Tags

Administrative State, AI Deregulation Decision Tool, Big Beautiful Bill, Dan Mitchell, Deferred Resignation, Deficit Reduction, DOGE, Elon Musk, Embedded Employees, Entitlement Reform, HHS, Medicaid, Medicare, Michael Reitz, Rescission Bill, RIF Rules, Senate DOGE Caucus, Senator Joni Ernst, Social Security, USAID, Veronique de Rugy, Veterans Administration

I’ve noted a number of policy moves by Donald Trump that I find aggravating (scroll my home page), but I still applaud his administration’s agenda to downsize government, promote operational efficiency, and deregulate the private economy. It’s just too bad that Trump demonstrates a penchant for expanding government authority in significant ways, which makes it harder to celebrate successes of the former variety. Beyond that, there have been huge obstacles to rationalizing the administrative state. We’ve seen progress in some areas, but the budgetary impact has been disappointing.

Grinding On

The Department of Government Efficiency (DOGE) was to play a large role in the effort to reduce fraud and inefficiency at the federal level. On the surface, it’s easy to surmise that DOGE has failed in its mission to root out government waste. After seven months, DOGE touts that it has saved taxpayers $205 billion thus far. That is well short of the original $2 trillion objective (subsequently talked down by Elon Musk), but it was expected to take 18 months to reach that goal. Still, the momentum has slowed considerably.

Moreover, the $205 billion figure does not represent recurring budgetary savings. Some of it is one-time proceeds from property sales or grant cancellations. Some of it ($30 billion) seems to represent savings in regulatory compliance costs to Americans, but that’s not clear as the DOGE website is lightly documented, to put it charitably. A recent analysis reached the conclusion that DOGE had exaggerated the savings it has claimed for taxpayers, which seems plausible.

But DOGE is still plugging away, reviewing federal contracts, programs, regulations, payments, grants, workforce deployment, and accounting systems. The work is desperately needed given the fraud that’s been exposed among the agency workforce, which seemed to escalate following the advent of massive Covid benefit payments during the pandemic. Some details of an investigation by the Senate DOGE Caucus, discussed at this link, are truly astonishing. Employees at multiple state and federal agencies have been collecting food stamps, survivor benefits, and even unemployment benefits while employed by government. Apparently, this was made possible by the lack of list de-duplication by the federal agencies that dole out these benefits. This might be a pretty good explanation for the lawsuits filed by federal employee unions attempting to prevent DOGE from accessing agency records. Congratulations to Senator Joni Ernst, Chairman of the Caucus, for her leadership in exposing this graft.

False Aspersions

Shortly after DOGE was constituted, most of its employees were assigned to individual agencies to identify opportunities to reduce waste and promote efficiency. This has led to confusion about the extent to which DOGE should take credit for certain savings maneuvers. However, contrary to some allegations, no DOGE employees have been “embedded” as career civil servants.

Since almost the start of Trump’s second term, DOGE has been blamed for workforce reductions that some deemed reckless and arbitrary. There were indeed some early mistakes, most notably at HHS, but a number of those key workers were rehired. Many of the force reductions were instigated by individual agencies themselves, and many of those were voluntary separations with generous severance packages.

As to the “arbitrary” nature of the force reductions, one former DOGE staffer described the difficulty of making sensible cuts at the Veterans Administration under agency rules:

“Then came a reality check about RIF rules, which turned out to be brutally deterministic:

- Tenure matters most—new hires were cut first

- Veterans’ preference comes next; vets are protected over non-vets

- Length of service trumps performance—seniority beats skill

- Performance ratings break any remaining ties

“These reduction-in-force rules–which stem from the Veterans’ Preference Act of 1944–surprised me and many others. Unlike private industry layoffs that target middle management bloat and low performers, the government cuts its newest people first, regardless of performance. Anyone promoted within the last two years was also considered probationary—first in line to go.“

It would be hard to be less arbitrary than these rules. Other agencies are subject to similar strictures on reductions in force. No wonder the Administration relied heavily on a buyout offer (“deferred resignation”) with broad eligibility in its attempt to downsize government. Furthermore, the elimination of positions was largely targeted functions that were wasteful of taxpayer resources, such as promoting DEI objectives and administering grants to NGOs driven by ideological motives.

Of course, the buyouts come with a cost to taxpayers. In fact, one report asserted that DOGE’s efforts themselves cost taxpayers $135 billion or more. Of course, buyouts carry a one-time cost. However, that figure also includes a questionable estimate of lost productivity caused by turmoil at federal agencies. I’m just a little skeptical when it comes to claims about the productivity of the federal workforce.

Obstacles

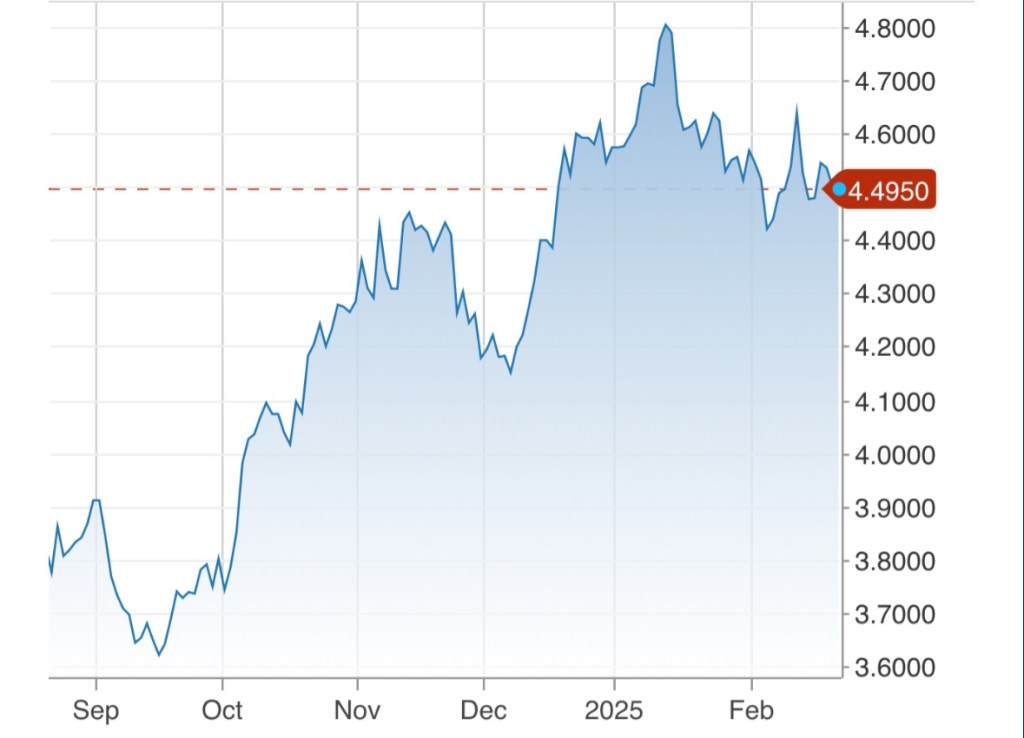

DOGE has had to grapple with other severe limitations, as Dan Mitchell has commented. These are primarily rooted in the spending authority of Congress. Only one rescission bill reflecting DOGE cuts, totaling just $9 billion, has made it to Trump’s desk. Another “untouchable” for DOGE is interest on the federal debt, which has become a huge portion of the federal budget.

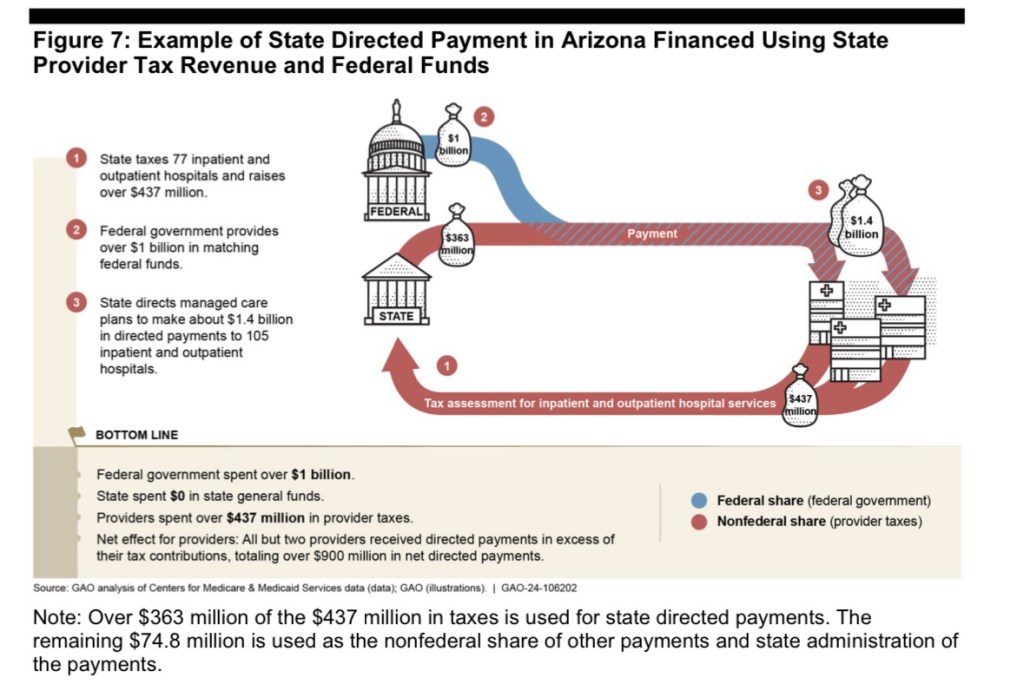

Furthermore, DOGE is guilty of one self-imposed obstacle: the main driver of ongoing deficits is entitlement spending, While the Big Beautiful Bill included Medicaid reforms, the Trump Administration and Congress have shown little interest in shoring up Social Security and Medicare, both of which are technically insolvent. While DOGE would seem to have limited authority over entitlements, as opposed to the discretionary budget, some charge that DOGE made a critical error in failing to address entitlement fraud. According to Veronique de Rugy:

“It is insane not to have started there. Given DOGE’s comparative advantage in data analytics and [information technology], this is where it can have the greatest impact… Cracking down on this waste isn’t just about saving money; it’s about restoring integrity to safety-net programs and protecting taxpayers. And if fixing this problem is not quintessential ‘efficiency,’ what is?“

On the Bright Side

Michael Reitz offered a different perspective. He cited the difficulty of reforming an entrenched bureaucracy. He also noted the following, however, as a kind of hidden success of DOGE and Elon Musk:

“But others I spoke with thought Musk’s four months in government were both substantive and symbolic. He changed the conversation about waste and grift. Musk made cuts cool again, especially for Republican politicians who have forgotten fiscal restraint. He highlighted the need to follow the data and oppose bureaucrats who impede reform by controlling the flow of information.“

Of course, DOGE has been instrumental in identifying absurdly wasteful federal contracts, even if they are “small change” relative to the size of the federal budget. This includes grants to NGOs that appear to have functioned primarily as partisan slush funds. DOGE has also helped identify deregulatory actions to eliminate duplicative or contradictory agency rules on industry, reducing costly economic burdens on the private sector. The DOGE website claims (preliminarily) that it has deleted 1.9 million words of regulation, but doesn’t provide a total number of rules eliminated.

An important part of DOGE’s mission was to modernize technology, software, and accounting systems at federal agencies. This included centralization of these systems with improved tracking of payments and a written justification for each payment. These efforts were met with hostility from some quarters, including lawsuits to limit or prevent DOGE personnel from accessing agency data. Nevertheless, DOGE has pushed ahead with the initiative. This is a laudable attempt to not only modernize systems, but to encourage transparency, accountability, and efficiency.

In a related development, this week DOGE was blamed by a whistleblower for uploading a file from Social Security containing sensitive information to an unsecured cloud environment. However, a spokesperson for the Social Security Administration stated that the data was secure and that the SSA had no indication that it had been breached. We shall see.

AI Scrutiny

Now, DOGE is recommending the use of an AI tool to cut federal regulations. According to Newsweek:

“The ‘DOGE AI Deregulation Decision Tool,’ developed by engineers brought into government under Elon Musk’s DOGE initiative, is programmed to scan about 200,000 existing federal rules and flag those that are either outdated or not legally required.“

Critics are concerned about accuracy and legal complexities, but the regulations flagged by the AI tool will be reviewed by attorneys and other agency personnel, and there will be an opportunity for public comment. The process could make deregulatory progress well beyond what would be possible under purely human review. DOGE believes that up to 100,000 rules could be eliminated, saving trillions of dollars in compliance costs. If successful, this might well turn out to be DOGE’s signal accomplishment.

Conclusion

I’m disappointed at the flagging momentum of DOGE’s quest to eliminate inefficiencies in the executive branch. I’m also frustrated by the limited progress in translating DOGE’s work into ongoing deficit reduction. In addition, it was a mistake to leave aside any scrutiny of improper entitlement payments. Nevertheless, DOGE has has some significant wins and the effort continues. Also, it must be acknowledged that DOGE has faced tremendous obstacles. For too long, government itself has metastasized along with bureaucratic inefficiencies and graft. That is the rotten fruit of the symbiosis between rent seeking behavior and a bloated public sector. We should applaud the spirit motivating DOGE and encourage greater progress.