Tags

Annie, Art for Art's Sake, Bob Weir, Che Guevara, Edgar Allan Poe, Hamilton The Musical, John Perry Barlow, Joseph Campbell, Karl Marx, Pareto-Improvement, Tendentious Art, The Grateful Dead, The Music Never Stopped

Art and politics have a long connection that is often quite awkward. One philosophy holds that art cannot be divorced from its social origins, that it is a legitimate platform from which to confront injustice and oppression, and indeed, that art must “serve some moral or didactic purpose”. In the nineteenth century, the contrary view was expressed by the phrase “art for art’s sake“, which has been credited to several individuals including Edgar Allen Poe. At the time, Marxists said the slogan served to prop-up the “petty bourgeois”, as if artistic beauty and exploration must themselves be inspired by political interests. Exploiting art to promote a point of view is not the exclusive domain of the Left, however. The Right has its own variations on political expression through art. But all such varieties on the Left and Right make me cringe just a bit; I cringe even when the intent of art is to promote views with which I strongly agree.

Art and politics have a long connection that is often quite awkward. One philosophy holds that art cannot be divorced from its social origins, that it is a legitimate platform from which to confront injustice and oppression, and indeed, that art must “serve some moral or didactic purpose”. In the nineteenth century, the contrary view was expressed by the phrase “art for art’s sake“, which has been credited to several individuals including Edgar Allen Poe. At the time, Marxists said the slogan served to prop-up the “petty bourgeois”, as if artistic beauty and exploration must themselves be inspired by political interests. Exploiting art to promote a point of view is not the exclusive domain of the Left, however. The Right has its own variations on political expression through art. But all such varieties on the Left and Right make me cringe just a bit; I cringe even when the intent of art is to promote views with which I strongly agree.

Art and Advocacy

Great art derives from an amorphous combination of talent, certain acquired technical skills, and inspiration. Inspiration can come from anything that might be, strictly speaking, non-art, such as natural beauty, any kind of human drama, the spiritual, or even politics. While many of us can agree that certain artistic works are great, it will always be a subjective matter to one degree or another.

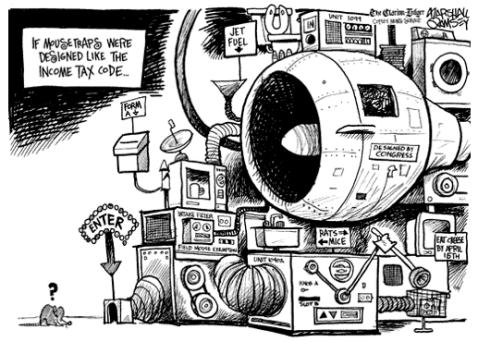

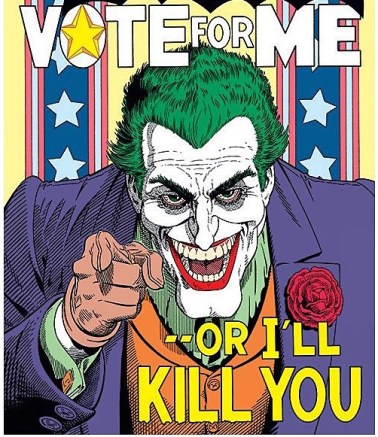

Art may cross subjective boundaries of propriety, and it may offend. No matter the specific topic or the intent, art becomes confrontational and political when some parties object to whatever is portrayed, and especially when attempts are made to suppress it. A work of art is tendentious if the intent is to promote a political viewpoint or a policy, either as a matter of protest or when it is used by either the state or “subversive elements” in an effort to propagandize. It ranges from state-sponsored “artistic” propaganda to private but jingoistic expression, to “protest art”, and to any kind of politically-motivated art.

Obviously, tendentious art can be good from a purely technical perspective even while the subject matter is unappealing to a particular observer. As well, TA can appeal to the emotions effectively, and it can be interesting as a sociological exercise. However, art can portray conditions, dire or otherwise, and appeal to emotions without advocating social policy, and art can be abstract and devoid of any political implication whatsoever.

Even worse than tendentious art are attempts to either censor it or subsidize it. May tendentious art live on as a tool in the marketplace of ideas, free of government involvement. However, on the whole, public or private, I find it unappealing.

Why I’m Averse to Tendentious Art

Here are several propositions about tendentious art (TA) to which I subscribe. They are overlapping to some extent, and I emphasize they are often matters of degree rather than kind:

- It compromises artistic standards;

- Persuasion is its purpose, making art subsidiary to the politics;

- It demotes art to a tool of delivery, subservient to the message;

- TA exploits art for political purposes;

- Art often functions as a refuge or escape; TA cannot;

- TA is often angry;

- the appeal of TA is often self-reverential;

- It confuses artistic value and political “virtue”;

- practitioners of TA often engage in willful historical distortion;

- TA can be self-antiquating;

- TA often recycles and co-opts existing art;

- It is never Pareto-improving.

I’ll elaborate on some of these points:

TA demotes the art part: To the extent that the art and the political message are separable, art becomes subsidiary to the message, and that is almost always true when the message is explicit. In fact, art becomes a mere conveyance.

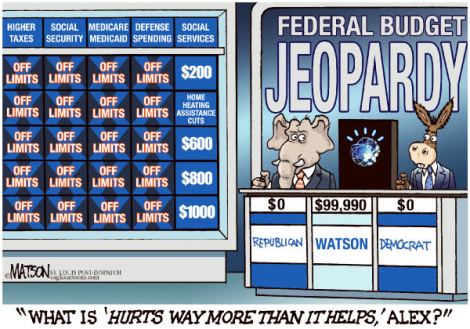

Artistic compromise: Your political message does not make you an artist. This is worth extra emphasis in the age of the meme and the meme “artist”. I’ve seen what I consider bad art. I’ve seen a great deal of bad TA. It is as if the artist can be forgiven for an unimpressive artistic effort so long as the message is valued by like-minded partisans. In this way, TA creates confusion over artistic value relative to political “virtue”.

Politics attempts to exploit art: I am appalled at the recent treatment of certain celebrities, artists or otherwise, who are facing demands to publicly state their political views, to support or denounce this or that person or policy. Whether or not one’s work intersects with the political sphere should be up to the artist. It is within one’s rights to be apolitical.

TA is Pareto-violating: Tendentiousness makes art unappealing to certain observers, and that might even be what the artist intends. A particular policy position embodied in TA, if adopted, might actually be threatening to some individuals in terms of their economic welfare or personal liberties. Even worse, extreme forms of TA might serve to incite violent action (free speech demands that government may not engage in “prior restraint”). The point I’m making here is distinct from any issues posed by physical presentation, such as high volume or lighting, that might make a third-party worse off.

In economics, exchange is said to be Pareto-improving if two trading parties are made better-off while no one is made worse off. Of course, one can always ignore certain forms of art, or one can try to if its expression is non-threatening. But someone may well be made worse-off by an exercise of TA, and in a value-free sense, that makes TA inferior to other art.

Trapped like a rat: TA tends to be ineffective as a refuge or escape, no matter how cathartic some might find the message. The observer is bound by the political reality and the conflict it implies. Art doesn’t have to transcend reality to serve as an escape, but it can transcend explicit advocacy.

Your art and your virtue: I don’t think it’s unfair to say that an observer who enjoys tendentious art indulges in a pleasure that is strongly self-reverential. They feel virtuous, and that is the wrong sentiment to derive from art. TA derives some of its value and power by stroking the ego of the observer.

Distorting history: I have seen many examples of inaccurate historical accounts in theatre and elsewhere. The musical Hamilton is prominent in this respect. The musical Annie has its share of distortions regarding the largely similar policies of Herbert Hoover and Franklin Delano Roosevelt. Che Guevara is sometimes depicted in art as heroic, yet he was murderous, misogynistic, and tyrannical. Got any Stalin shirts? I could go on….

TA can get stale: In some circumstances, TA can make art self-antiquating: captive to the time in which it is created and reducing its relevance as times change, especially if the artist is on the losing side of the politics.

What Prompted This? A Band Beyond Description

This post was motivated by my observation of comments on “fan pages” to which I belong on-line. I’ve been an avid follower of a certain group of musicians over the years, and these fan pages give me an opportunity to interact with other enthusiasts, view concert video, and get news about the band. The fans tend to be affable and we share a certain cultural zeitgeist. However, there is division on these pages over politics, and while I’d describe many of the fans as leftist, there is more diversity of opinion than one might guess. One fan page actually has a “no politics” rule, as it’s proven to create unwelcome strife on other pages. I believe the page administrators are correct in viewing politics as “off-topic”. That is not censorship; it is private governance — house rules, as it were, to which I can’t object. Some fans just can’t help violating the rule, however. There, and on other fan pages, a significant segment of fans seem to believe that one cannot really “get” the band and their music without sharing certain political opinions. That doesn’t surprise me, but I dislike the “groupthink” attitude it reflects.

I realized early-on that the band tended to avoid tendentious art, greatly to their credit. Their music often focuses on traditional themes like love, love lost, celebration, the human condition, and many fascinating stories populated with colorful characters. They even cover some biblical topics that are just great stories. Other frequent musical themes are quite abstract, by turns sinister and dreamy.

There is no doubt that the members of the band have opinions about politics. They have supported a number of causes such as the anti-war movement, ending the drug war, environmental causes, and gay rights. But I believe they have intentionally avoided explicit advocacy in their music. They tend not to use the stage as a pulpit, except generally as a pulpit of musical celebration and fun. They sing sweetly (mostly) and they can rock!

Again, the distinctions I’m making are matters of degree. For example, occasionally the group plays concerts to benefit causes or even candidates for office. That’s fine. I might not support their candidate, or I might disagree with a policy position, but that sort of explicit advocacy seldom if ever intersects with their music. It imposes little or nothing on me.

The band has written and performed a few songs expressing concerns that I don’t fully share. In my opinion (in seeming violation of some of the principles I listed above), I consider those songs to be great from a purely musical perspective; the lyrics are well-turned; and they tend to reveal general sentiment and anxiety about things we’d all like to resolve, rather than direct advocacy of specific policies. I like those songs, though I might disagree with the policy prescriptions of the musicians themselves. In any case, they don’t claim technical expertise in those subject areas. I like their art and don’t really care about their policy preferences, unless they rub my nose in them. But they don’t.

Again, while these are matters of degree, this band has always tended not to use their music as a political soapbox. Perhaps the band’s greatest luminary once said the following:

“You need music, I don’t know why. It’s probably one of those Joe Campbell questions [who said, ‘Follow your bliss.’], why we need ritual. We need magic, and bliss, and power, myth, and celebration and religion in our lives, and music is a good way to encapsulate a lot of it.“

Denouement

My admittedly subjective opinion is that the explicit messaging of tendentious art cheapens artistic expression in several ways: it demotes art in favor of political messaging; it subverts the role of art as an escape; it may be inferior by making third-parties worse off; its enjoyment is something of a self-reverential exercise; it confuses artistic value with political “virtue”; it makes art less durable to the extent that the message it embodies may become less relevant with time; and it is usually angry.

The band I’ve referenced in this discussion is the Grateful Dead. I’ll continue to celebrate their great music with anyone who appreciates it as music. (The name of the band originally appealed to the group partly because it seemed somewhat repellent to conformists. That’s a bit confrontational, perhaps, but the name is folkloric.) Their politics don’t much matter to me because I believe they are artists first. They have kept their art largely free of politics.

I close with lyrics to a Grateful Dead song about music and it’s effect on the human spirit, written by John Perry Barlow and Bob Weir. It is non-tendentious:

The Music Never Stopped

[First voice]

There’s mosquitoes on the river

Fish are rising up like birds

It’s been hot for seven weeks now

Too hot to even speak now

Did you hear what I just heard?

Say, it might have been a fiddle

Or it could have been the wind

But there seems to be a beat now

I can feel it in my feet now

Listen here it comes again

[Second voice]

There’s a band out on the highway

They’re high-stepping into town

It’s a rainbow full of sound

It’s fireworks, calliopes and clowns

Everybody’s dancing

[First voice]

Come on children, come on children

Come on clap your hands

The sun went down in honey

And the moon came up in wine

You know stars were spinning dizzy

Lord the band kept us so busy

We forgot about the time

They’re a band beyond description

Like Jehovah’s favorite choir

People joining hand in hand

While the music plays the band

Lord they’re setting us on fire

Crazy rooster crowing midnight

Balls of lightning roll along

Old men sing about their dreams

Women laugh and children scream

And the band keeps playing on

[Second voice]

Keep on dancing through to daylight

Greet the morning air with song

No one’s noticed but the band’s all packed and gone

Was it ever here at all?

But they kept on dancing

[First voice]

Come on children, come on children

Come on clap your hands

Well the cool breeze came on Tuesday

And the corn’s a bumper crop

And the fields are full of dancing

Full of singing and romancing

The music never stopped