a backward intervention that puts more efficient sources of power at a disadvantage.

Seduction On the Farm

Solar farms installed on erstwhile cropland reflect confused public priorities. Land that is well-suited to growing crops or grazing livestock is probably better left available for those purposes. Granted, rural landowners who add solar panels probably limit installations to their least productive crop- or rangeland, but not always. Private incentives are distorted by the firehose of subsidies available for solar installations. Regardless, lands left fallow, dormant or forested still put the sun’s energy to good ecological use.

Capital invested in solar power entails unutilized capacity at night and under-utilized capacity over much of the day. Peaks in solar collection generally occur when power demand is low during daylight hours, but it is unavailable when power demand is high in the evening. Battery technology remains woefully inadequate for effective storage, necessitating a steep ramp in back-up power sources at night. And those back-up sources are, in turn, underutilized during daylight hours. The over-investment made necessary by renewables is staggering.

Landowners can try to grow certain crops underneath or between panels, or grass and weeds for grazing livestock, on what sunlight reaches ground level. This is known as Agrivoltaics. It comes with extra costs, however, and it is a bit of a dive for crumbs. Ridley says agrivoltaics is a zero-sum game, but the federal government offers subsidized funding for “experiments” of this nature. Absent subsidies, agrivoltaics might well be negative-sum in an economic sense.

Environmental Hazards

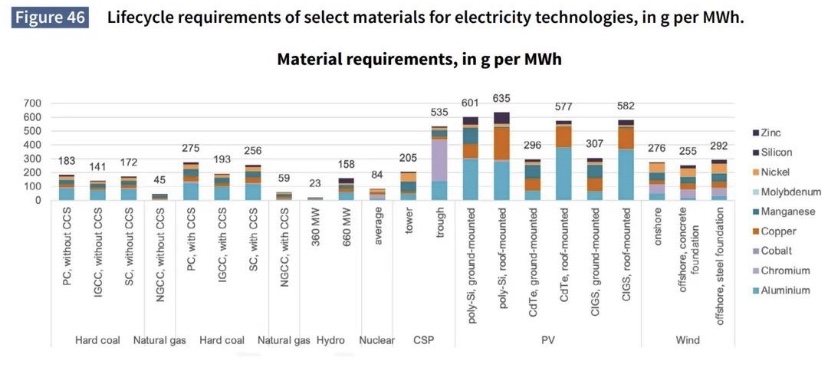

Ridley discusses the severe environmental costs and add-on risks of solar farming to local environments. Fabrication of the panels themselves requires intensive mining, processing and energy consumption. In the field, the underlying structural requirements are massive. The panels raise air temperatures within their vicinity and present a hazard to waterfowl. Panels damaged by storms, birds, or deterioration due to age are pollution hazards. Furthermore, panels have heavy disposal costs at the end of their useful lives. and old panels are often toxic. Adding today’s inefficient battery technology to solar installations only compounds these environmental risks.

Better Alternatives

Solar and renewable energy advocates seem to have little interest in the efficiency advantages of dispatchable, zero-carbon nuclear power. Nor will they wait for prospective space-based solar collection. Instead, they continue to push terrestrial solar and the idle capital it entails.

It’s worth asking why advocates of energy planning tolerate the obvious ugliness and inefficiencies of solar farming. Of course, they are preoccupied with climate risk, or at least they’d like for you to be so preoccupied. They prescribe measures against climate risk that seem to offer immediacy, but these measures are ineffectual at best and damaging in other ways. There are better technologies for producing zero-carbon energy, and it looks as if the power demands of the AI revolution might finally provide the impetus for a renaissance in nuclear power investment.