Tags

Bernie Sanders, Bubble Tax, Cross Subsidies, David Harsanyi, Individual Mandate, Insurability, Jeffrey Tucker, Medical Expense Deduction, Medicare, Obamacare, Paygo, Penalty Tax, Progressive Left, Snopes, Standard Deduction, Tax Reform, Veronique de Rugy

A misapprehension of progressive leftists is that the tax reform bills under debate by the GOP will revoke something from the needy: the poor, cancer patients, the working class, the aged, you name it. Well, that is a misapprehension held by many earnest leftists, but it amounts to deceitful rhetoric from others. David Harsanyi, in an article about the Left’s penchant for corrupting the English language, attempts to set the record straight:

“Whenever the rare threat of a passable Republican bill emerges, we learn from Democrats that thousands, or perhaps millions, of lives are at stake. …

… the most obvious and ubiquitous of the Left’s contorted contentions about the tax bill deliberately muddles the concept of giving and the concept of not taking enough. This distortion is so embedded in contemporary rhetoric that I’m not sure most of the foot soldiers even think it’s odd to say anymore. … Whatever you make of the separate tax bills the House and Senate have passed, though, the authors do not take one penny from anyone. In fact, no spending is being cut (unfortunately). Not one welfare program is being block-granted. Not one person is losing a subsidy. It’s just a wide-ranging tax cut without any concurrent spending cuts.“

The Left may have a basic math incompetency, or maybe they know better when they insist that the GOP plans will inflict a new burden on the middle class. The middle class actually receives larger reductions in taxes than higher strata. Veronique de Rugy highlighted this point recently:

“President Trump’s intention to give a real tax break to the middle class is counter-productive considering the middle class barely shoulders any of the income tax as it is. The top 10 percent of income earners—households making $133K [or more], not $1 million as most assume—currently pay more than 70 percent of all income tax revenue. The middle quintile pays, on average, 2.6 percent of the federal income tax.

And yet, in both the House and Senate plans the middle class receives the largest tax relief by reducing their marginal tax rates, increasing the child tax credit and doubling the standard deduction. The result is fewer taxpayers would be paying income tax at all, problematic from a small government perspective. It also means a more progressive income tax code than it already is.

The House plan also effectively jacks up the top marginal rate for some high earners by using a 39.6 percent bubble rate on the first $90K earned by single taxpayers making $1 million and married taxpayers making $1.2 million and a 12 percent rate like everyone else.“

I have listened to horror stories about school teachers who, in the past, were able to deduct supplies they purchased for their students. Now, the cruel GOP is trying to take that away! This argument neatly ignores the doubling of the standard deduction. Many teachers will find that it no longer makes sense to itemize deductions, and they will come out ahead. But for the sake of argument, suppose a teacher earning $50,000 itemizes and spends $2,500 on unreimbursed supplies for their students every year. At the Senate plan’s new rate in that bracket, the lost deduction will cost the teacher $550, but about $300 would be saved via rate reductions for every $10,000 of taxable income. The teacher is likely to come out ahead even if he unwisely passes on the improved standard deduction.

Liberal thought-whisperers have goaded their minions into believing that the GOP intends to cut Medicare funds by $25 billion a year going forward. The bills under discussion would do no such thing. However, in a rare gesture of fiscal responsibility, President Obama in 2010 signed the Statutory Pay-As-You-Go Act (Paygo), which may require automatic reductions in outlays when spending or tax changes lead to an increase in federal debt. The act has never been enforced, and Republican leadership in both houses insists that Paygo can and will be waived. Clearly, the GOP’s intent is not to allow the Paygo cuts to take place. Even the left-leaning Snopes.com is reasonably neutral on this point. But if Paygo takes hold, the lefties will have themselves to blame.

At the last link, Snopes also touches on one actual provision of the Senate tax plan, the repeal of the Obamacare individual mandate, or rather, the repeal of the “penalty tax” imposed by the IRS on uninsured individuals. The Supreme Court ruled that it is a tax in 2012, at the time giving rise to a mixture of delight and embarrassment on the Left. The ruling saved Obamacare, but the Left had been loath to call the penalty a tax. The supposed rub here is that repeal of the mandate will be greeted enthusiastically by many young and healthy individuals. Freed from coercion, many of them will elect to go without coverage, leading to a deterioration of the exchange risk pools and causing premiums paid by the remaining exchange buyers to rise. However, the critics conveniently ignore the fact that Obamacare individual subsidies will automatically ratchet upward with increases in the premium on the Silver Plan. So the panic related to this portion of the Senate tax bill is misplaced.

One other point about the mandate: because it coerces the payment of cross-subsidies by the young and healthy to higher-risk insurance buyers, the mandate distorts the pricing of risk, the incentives to insure, and the use of resources in the provision of health insurance and health care itself. This is how the proper function of a market is destroyed. And this is how resources are wasted. Good riddance to the mandate. The high-risk population should be subsidized directly, not through distorted pricing, at least until such time as a market for future insurability can be established. As Jeffrey Tucker has said, repeal of the mandate is a very good first step.

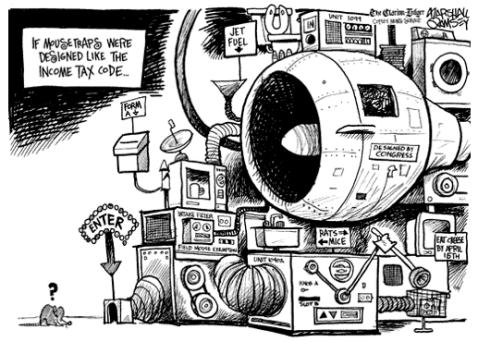

The loss of the medical expense deduction is not a done deal. While the House plan eliminates the deduction, the Senate plan reduces the minimum medical expense requirement from 10% to just 7.5% of qualified income, so it is more generous than under current law. I’ve seen bloggers commit basic misstatements of facts on this and other provisions, such as confusing this limit with a total limit on the amount of the medical deduction. This deduction tends to benefit higher-income individuals who itemize deductions, which will represent a higher threshold under the increased standard deduction. Of course, this deduction appeals to our sense of fairness, but like all the complexities in the tax code, it comes with costs: not only does it add to compliance costs and create a need for higher tax rates, but it subsidizes demand for medical care, much like the tax breaks available on employer-provided health care, and it therefore inflates health care costs for everyone. To the extent that these deductions and many others are still in play, the GOP plans fall short of real tax reform.

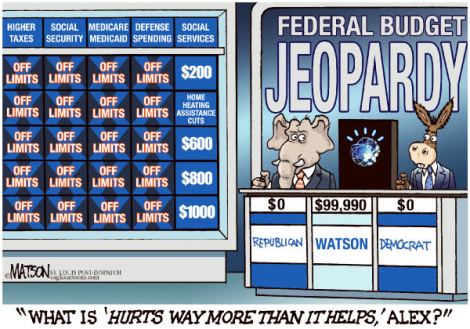

The GOP tax bills certainly have their shortcomings. I hope some of them are rectified in conference. The bills do not offer extensive simplification of the tax code, and they would not be truly historic: in real terms, an earlier version of the House bill would have been the fourth biggest cut in U.S. history relative to GDP, and I believe the version that passed the House is smaller. However, many of the arguments mounted by the Left against the bills are without merit and are often deceitful. The Left strongly identifies with the zero-sum philosophy inherent in collectivism, and the misleading arguments I’ve cited are plausible to the less-informed among that crowd. That brings me back to David Harsanyi’s point, discussed at the top of this post: “intellectuals” on the progressive Left find value in corrupting the meaning of words and phrases like “budget cuts”, “giving” and “taking”:

“Everyone tends to dramatize the consequences of policy for effect, of course, but a Democratic Party drifting towards Bernie-ism is far more likely to perceive cuts in taxation as limiting state control and thus an attack on all decency and morality.“

“There is a parallel explanation for the hysterics. With failure comes frustration, and frustration ratchets up the panic-stricken rhetoric. It’s no longer enough to hang nefarious personal motivations on your political opponents — although it certainly can’t hurt! — you have to corrupt language and ideas to imbue your ham-fisted arguments with some kind of basic plausibility.“