Tags

Bolshevik Revolution, Coercion, Dictatorship of the Proletariat, Gary Saul Morson, Glenn Reynolds, Identity Politics, Karl Marx, Leninthink, Redistribution, Social Justice, The New Criterion, Vladimir Lenin, Zero-Sum Economics, Zero-Sum Society

I suggested recently that the pursuit of zero-sum gains, and zero-sum thinking generally, is a form of social rot. How timely that Gary Saul Morson has offered this interesting essay on “Leninthink” in the October issue of The New Criterion. It validates my conviction that a zero-sum view of the world invites social brutalism and economic cannibalism. Vladimir Ilyich Ulyanov, better known as Vladimir Lenin, was of course the first premier of the Soviet Union after the Bolshevik Revolution in 1917. His philosophy was a practical derivative of Marxism, a real-world implementation of a “dictatorship of the proletariat“. Morson describes Lenin’s view of social relations thusly:

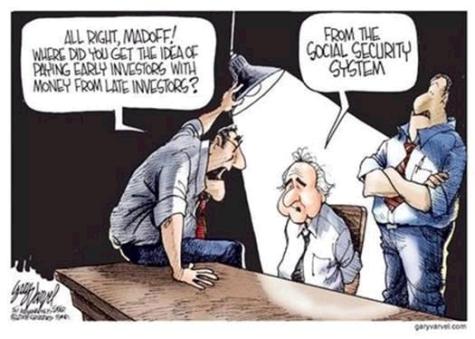

“Lenin regarded all interactions as zero-sum.To use the phrase he made famous, the fundamental question is always ‘Who Whom?’—who dominates whom, who does what to whom, ultimately who annihilates whom. To the extent that we gain, you lose. Contrast this view with the one taught in basic microeconomics: whenever there is a non-forced transaction, both sides benefit, or they would not make the exchange. For the seller, the money is worth more than the goods he sells, and for the buyer the goods are worth more than the money. Lenin’s hatred of the market, and his attempts to abolish it entirely during War Communism, derived from the opposite idea, that all buying and selling is necessarily exploitative. When Lenin speaks of ‘profiteering’ or ‘speculation’ (capital crimes), he is referring to every transaction, however small. Peasant ‘bagmen’ selling produce were shot.

Basic books on negotiation teach that you can often do better than split the difference, since people have different concerns. Both sides can come out ahead—but not for the Soviets, whose negotiating stance John F. Kennedy once paraphrased as: what’s mine is mine; and what’s yours is negotiable. For us, the word ‘politics’ means a process of give and take, but for Lenin it’s we take, and you give. From this it follows that one must take maximum advantage of one’s position. If the enemy is weak enough to be destroyed, and one stops simply at one’s initial demands, one is objectively helping the enemy, which makes one a traitor. Of course, one might simply be insane. Long before Brezhnev began incarcerating dissidents in madhouses, Lenin was so appalled that his foreign minister, Boris Chicherin, recommended an unnecessary concession to American loan negotiators, that he pronounced him mad—not metaphorically—and demanded he be forcibly committed. ‘We will be fools if we do not immediately and forcibly send him to a sanatorium.'”

The ruthlessness of Lenin’s mindset was manifested in his unwillingness to engage in rationalizations or even civil debate:

“Lenin’s language, no less than his ethics, served as a model, taught in Soviet schools and recommended in books with titles like Lenin’s Language and On Lenin’s Polemical Art. In Lenin’s view, a true revolutionary did not establish the correctness of his beliefs by appealing to evidence or logic, as if there were some standards of truthfulness above social classes. Rather, one engaged in ‘blackening an opponent’s mug so well it takes him ages to get it clean again.’ Nikolay Valentinov, a Bolshevik who knew Lenin well before becoming disillusioned, reports him saying: ‘There is only one answer to revisionism: smash its face in!’

When Mensheviks objected to Lenin’s personal attacks, he replied frankly that his purpose was not to convince but to destroy his opponent. In work after work, Lenin does not offer arguments refuting other Social Democrats but brands them as ‘renegades’ from Marxism. Marxists who disagreed with his naïve epistemology were ‘philosophic scum.’ Object to his brutality and your arguments are ‘moralizing vomit.’ You can see traces of this approach in the advice of Saul Alinsky—who cites Lenin—to ‘pick the target, freeze it, personalize it.'”

This offers a useful perspective on why it’s so difficult to have civil discussions with leftists today. They have inherited versions of Lenin’s polemic style. You’re more likely to be verbally attacked by the Left than to be engaged in a productive exchange of ideas, as I’m constantly reminded by observing the behavior of SJWs on social media. Leftist retribution is swift. Glenn Reynolds has mused, “As the old saying has it, the left looks for heretics and the right looks for converts, and both find what they’re looking for.” That might be too optimistic!

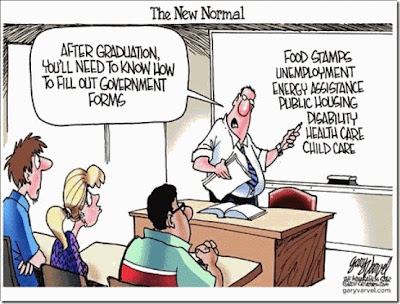

The richest source of zero-sum gains is through the levers of government, which possesses the necessary coercive power to achieve that aim. When coercive power is so ruthlessly exercised, the appearance of loyalty to those in power becomes paramount for survival. This can make it necessary to display an outward acceptance of fanciful claims:

“Lenin’s idea that coercion is not a last resort but the first principle of Party action. Changing human nature, producing boundless prosperity, overcoming death itself: all these miracles could be achieved because the Party was the first organization ever to pursue coercion without limits. In one treatise Stalin corrects the widespread notion that the laws of nature are not binding on Bolsheviks, and it is not hard to see how this kind of thinking took root. And, given an essentially mystical faith in coercion, it is not hard to see how imaginative forms of torture became routine in Soviet justice.

Dmitri Volkogonov, the first biographer with access to the secret Lenin archives, concluded that for Lenin violence was a goal in itself. He quotes Lenin in 1908 recommending ‘real, nationwide terror, which invigorates the country and through which the Great French Revolution achieved glory.'”

Morson provides this revealing quote from the madman Lenin himself:

“The kulak uprising in [your] 5 districts must be crushed without pity. . . . 1) Hang (and I mean hang so that the people can see) not less than 100 known kulaks, rich men, bloodsuckers. 2) Publish their names. 3) Take all their grain away from them. 4) Identify hostages . . . . Do this so that for hundreds of miles around the people can see, tremble, know and cry . . . . Yours, Lenin. P. S. Find tougher people.”

At least today the Lefties try to dox people first, rather than #2. The hanging might have to come later.

There is a real danger in encouraging such zero-sum notions as redistribution and class warfare. Even today’s preoccupation with identity politics is one of zero-sum emphasis. Furthermore, the concepts of mass victimization and social justice promote a delusion of righteousness, a necessary precondition to the kind of monstrous acts of a Lenin. Anyone truly interested in promoting an atmosphere of social cooperation should recognize the echos of Leninism we see today from Leftists on social media and in the streets. These tyrants must be resisted before we’re all on the wrong side of the ultimate zero sum outcome.