Tags

Assimilation, Birthright Citizenship, Criminal Records, Daniel Di Martino, Denmark Immigration, Deportation, entitlements, Fiscal Contribution, Garret Jones, Illegal Aliens, Immigration, Improper Entry, Jesús Fernández-Villaverde, Manhattan Institute, Merit-Based Immigration, National Academy of Sciences, Remigration, Robby Soave, Security Risks, Welfare State

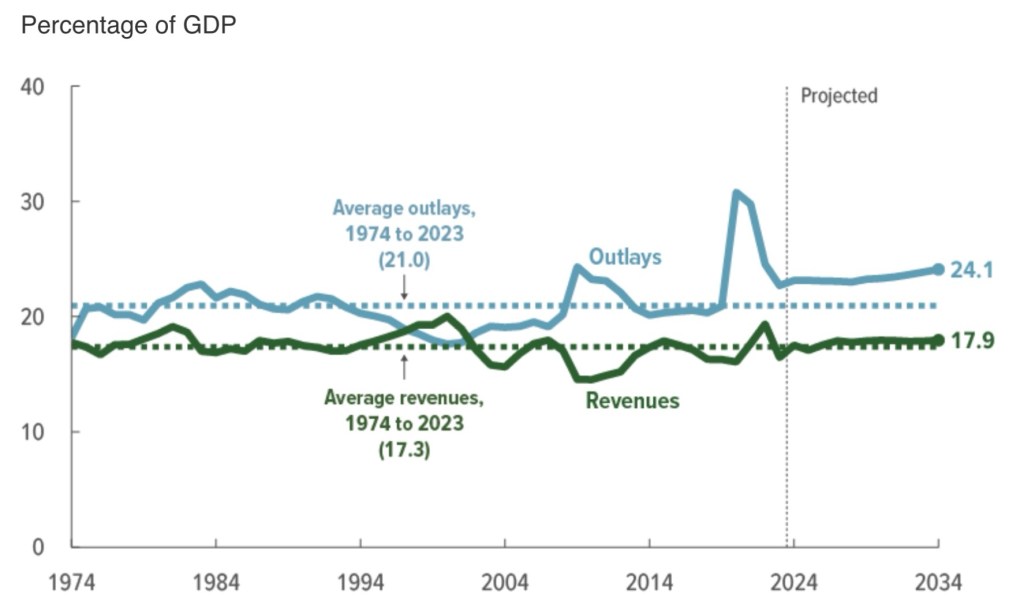

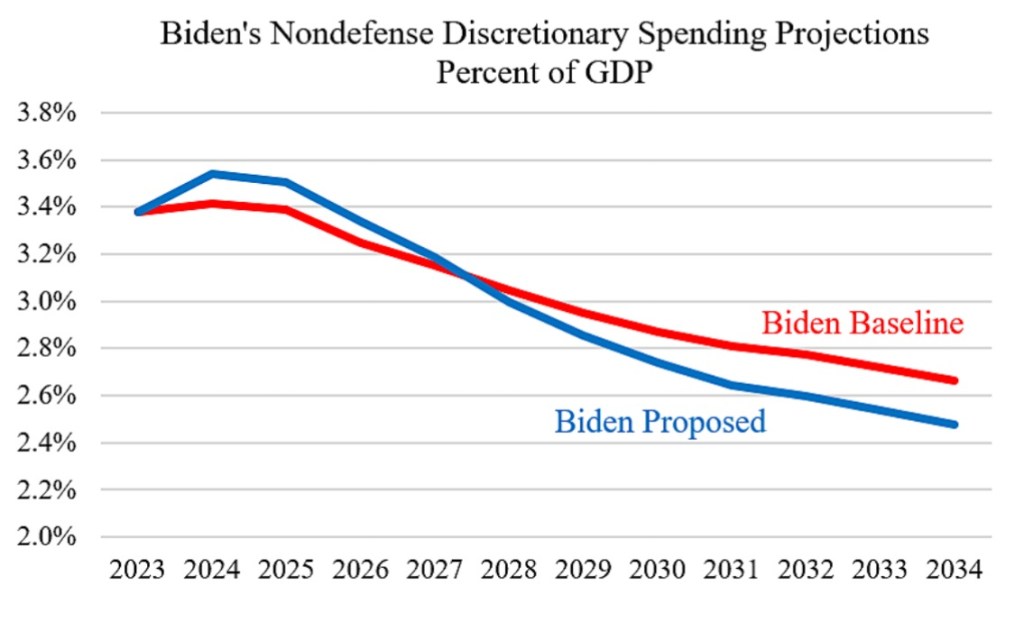

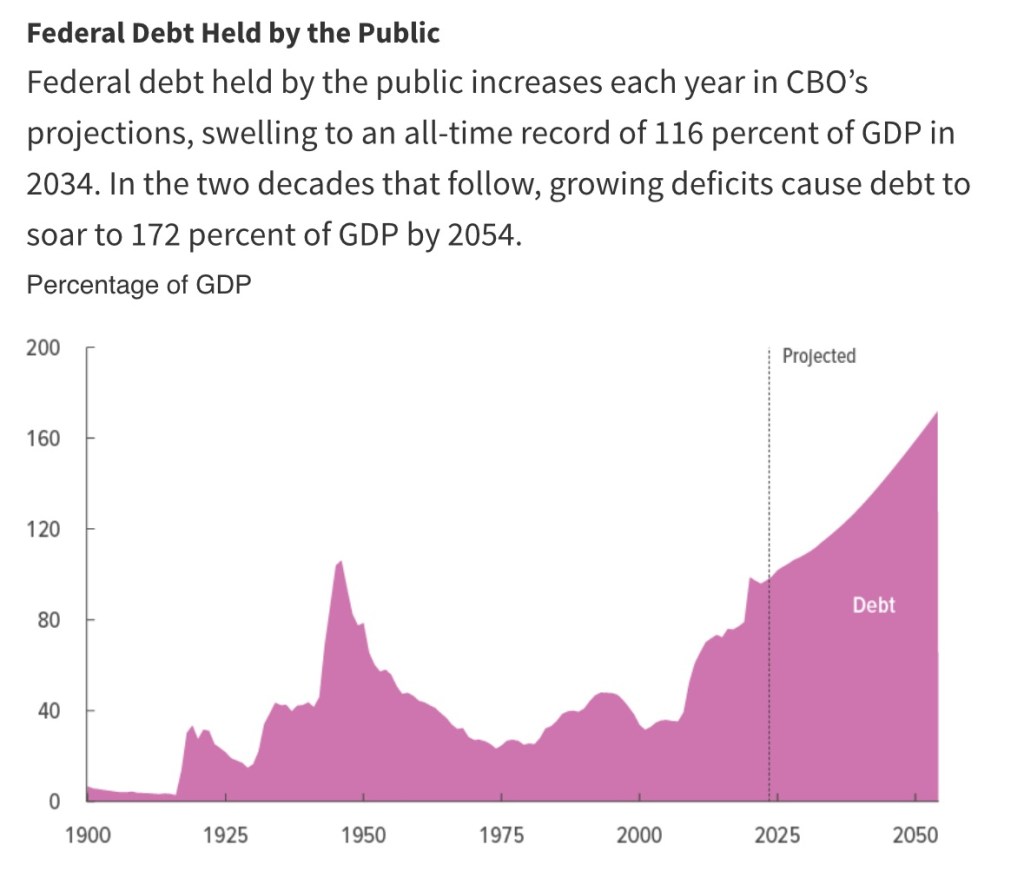

Immigration into the U.S. can be a powerful force for economic growth. This takes on special importance given low fertility rates in the U.S. and the effective insolvency of our entitlement systems (with dim prospects for reform). But whether a given flow of immigrants will mitigate the negative growth and fiscal effects of unfavorable demographic trends is a conclusion requiring some qualification.

This certainly isn’t a case of “the more, the merrier”. Sharp tradeoffs bear on whether and how immigration can be a part of the solution to our demographic and fiscal woes.

Fiscal Contribution

University of Pennsylvania economist Jesús Fernández-Villaverde asserts that a high volume of immigrants will not solve our fiscal challenges. His reasoning is straightforward: immigrants are concentrated in the lower part of the income distribution, and therefore relatively few provide a surplus contribution to the nation’s fiscal balance. In fact, our large fiscal imbalance is driven by the country’s generous welfare state. With near-open borders, it serves as a magnet for low-income migrants. Thus, a broadly lenient immigration policy will not solve fiscal issues caused by low birth rates. However, Fernandez-Villaverde offers no direct empirical evidence except to say that data from some European countries support his claim.

Daniel Di Martino of the Manhattan Institute recently published a detailed analysis of the fiscal effects of immigration, including the fiscal contributions of both immigrants and two subsequent generations of offspring. He provided an excellent summary in a later tweet:

“… when it comes to immigration, the main question isn’t how many immigrants but which immigrants.”

In particular, highly-educated immigrants engender a surplus fiscal contribution. All else equal, so do immigrants less than 40 years of age. Low-skill immigrants are likely to produce a fiscal deficit, however. Legal immigrants tend to have a positive fiscal effect, while illegal immigrants tend to add to deficits.

This 2017 report from the National Academies of Sciences found similarly mixed results on the fiscal impact of immigrants. Education and age were again important determinants.

Country of Origin

Garret Jones argues that place of origin is a vital indicator of fiscal contribution. Here is a chart he posted at the link (from The Economist):

The chart pertains to immigration into Denmark, so like Jesús Fernández-Villaverde, we’re relying on European data. However, I suspect this generalizes to most other western countries. Of course, the plots above represent averages; individuals from any of the categories shown in the chart might differ substantially. Nevertheless, the average non-western immigrant into Denmark makes a weak or negative fiscal contribution relative to immigrants of western origin. The contrast is especially sharp for immigrants from the category that includes the Middle East, North Africa, Pakistan, and Turkey.

There are a variety of explanations for these disparate results. Westerners emigrating to Denmark probably have a strong advantage in terms of common languages and communication. Average skill levels are probably higher for westerners as well. Cultural differences almost surely make assimilation into society and the workplace more difficult for non-westerners.

A strict ban or quota on immigration from certain countries is probably unwise, however. Given our growth and fiscal objectives, we should seek to attract talented individuals from all over, and humanitarian imperatives suggest acceptance of legitimate refugees from political, religious, racial, or ethnic persecution. That might well mean a greater annual number of legal immigrants into the U.S. But if the question is whether it’s fiscally sound to encourage broad inflows of non-western immigrants, the answer is mostly no.

Vetting

It should go without saying that all potential immigrants must be vetted, and the intensity of the process could be made a function of an individual’s place of origin. Military-age males from hostile countries should receive particular scrutiny so that we can mitigate risks like those described here.

It’s reasonable to demand that those entering the country meet some subset of possible qualifications, some of which might override other criteria. For example, highly productive workers make wonderful immigrants, contribute to economic growth, make a greater fiscal contribution, and are more likely to assimilate successfully. Those are key rationales for a merit-based immigration system. But an overriding consideration might apply to individuals or families fleeing their homeland due to persecution, who have legitimate claims to refugee status regardless of economic potential. It’s also reasonable to extend favorable treatment to individuals having close family members already in the U.S., barring any red flags.

A related concern is birthright citizenship, which is a constitutional right. As long as immigrants clear reasonable hurdles for legal entry, birthright citizenship should stand going forward. The Supreme Court is likely to rule against the Trump Administration’s challenge to birthright citizenship, and it should, though the vast number of illegals who entered the U.S. under Biden certainly creates a birthright burden for U.S. taxpayers. It also sometimes complicates efforts to deport individuals who never should have been allowed to enter.

Merit

Rigid immigration quotas don’t make economic sense. It’s desirable to allow flexibility as labor market conditions evolve. Those capable of work might be ranked by education or skill, and in turn assigned priority based on the strength of domestic opportunities in their areas of experience or expertise. This can accommodate unskilled workers when they are in heavy demand. But merit and labor-market pressures aside, please don’t adopt preferences like the last two sentences shown here (from the White House’s latest national security strategy document).

Legal immigration should not be handled as a residual. Employers will often find that an immigrant is more qualified for a certain job. They should be free to hire that individual assuming the immigrant is vetted. As Robby Soave notes at the tweet linked above, the White House position is economically equivalent to hiring on the basis of DEI preferences.

Needless to say, almost any formula or decision tree can be manipulated unless it is spelled out in detail by law. However, that too might subvert economic and fiscal objectives by imparting too much rigidity to the system.

Crimes and Misdemeanors

Notwithstanding protestations from many economists I admire, who make endless assertions that illegal immigrants have lower crime rates than the domestic population, those arguments are beside the point. There seems little justification for allowing anyone having a record of serious crime to enter the country. It is hard to imagine many circumstances under which exceptions should be considered. Yet we have managed to allow large numbers of proven criminals to enter the U.S. (similar numbers reported here). It goes without saying that we cannot properly vet potential immigrants unless they go through the proper legal process for entering the country. For example, this is what happened in Europe as countries allowed unchecked inflows of migrants (and continue to do so).

Illegal immigrants are obviously in violation of immigration laws, which cannot simply be rewarded. Rather than the traditional fines or jail time for improper entry, so-called “remigration” is an increasingly popular solution. Voluntary deportation is one possibility; should the immigrant refuse, there must be a greater price to pay for the violation of law. Involuntary deportation is more controversial but might be warranted if the alternative is state dependency. Other possibilities include private sponsorship with a price tag high enough to pay what would otherwise become an obligation imposed on taxpayers. Factors that could weigh in favor of an illegal immigrant would be employability, a commitment to learn the English language, and a course of study toward meeting the requirements for citizenship.

Summary

An open borders policy is idealized by some libertarians, but it has severe drawbacks. Among those are potential compromises in national security and a blind eye to the ingress of dangerous criminals. Furthermore, many potential immigrants contribute to fiscal deficits due to their reliance on the welfare state and the generous entitlements available to many U.S. residents. A well-designed immigration system would screen for merit across a number of dimensions, with responsiveness to labor market conditions.