Tags

Betsy DeVos, Common Core, Department of Education, Federal Budget, federal subsidies, High-Need Students, Nick Gillespie, Public Safety Net, Social Insurance, Special Olympics, U.S. Olympic Committee

The federal government’s contribution to funding the Special Olympics (SO) illustrates the widespread view of government as a limitless font of subsidies for appealing causes. People were up in arms over the elimination of $17.6 million dollars in federal grants for the SO in President Trump’s budget proposal. Granted, that’s a pittance as budget items go. Later, Trump promised to restore the funding. That is, of course, in addition to the millions in federal tax subsidies already granted on private gifts to the SO. As Nick Gillespie explains, SO funding is like so many other things people want from government that government has no business doing. Why, exactly, should the federal government, or any level of government, fund the SO? It is a wonderful program, but it simply does not have the character of a public good, nor is it a safety net issue.

The SO certainly benefits the athletes and families that take part, but those benefits are strictly private. Perhaps the larger population of disabled individuals takes inspiration from watching the SO, along with good-hearted people everywhere. Most everyone is happy to know that the SO happen, but those are no more public benefits than the good vibes you get from viewing an inspirational film or theatrical production. For that matter, sports fans and patriots are inspired by great efforts on the part of the U.S. Olympic team, but the federal government does not fund the U.S. Olympic Committee. It’s therefore absurd to assert that the public bears an obligation to pay for the most athletic of disabled individuals to have opportunities to compete and win medals just like Olympic athletes.

Gillespie explains a little about the history and funding of the SO:

“Founded in 1968 by Eunice Kennedy Shriver, the Special Olympics is a 501(c)3 nonprofit, meaning that deductions to it are tax deductible. According to its 2017 financials (the most-recent available on the web), the organization had total revenues of about $149 million, including $15.5 million in federal grants. It’s not a stretch to assume that if federal funding disappears, the resulting outcry would lead to record donations.”

And again, let’s not forget that corporate gifts to the SO are tax deductible up to certain limits. Gillespie also quotes Secretary of Education Betsy DeVos:

“There are dozens of worthy nonprofits that support students and adults with disabilities that don’t get a dime of federal grant money. But given our current budget realities, the federal government cannot fund every worthy program, particularly ones that enjoy robust support from private donations.”

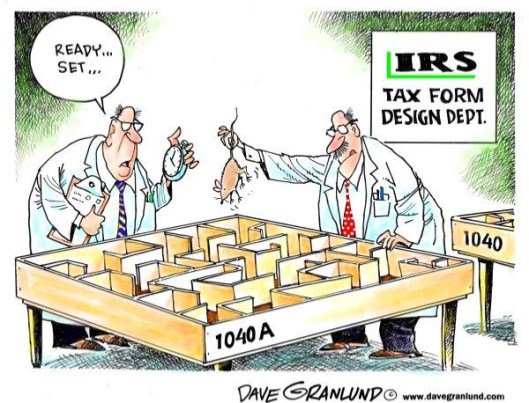

Families with disabled children have extraordinary needs. It’s probably better to think of federal support for those needs as a safety net issue, a form of social insurance. There are several federal programs that provide funds to support low-income families with disabled kids. And while the cut to SO funding was in the budget originally submitted by Secretary DeVos, Gillespie notes that the DOE’s budget “allocates over $32 billion for ‘high-need students,’ which includes intellectually disabled students.”

DeVos was widely criticized for her budget, but as Gillespie says, she sets a fine example for anyone in a position to help rein in the growth of federal spending and ultimately the federal budget deficit. Given the DOE’s track record of poor programmatic guidance (Common Core), counter-productive school disciplinary mandates, and it’s complete lack of impact on educational outcomes after 40 years of existence and many billions of dollars spent, the continued existence of the DOE is difficult to rationalize.

Once a program appears in the federal budget, no matter how inappropriate as a public priority, and no matter how ineffective, its constituency will always defend its funding with rabid enthusiasm. That defense is multiplied by a chorus of statists in the media and elsewhere who, in their benevolent intentions for the taxes paid by others, can be counted upon to call out the “cruelty” of any proposed cuts, or even mere cuts in a program’s projected growth. The Special Olympics episode, and the DOE, are cases in point.