Tags

Balance of Payments, Big Beautiful Bill, central planning, Coercion, Cronyism, Donald Trump, Eric Boehm, Fiscal Restraint, Foreign Investment, Free trade, Liberation Day, National Security, Non-Tariff Barriers, Price Pressures, Punitive Tariffs, Reciprocal Tariffs, Retaliatory Tariffs, Selective Tariffs, Tariff Exceptions, Tariff Incidence, Trade Deals, Trade Deficit

Just a few weeks back I engaged in wishful speculation that Trump’s drastic imposition of “reciprocal” and punitive tariffs could actually prove to be a free-trade play, but only if the U.S. used its universally dominant position in trade wisely at the bargaining table. I worried, however, that any notion Trump might have along those lines was eclipsed by his antipathy for otherwise harmless trade deficits. Another bad indicator was his conviction that manipulating tariffs could restore “fairness” in trade relations while raising revenue to pay for the selective tax cuts he promised for tips, overtime wages, and social security benefits.

Aside from that, I won’t repeat all of Trump’s fallacies about trade (and see here and here) except where they’ve impinged on recent developments.

One Raw Deal

My hopes for reduced trade barriers were dashed when the first “deal” (or really a “Memorandum of Understanding”) was announced with the United Kingdom. The U.S. runs a trade surplus with the UK, so one might think Trump would find it unnecessary to levy tariffs on U.S. imports from the UK. No dice! Clearly this was not motivated by the trade deficit bogeyman of Trump’s fever dreams. The White House stated that buyers of goods from the UK will pay the minimum 10% tariff (up from 3.3% before Trump took office).

Trump simply likes tariffs. Apparently he’s never given much thought to their incidence, which falls largely on domestic consumers and businesses. The MAGA faithful are in blissful denial that such a burden exists, despite ample evidence of its reality.

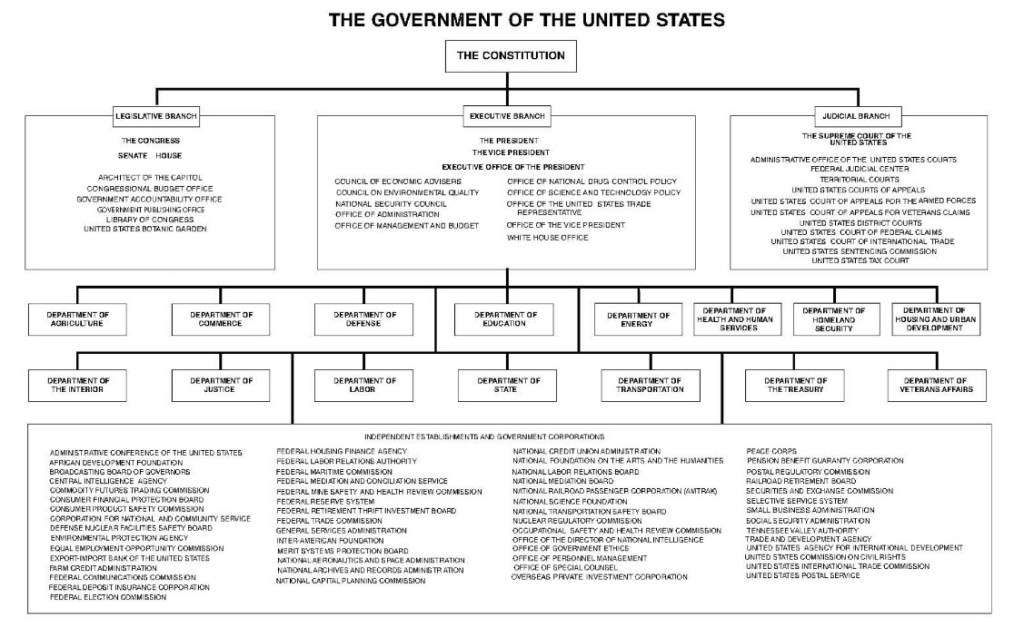

As Eric Boehm notes, the U.S. received a few concessions on British tariffs under the deal, but the reductions only amount to about a 2% equivalent. There are sharp reductions in special tariffs on U.S. agricultural products, especially meat. There are also exceptions to tariffs on certain British goods, like autos (up to 100,000 units). The selective nature of the concessions on both sides underscores the cronyist underpinnings of this style of economic governance, which amounts to ad hoc central planning.

Also troubling is the misleading spin the Administration attempted to put on news coverage of the deal. They claimed to have reduced tariffs of goods imported from the UK, which is true only in comparison to post-“Liberation Day” tariff levels established in early April. In fact, the baseline tariff now applied to most UK goods sold in the U.S. has more than tripled since last year! As Boehm states, American consumers and businesses are paying a lot more for this “deal” than their British counterparts.

Raw Deals To Be?

The “deal” with China is worse, partly because it’s only a 90-day pause in implementation (pending negotiation), and partly because the “reciprocal” tariff rate of 30% applied to Chinese goods is much higher than before Trump imposed the punitive rates. Still worse, the 10% tariff on U.S. exports to China applied during the pause is also much higher. What a deal! And it could get worse. These tariff hikes have little to do with “national security” and they are regressive, having disproportionately large burdens on lower-income consumers and small businesses.

The only other agreement announced thus far is with India. It is not a “trade deal” at all, but a so-called “Terms of Reference On Bilateral Trade Agreement”. It is a “roadmap” for future negotiations. Perhaps it will come together quickly, but it’s hard to expect much after the UK agreement.

Uniting Western Civilization

Just this week we had another hardball move by Trump: a 50% tariff on goods from the European Union starting in June, up from an average of about 3.8% on a trade-weighted basis. The new tariff rate is also higher than the 10% baseline tariff in place since the 90-day pause was announced in April. Trump claims the EU has been levying tariffs of 39% on U.S. goods, which might include what the Administration would call effective tariffs from non-tariff barriers to trade. Or it might refer to retaliatory tariffs announced by the EU in response to Trump’s Liberation Day announcement, but all of those have been paused. In any case, the World Trade Organization says EU tariffs on US goods average 4.8%. Quite a difference!

The move against the EU is much like Trump’s earlier ploy with China, but he says he’s “not looking for a deal”. He also says talks with the EU are “going nowhere”, though the Polish Trade Minister reassures that talks are “ongoing”. The outcome is likely to be a disappointment for anyone (like me) hoping for freer trade. The EU will probably make commitments to buy something from the U.S., maybe beef or liquified natural gas. But U.S. tariffs on EU goods will be higher than in the past.

So, thus far we have only one “deal” (such as it is), one roadmap for negotiations to follow, and a bunch of pauses pending negotiation (China included). The Trump team says about 100 countries hope to negotiate trade deals, but that is a practical impossibility. Even Trump says “… it’s not possible to meet the number of people that want to see us.” But it could be easy: just drop all U.S. trade barriers and allow protectionist countries to tax their own citizens, denying them access to free choice.

Bullying Enemies, Allies and Producers

Higher U.S. tariffs will put some upward pressure on the prices of imports and import-competing goods. We haven’t seen this play out just yet, but it’s early. In a defensive move, Trump is attempting to bully and shame domestic companies such as WalMart for attempting to protect their bottom lines in the face of tariffs. He also warned automakers about their pricing before carving out an exception for them. And now Apple has been singled-out by Trump for a special 25% tariff after it had announced plans to move assembly of iPhones to India, rather than in the U.S.

You better stay on Trump’s good side. This is a loathsome kind of interference. It encourages firms to seek favors in the form of tariff exemptions or to accept what amounts to state expropriation of profits. Cronyism and coercion reign.

Swamped By Spendthrifts?

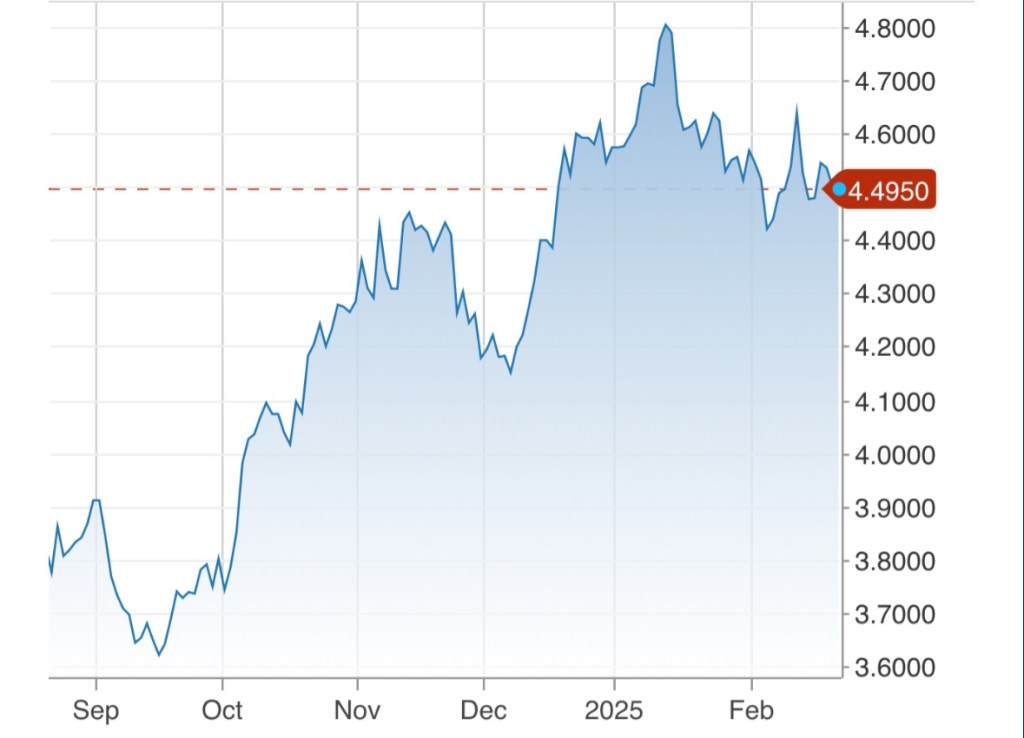

The market seems to believe the negative impact of tariffs on economic growth will be more than offset by other stimulative forces. This includes the extension of Trump’s 2017 tax cuts. The so-called “big beautiful bill” passed by the House of Representatives also includes new tax breaks on tip and overtime pay, and an increase in the deduction for state and local taxes. While the bill reduces the growth of federal spending, there is disappointment that spending wasn’t reduced. The Senate might pass a version with more cuts, but the market sees nothing but deficits going forward. This is not the sort of “fiscal restraint” the market hoped for, particularly with escalating interest costs on the burgeoning federal debt.

Conflicting Goals

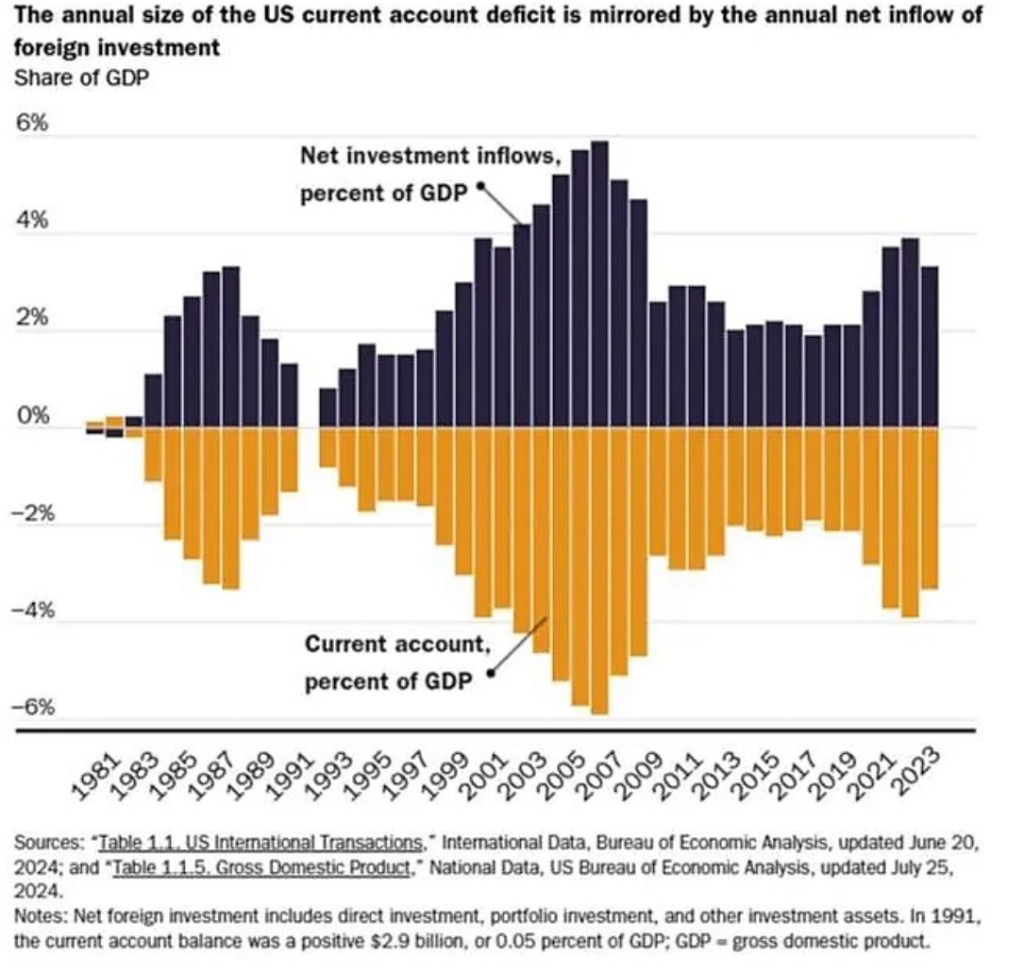

Trump has bargained successfully for some major investments in the U.S. by wealthy nations like Saudi Arabia and Dubai, as well as a few major manufacturing and technology firms. That’s wonderful. He doesn’t understand, however, that strong foreign investment in the U.S. will encourage larger trade deficits. That’s because foreign capital inflows raise incomes, which increase demand for imports. In addition, the capital inflows cause the value of the dollar to appreciate, making imports cheaper but exports more expensive for foreigners. It would be a shame if Trump reacted to these eventualities by doubling down on tariffs.

Conclusion

Alas, my hopes that Trump’s bellicose trade rhetoric was mere posturing were in vain. He could have used our dominant trading position to twist arms for lower trade barriers all around. While I worried that he massively misunderstood the meaning of trade deficits, and that he viewed higher tariffs as a magic cure, I should have worried much more!