Tags

Barack Obama, Benito Mussolini, central planning, competition, Dodd-Frank, fascism, Industrial Concentration, Industrial Policy, Innovation, Jonah Goldberg, Obamacare, rent seeking, Sheldon Richman, Socialism, Thomas Sowell

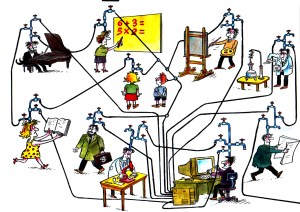

President Obama is a believer in centralized social and economic management, despite the repeated disasters that have befallen societies whose leaders have applied that philosophy in the real world. Those efforts have often taken the form of socialism, with varying degrees of government ownership of resources and productive capital. However, it is not necessary for government to own the means of production in order to attempt central planning. You can keep your capital as long as you take direction from the central authority and pay your “fair share” of the public sector burden.

A large government bureaucracy can coexist with heavily regulated, privately-owned businesses, who are rewarded by their administrative overlords for expending resources on compliance and participating in favored activities. The rewards can take the form of rich subsidies, status-enhancing revolving doors between industry and powerful government appointments, and steady profits afforded by monopoly power, as less monied and politically-adept competitors drop out of the competition for customers. We often call this “corporatism”, or “crony capitalism”, but it is classic fascism, as pioneered by Benito Mussolini’s government in Italy in the 1920s. Here is Sheldon Richman on the term’s derivation:

“As an economic system, fascism is socialism with a capitalist veneer. The word derives from fasces, the Roman symbol of collectivism and power: a tied bundle of rods with a protruding ax.“

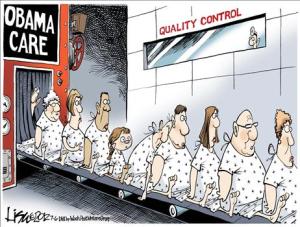

With that in mind, here’s an extra image:

The meaning of fascism was perverted in the 1930s, as noted by Thomas Sowell:

“Back in the 1920s, however, when fascism was a new political development, it was widely — and correctly — regarded as being on the political left. Jonah Goldberg’s great book ‘Liberal Fascism’ cites overwhelming evidence of the fascists’ consistent pursuit of the goals of the left, and of the left’s embrace of the fascists as one of their own during the 1920s. …

It was in the 1930s, when ugly internal and international actions by Hitler and Mussolini repelled the world, that the left distanced themselves from fascism and its Nazi offshoot — and verbally transferred these totalitarian dictatorships to the right, saddling their opponents with these pariahs.“

The Obama Administration has essentially followed the fascist playbook by implementing policies that both regulate and reward large corporations, who are only too happy to submit. Those powerful players participate in crafting those policies, which usually end up strengthening their market position at the expense of smaller competitors. So we have transformational legislation under Obama such as Obamacare and Dodd-Frank that undermine competition and encourage concentration in the insurance, health care, pharmaceutical and banking industries. We see novel regulatory interpretations of environmental laws that destroy out-of-favor industries, while subsidies are lavished on favored players pushing economically questionable initiatives. Again, the business assets are owned by private cronies, but market forces are subjugated to a sketchy and politically-driven central plan designed jointly by cronies inside and outside of government. That is fascism, and that’s the Obama approach. He might be a socialist, and that might even be the end-game he hopes for, but he’s a fascist in practice.

As Sowell points out, Obama gains some crucial advantages from this approach. For starters, he gets a free pass on any claim that he’s a socialist. And however one might judge his success as a policymaker, the approach has allowed him to pursue many of his objectives with the benefit of handy fall-guys for failures along the way:

“… politicians get to call the shots but, when their bright ideas lead to disaster, they can always blame those who own businesses in the private sector. Politically, it is heads-I-win when things go right, and tails-you-lose when things go wrong. This is far preferable, from Obama’s point of view, since it gives him a variety of scapegoats for all his failed policies, without having to use President Bush as a scapegoat all the time.

Thus the Obama administration can arbitrarily force insurance companies to cover the children of their customers until the children are 26 years old. Obviously, this creates favorable publicity for President Obama. But if this and other government edicts cause insurance premiums to rise, then that is something that can be blamed on the “greed” of the insurance companies.The same principle, or lack of principle, applies to many other privately owned businesses. It is a very successful political ploy that can be adapted to all sorts of situations.“

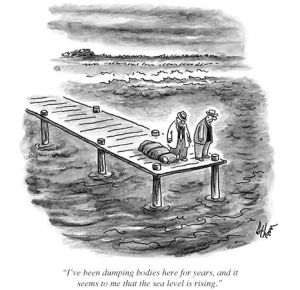

Obama’s most ardent sycophants are always cooing that he’s the best president EVAH, or the coolest, or something. But the economy has limped along for much of his presidency; labor force participation is now at its lowest point since the late 1970s; and median income has fallen on his watch. He has Federal Reserve policy to thank for stock market gains that are precarious, at least for those companies not on the fascist gravy train. Obama’s budgetary accomplishments are due to a combination of Republican sequestration (though he has taken credit) and backloading program shortfalls for his successors to deal with later. Obamacare is a disaster on a number fronts, as is Dodd-Frank, as is the damage inflicted by questionable environmental and industrial policy, often invoked via executive order. (His failures in race relations and foreign policy are another subject altogether.)

Fascism is not a prescription for rapid economic growth. It is a policy of regression, and it is fundamentally anti-innovation to the extent that government policymakers create compliance burdens and are poor judges of technological evolution. Fascism is a policy of privilege and is regressive, with rewards concentrated within the political class. That’s what Obama has wrought.