Tags

Absolute Advantage, AI Capital, Artificial Intelligence, Baby Bonds, Comparative advantage, Complementary Inputs, Human Touch, Opportunity cost, Robitics, Scarcity, Tradeoffs, Type I Civilization, Universal Basic Income, Universal Capital Endowments

As of February 2026, I’m adding this short preamble to a few older posts on the subject of AI and future prospects for human labor. In the original post below (and a few others), I overstated the case that the law of comparative advantage would assure a continued role for humans in production. I still think the case is strong, mind you, but now I’m convinced that the outcome depends on elasticities of input substitution and how those elasticities might shift given the advent of AI-augmented capital. You can read my most recent thoughts on the matter here.

____________________________________________

Every now and then I grind my axe against the proposition that AI will put humans out of work. It’s a very fashionable view, along with the presumed need for government to impose “robot taxes” and provide everyone with a universal basic income for life. The thing is, I sense that my explanations for rejecting this kind of narrative have been a little abstruse, so I’m taking another crack at it now.

Will Human Workers Be Obsolete?

The popular account envisions a world in which AI replaces not just white-collar technocrats, but by pairing AI with advanced robotics, it replaces workers in the trades as well as manual laborers. We’ll have machines that cure, litigate, calculate, forecast, design, build, fight wars, make art, fix your plumbing, prune your roses, and replicate. They’ll be highly dextrous, strong, and smart, capable of solving problems both practical and abstract. In short, AI capital will be able to do everything better and faster than humans! The obvious fear is that we’ll all be out of work.

I’m here to tell you it will not happen that way. There will be disruptions to the labor market, extended periods of joblessness for some individuals, and ultimately different patterns of employment. However, the chief problem with the popular narrative is that AI capital will require massive quantities of resources to produce, train, and operate.

Even without robotics, today’s AIs require vast flows of energy and other resources, and that includes a tremendous amount of expensive compute. The needed resources are scarce and highly valued in a variety of other uses. We’ll face tradeoffs as a society and as individuals in allocating resources both to AI and across various AI applications. Those applications will have to compete broadly and amongst themselves for priority.

AI Use Cases

There are many high-value opportunities for AI and robotics, such as industrial automation, customer service, data processing, and supply chain optimization, to name a few. These are already underway to a significant extent. To that, however, we can add medical research, materials research, development of better power technologies and energy storage, and broad deployment in delivering services to consumers and businesses.

In the future, with advanced robotics, AI capital could be deployed in domains that carry high risks for human labor, such as construction of high rise buildings, underwater structures, and rescue operations. This might include such things as construction of solar platforms and large transports in space, or the preparation of space habitats for humans on other worlds.

Scarcity

There is no end to the list of potential applications of AI, but neither is there an end to the list of potential wants and aspirations of humanity. Human wants are insatiable, which sometimes provokes ham-fisted efforts by many governments to curtail growth. We have a long way to go before everyone on the planet lives comfortably. But even then, peoples’ needs and desires will evolve once previous needs are satisfied, or as technology changes lifestyles and practices. New approaches and styles drive fashions and aesthetics generally. There are always individuals who will compete for resources to experiment and to try new things. And the insatiability of human wants extends beyond the strictly private level. Everyone has an opinion about unsatisfied needs in the public sphere, such as infrastructure, maintenance, the environment, defense, space travel, and other dimensions of public activity.

Futurists have predicted that the human race will seek to become a so-called Type I civilization, capable of harnessing all of the energy on our planet. Then there will be the quest to harness all the energy within our solar system (a Type II civilization). Ultimately, we’ll seek to go beyond that by attempting to exploit all the energy in the Milky Way galaxy. Such an expansion of our energy demands would demonstrate how our wants always exceed the resources we have the ability to exploit.

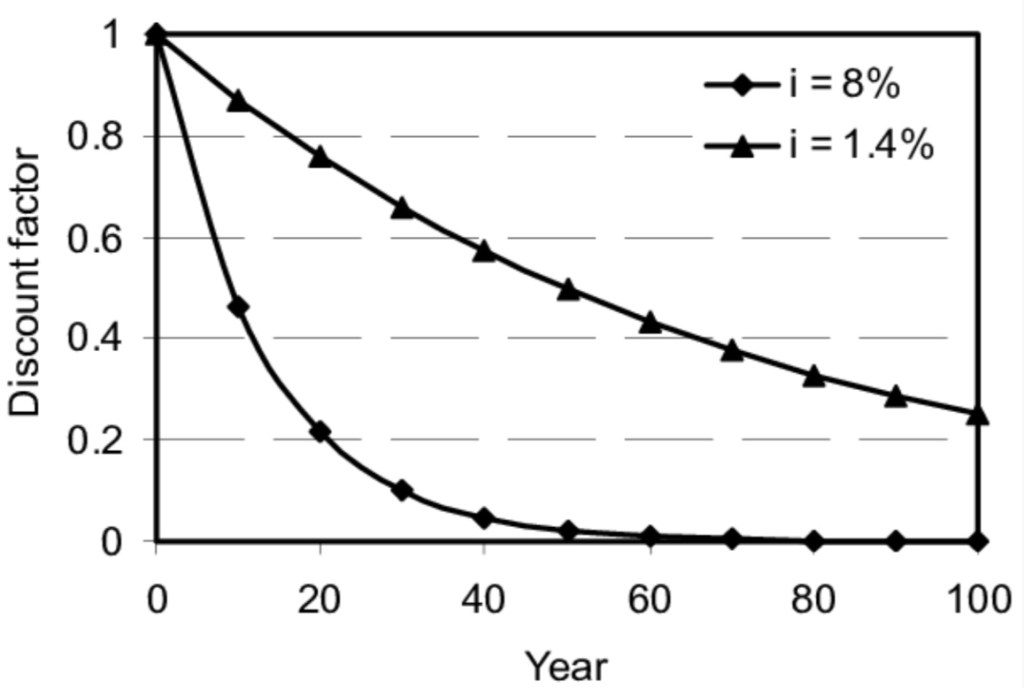

In other words, scarcity will always be with us. The necessity of facing tradeoffs won’t ever be obviated, and prices will always remain positive. The question of dedicating resources to any particular application of AI will bring tradeoffs into sharper relief. The opportunity cost of many “lesser” AI and robotics applications will be quite high relative to their value to investors. Simply put, many of those applications will be rejected because there will be better uses for the requisite energy and other resources.

Tradeoffs

Again, it will be impossible for humans to accomplish many of the tasks that AI’s will perform, or to match the sheer productivity of AIs in doing so. Therefore, AI will have an absolute advantage over humans in all of those tasks.

However, there are many potential applications of AI that are of comparatively low value. These include a variety of low-skill tasks, but also tasks that require some dexterity or continuous judgement and adjustment. Operationalizing AI and robots to perform all these tasks, and diverting the necessary capital and energy away from other uses, would have a tremendously high opportunity cost. Human opportunity costs will not be so high. Thus, people will have a comparative advantage in performing the bulk if not all of these tasks.

Sure, there will be novelty efforts and test cases to train robots to do plumbing or install burglar alarm systems, and at some point buyers might wish to have robots prune their roses. Some people are already amenable to having humanoid robots perform sex work. Nevertheless, humans will remain competitive at these tasks due to the comparatively high opportunity costs faced by AI capital.

There will be many other domains in which humans will remain competitive. Once more, that’s because the opportunity costs for AI capital and other resources will be high. This includes many of the skilled trades, caregivers, and a great many management functions, especially at small companies. Their productivity will be enhanced by AI tools, but those jobs will not be decimated.

The key here is understanding that 1) capital and resources generally are scarce; 2) high value opportunities for AI are plentiful; and 3) the opportunity cost of funding AI in many applications will be very high. Humans will still have a comparative advantage in many areas.

Who’s the Boss?

There are still other ways in which human labor will always be required. One in particular involves the often complementary nature of AI and human inputs. People will have roles in instructing and supervising AIs, especially in tasks requiring customization and feedback. A key to assuring AI alignment with the objectives of almost any pursuit is human review. These kinds of roles are likely to be compensated in line with the complexity of the task. This extends to the necessity of human leadership of any organization.

That brings me to the subject of agentic and fully autonomous AI. No matter how sophisticated they get, AIs will always be the product of machines. They’ll be a kind of capital for which ownership should be confined to humans or organizations representing humans. We must be their masters. Disclaiming ownership and control of AIs, and granting agentic AIs the same rights and freedoms as people (as many have imagined) is unnecessary and possibly dangerous. AIs will do much productive work, but that work should be on behalf of human owners, and human labor will be deployed to direct and assess that work.

AIs (and People) Needing People

The collaboration between AIs and humans described above will manifest more broadly than anything task-specific, or anything we can imagine today. This is typical of technological advance. First-order effects often include job losses as new innovations enhance productivity or replace workers outright, but typically new jobs are created as innovations generate new opportunities for complementary products and services both upstream in production or downstream among ultimate users. In the case of AI, while much of this work might be performed by other AIs, at a minimum these changes will require guidance and supervision by humans.

In addition, consumers tend to have an aesthetic preference for goods and services produced by humans: craftsmen, artists, and entertainers. For example, if you’ve ever shopped for an oriental rug, you know that hand-knotted rugs are more expensive than machine-weaved rugs. Durability is a factor as well as uniqueness, the latter being a hallmark of human craftspeople. AI might narrow these differences over time, but the “human touch” will always have value relative to “comparable” AI output, even at a significant disadvantage in terms of speed and uncertainty regarding performance. The same is true of many other forms, such as sports, dance, music, and the visual arts. People prefer to be entertained by talented people, rather than highly-engineered machines. The “human touch” also has advantages in customer-facing transactions, including most forms of service and high-level sales/financial negotiations.

Owning the Machines

Finally, another word about AI ownership. An extension of the fashionable narrative that AIs will wholly replace human workers is that government will be called upon to tax AI and provide individuals with a universal basic income (UBI). Even if human labor were to be replaced by AIs, I believe that a “classic” UBI would be the wrong approach. Instead, all humans should have an ownership stake in the capital stock. This is wealth that yields compound growth over time and produces returns that make humans less reliant on streams of labor income.

Savings incentives (and negative consumption incentives) are a big step in encouraging more widespread ownership of capital. However, if direct intervention is necessary, early endowments of capital would be far preferable to a UBI because they will largely be saved, fostering economic growth, and they would create better incentives than a UBI. Along those lines, President Trump’s Big Beautiful Bill, which is now law, has established “Baby Bonds” for all American children born in 2025 – 2028, initially funded by the federal government with $1,000. Of course, this is another unfunded federal obligation on top of the existing burden of a huge public debt and ongoing deficits. Given my doubts about the persistence of AI-induced job losses, I reject government establishment of both a UBI and universal endowments of capital.

Summary

Capital and energy are scarce, so the tremendous resource requirements of AI and robotics means that the real world opportunity costs of many AI applications will remain impractically high. The tradeoffs will be so steep that they’ll leave humans with comparative advantages in many traditional areas of employment. Partly, these will come down to a difference in perceived quality owing to a preference for human interaction and human performance in a variety of economic interactions, including patronization of the art and athleticism of human beings. In addition, AIs will open up new occupations never before contemplated. We won’t be out of work. Nevertheless, it’s always a good idea to accumulate ownership in productive assets, including AI capital, and public policy should do a better job of supporting the private initiative to do so.