Tags

Bernie Sanders, central planning, Confiscation, Contrived Scarcity, Don Boudreaux, Free Stuff, Hillary Clinton, incentives, Jeffrey Tucker, Nonprice Rationing, Overuse of Resources, Property Rights, Redistribution, Scarcity Deniers, Socialism

When things are scarce, they can’t be free. That’s an iron law of economics. It’s true of everything we ever wish for and almost everything we take for granted. Things are naturally scarce, but when we are told that things can be free, it always comes from likes of whom Jeffrey Tucker calls “scarcity deniers”. Bernie Sanders and Hillary Clinton have told America that a college education should be free, and a large number of people take that seriously. They are scarcity deniers. On one level, the Sanders/Clinton claim is like any other promise that simply cannot be met at the stated cost — a rather garden-variety phenomenon among politicians. These promises are not harmless, as such initiatives usually involve budget overruns, compromised markets, underproduction and wasted resources.

The Sanders/Clinton claim, however, is a form of scarcity-denial that comes almost exclusively from the political left. That is really the point of Tucker’s article:

“This claim seems to confirm everything I’ve ever suspected about socialism. It’s rooted in a very simple error, one so fundamental that it denies a fundamental feature of the world. It denies the existence and the persistence of scarcity itself. That is to say, it denies that producing and allocating is even a problem. If you deny that, it’s hardly surprising that you have no regard for economics as a discipline of the social sciences.“

Our socialist friends (who otherwise claim to be defenders of science) contend that free things can be offered to a broad swath of the population with little consequence. The least cynical among them (perhaps including Sanders) believe that the costs can be shouldered by the wealthy and/or big corporations and banks. Others (including Clinton) know that the cost of “free things” must be met by higher taxes on a broader share of the population. Doesn’t that mean they recognize scarcity? Only superficially, because they fail to grasp the dynamics of resource allocation, the subtle forms in which costs are imposed, and the true magnitude of those costs.

If a thing is scarce, available supplies must be balanced against demand. The reward to suppliers at the margin must match the willingness of buyers to pay. That means there is no surplus and waste, nor any loss attendant to shortage and non-price rationing. The price creates an incentive for consumers to conserve and an incentive for producers to bring additional supplies to market when they are demanded.

A crucial prerequisite for this to work is the establishment of secure property rights. Then, absent coercion, one can’t overuse what isn’t theirs. One can’t simply take a thing from those who create it without a mutually agreeable payment. Creators cannot be forced to respond on demand without compensation. No one can be required to husband resources for others to simply take. No one can be asked to pay for a thing that will be commandeered by others. The establishment of property rights serves these purposes. Incentives become meaningful because they can be internalized by all actors — those consuming and those producing. And the incentives solve the problem of scarcity by balancing the availability of things with needs and desires, and balance them against all other competing uses of resources. Then, the market-clearing price of a thing reflects its degree of scarcity relative to other goods.

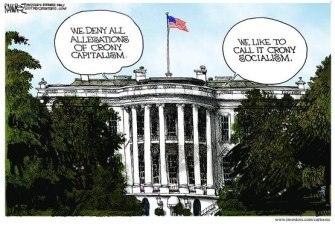

The socialist bluster holds that all this is nonsense. Would-be central planners propose that more of a thing be produced because they deem it to be of high value. Furthermore, it must be made available to buyers at a price the planners deem acceptable, or quite possibly for free to their intended constituency! Property rights are violated here in several ways: first, the owner/producer’s authority over their own resources is declared void; second, the owner has no incentive to care for their resources in a responsible and sustainable way; third, a confiscation of resources from others is required to pay at least some of the costs; fourth, the beneficiaries overuse and degrade the resource.

We know a scarce thing cannot be provided for free. Here are some consequences of trying:

- Overuse of resources. When the buffet is free, the food disappears.

- The “free thing” will be over-allocated to those who benefit and value it the least. (Example: the education of students for whom there are better alternatives.)

- Supplies will evaporate unless producers are fully compensated. Otherwise, quality and quantity will deteriorate. This is a form of “contrived scarcity” (HT: Don Boudreaux).

- If supplies dwindle, new forms of rationing will be necessary. This might involve time-consuming queues, arbitrary allocations, bribes, side payments and favoritism.

- If suppliers are compensated, someone must pay. That means taxes, public borrowing or money printing.

- Taxes weaken productive incentives and chase resources away. The consequent deterioration in productive capacity undermines the original goal of providing something “for free” and inflicts costs on the outcomes of all other markets. This creates more contrived scarcity.

- So-called progressive taxes tend to hit the most productive classes with the greatest negative force.

- Government borrowing to fund “free stuff” today inflicts costs on future taxpayers. More fundamentally, it misallocates resources toward the present and away from the future.

- Printing money to pay for a “free thing” might well cause a general rise in prices. This is a classic, hidden inflation tax, and it may involve the distortion of interest rates, leading to an inter-temporal misallocation of resources.

Scarcity denial is a carrot, but it inevitably becomes a stick. To voters, and to naive shoppers in the marketplace of ideas, the indignant assertion that things can and should be free is powerful rhetoric. Producers, too, might happily accept “free-stuff” policies if they expect to be fully compensated by the government, and they might be pleased to have the opportunity to serve more customers if they think they can do so profitably. However, serving all takers of “free stuff” will escalate costs and is likely to compromise quality. It is also likely to create unpleasant circumstances for customers, such as long waiting times and unfulfilled orders. The stick, on the other hand, will be brandished by the state, blaming and penalizing suppliers for their failure to meet expectations that were unrealistic from the start. The fault for contrived conditions of scarcity lies with the policy itself, not with producers, except to the extent that they allowed themselves to be duped by scarcity deniers. Tucker notes the following:

“Things can be allocated by arbitrary decision backed by force, or they can be allocated through agreement, trading, and gifting. The forceful way is what socialism has always become.“

Politicians and would-be planners with the arrogance to claim that naturally scarce things should be free are dangerous to your welfare. These scarcity deniers cannot provide for human needs more effectively than the free market, and ultimately their efforts will make you subservient and poor.