Tags

Administrative Costs, CATO Institute, Don Boudreaux, Monopoly Schools, Monopsonist Unions, Rural Education, School Choice, Show-Me Institute, Specialization, Teachers Unions, The Netherlands

The evidence that school choice is associated with better educational outcomes has been mounting. Given the poor performance of so many public schools, it is time to reject the “sanctity” of their monopoly privilege. The link above emphasizes the promise of choice as a reform for public schools in the U.S. (as do several other links below from the Show-Me Institute and elsewhere).

It is implausible to suggest that the opportunities afforded by choice could make things worse than public-school outcomes. Poorly-served students and families have too much to gain from broadening their educational options and they know it. A recent survey of African-American parents of school children found that more than 75% of the respondents were interested “in obtaining a voucher to cover the cost of private or parochial school tuition for [their] children“. A majority agreed that:

“… I should be able to enroll my child in the school I think will give my child the best educational opportunity. If my choice is a private or parochial school then I should be allowed to use the same tax dollars allotted to every child in public school to cover the cost of their tuition.“

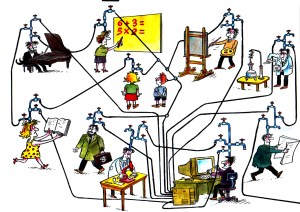

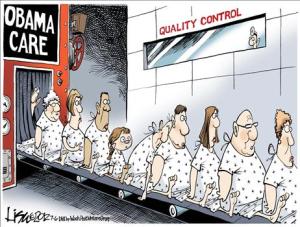

Choice should not be viewed as a threat to the public school system, although that is a familiar narrative issued by school-choice opponents. In fact, it will create new opportunities for public schools to excel, taking advantage of the benefits of specialization that are well-known in most walks of life. Choice and competition will either reform or weed-out the worst-performing schools and will encourage a rationalization of the administrative bloat so characteristic of public institutions. That’s all to the good, but by weakening schools’ market power, choice will change the relationships between public schools and families. Apparently that is threatening to vested interests, which underscores the importance of reform.

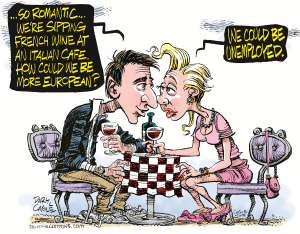

The Netherlands has had a system of school vouchers in place for almost 100 years, and research indicates that it has been highly successful:

“Specifically, access to private schooling has helped Dutch students. A 2013 study reveal[ed] strong positive effects for students using the voucher program to attend private schools. The effects were anywhere between 0.2 and 0.3 standard deviations, which would move a student at the mean of the standard bell curve of student performance up 10 or so percentile points (from a 50 to a 60).

Given these large effects, it shouldn’t be surprising that in a system where two thirds of the schools are private, we see strong academic performance. What’s more, according to the National Center on Education Statistics, Dutch schools spend on average $1,500 less per student per year than American schools do.“

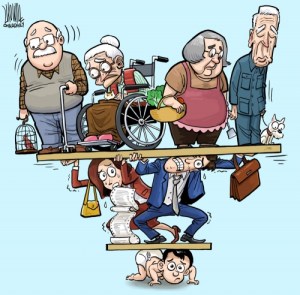

A recent study from the CATO Institute demonstrated the long-run impacts of school choice on several types of outcomes. Little wonder that choice is described as a “Moral and Financial Imperative” (video). School choice is also an option for providing better educations to students in rural areas, despite the worn-out argument that distances make it impossible. Under today’s archaic structure, course offerings at many rural schools are necessarily limited, but new technology and choice programs can allow those schools to specialize and give their local students broader access to educational resources.

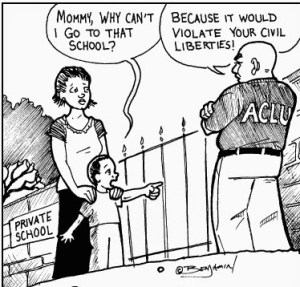

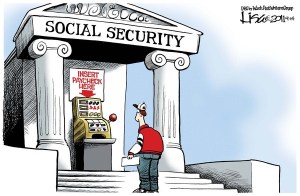

Teacher’s unions have been consistent opponents of school choice. They view choice as a threat to their members’ job security and their own ability to negotiate favorable contract terms. Perhaps, but the goal of improving educational outcomes cannot be subjugated to the goals of union monopsonists. When it comes to education, the schools should focus on serving children and their parents, and parents in failing schools want the kind of solution choice can offer.

Several months ago, a post here on Sacred Cow Chips discussed an entertaining question posed by Don Boudreaux: What if supermarkets were like public schools? To quote Boudreaux directly:

“In the face of calls for supermarket choice, supermarket-workers unions would use their significant resources for lobbying—in favor of public-supermarkets’ monopoly power and against any suggestion that market forces are appropriate for delivering something as essential as groceries.“

Parental control is a critical change needed in our schools. Schools should never be placed in a position exceeding the authority of parents over their children, even if public funds are involved. Teachers and administrators of public schools must learn to treat parents like customers. The only way to assure that kind of responsiveness is to give parents a choice.