Tags

Antonia Ocasio-Cortez, Bernie Sanders, Biden Administration, Budget Reconcilation Bill, Capital Gains, Civilian Climate Corps, Clean Energy, corporate income tax, dependency, Federal Reserve, Fossil fuels, Green Cards, infrastructure, Joe Manchin, Legal Permanent Residency, Paid Family Leave, Physical Investment, Productivity Growth, Social Infrastructure, Tax the Rich, Tragedy of the Commons, Universal Pre-School, Welfare State

The Socialist Party faithful once known as Democrats are pushing a $3.5 trillion piece of legislation they call an “infrastructure” bill. They hope to pass it via budget reconciliation rules with a simple majority in the Senate. The Dems came around to admitting that the bill is not about infrastructure in the sense in which we usually understand the term: physical installations like roads, bridges, sewer systems, power lines, canals, port facilities, and the like. These kinds of investments generally have a salutary impact on the nation’s productivity. Some “traditional” infrastructure, albeit with another hefty wallop of green subsidies, is covered in the $1.2 trillion “other” infrastructure bill already passed by the Senate but not the House. The reconciliation bill, however, addresses “social infrastructure”, which is to say it would authorize a massive expansion in the welfare state.

What Is Infrastructure?

Traditionally, public and private infrastructure are underlying assets that facilitate production or consumption in one way or another, consistent with the prefix “infra”, meaning below or within. For example, a new factory requires physical access by roads and/or rail, as well as sewer service, water, gas and/or electric supply. All of the underlying physical components that enable that factory to operate may be thought of as private infrastructure, which has largely private benefits. Therefore, it is often privately funded, though certainly not always.

Projects having many beneficiaries, such as highways, municipal sewers, water, gas and electrical trunk lines, canals, and ports may be classified as public infrastructure, though they can be provided and funded privately. Pure public infrastructure provides services that are non-rivalrous and non-excludable, but examples are sparse. Nevertheless, the greater the public nature of benefits, the greater the rationale for government involvement in their provision. In practice, a great deal of “public” infrastructure is funded by user fees. In fact, a failure to charge user fees for private benefits often leads to a tragedy of the commons, such as the overuse of free roads, imposing a heavier burden on taxpayers.

The use of the term “infrastructure” to describe forms of public support is not new, but the scope of government interventions to which the term is applied has mushroomed during the Biden Administration. Just about any spending program you can think of is likely to be labeled “infrastructure” by so-called progressives. The locution is borrowed somewhat questionably, seemingly motivated by the underlying structure of political incentives. More bluntly, it sounds good as a sales tactic!

$3.5 Trillion and Chains

Among other questionable items, the so-called budget reconciliation “infrastructure” bill allocates funds toward meeting:

“… the President’s climate change goals of 80% clean electricity and 50% economy-wide carbon emissions by 2030, while advancing environmental justice and American manufacturing. The framework would fund:

• Clean Energy Standard

• Clean Energy and Vehicle Tax Incentives

• Civilian Climate Corps

• Climate Smart Agriculture, Wildfire Prevention and Forestry

• Federal procurement of clean technologies

• Weatherization and Electrification of Buildings

• Clean Energy Accelerator”

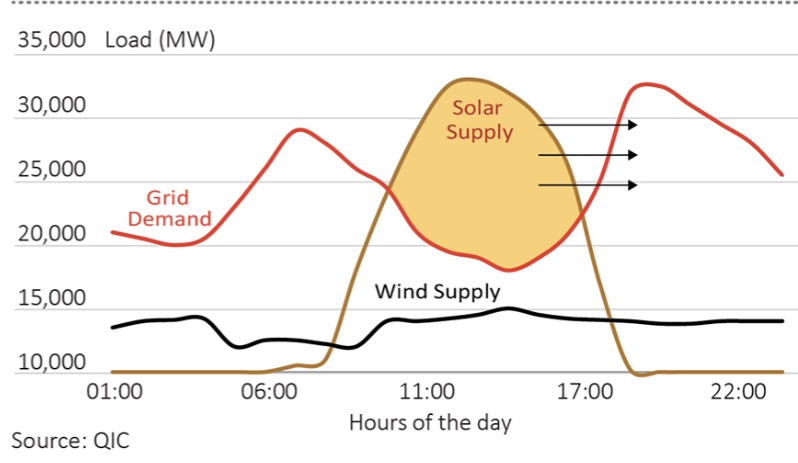

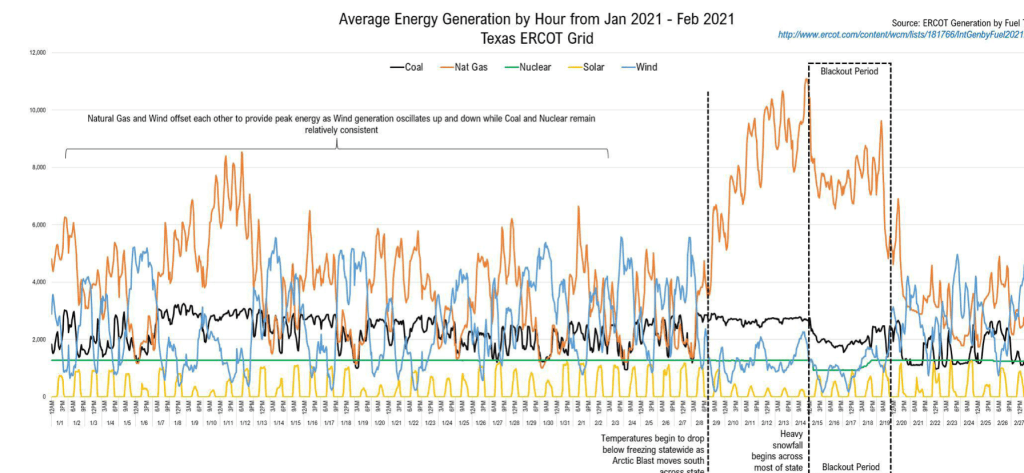

The resolution would also institute “methane reduction and polluter import fees”. Thus, we must be prepared for a complete reconfiguration of our energy sector toward a portfolio of immature and uneconomic technologies. This amounts to an economic straightjacket.

Next we have a series of generous programs and expansions that would encourage dependence on government:

“• Universal Pre-K for 3 and 4-year old children

• High quality and affordable Child Care

• [free] Community College, HBCUs and MSIs, and Pell Grants

• Paid Family and Medical Leave

• Nutrition Assistance

• Affordable Housing”

If anything, pre-school seems to have cognitive drawbacks for children. Several of these items, most obviously the family leave mandate, would entail significant regulatory and cost burdens on private businesses.

There are more generous provisions on the health care front, which are good for further increasing the federal government’s role in directing, regulating, and funding medical care:

“• new Dental, Vision, and Hearing benefit to Medicare

• Home and Community-Based Services expansion

• Extend the Affordable Care Act Expansion from the ARP

• Close the Medicaid “Coverage Gap” in the States that refused to expand

• Reduced patient spending on prescription drugs”

Finally, we have a series of categories intended to “help workers and communities across the country recover from the COVID-19 pandemic and reverse trends of economic inequality.”

“• Housing Investments

• Innovation and R & D Upgrades

• American Manufacturing and Supply Chains Funding

• LPRs for Immigrants and Border Mangt. • Pro-Worker Incentives and Penalties • Investment in Workers and Communities • Small Business Support

I might suggest that a recovery from the pandemic would be better served by getting the federal government out of everyone’s business. The list includes greater largess and more intrusions by the federal government. The fourth item above, grants of legal permanent residency (LPR) or green cards, would legalize up to 8 million immigrants, allowing them to qualify for a range of federal benefits. It would obviously legitimize otherwise illegal border crossings and prevent any possibility of eventual deportation.

Screwing the Pooch

How many of those measures really sound like infrastructure? This bill goes on for more than 10,000 pages, so the chance that lawmakers will have an opportunity to rationally assess all of its provisions is about nil! And the reconciliation bill doesn’t stop at $3.5T. There are a few budget gimmicks being leveraged that could add as much as $2T of non-infrastructure spending to the package. One cute trick is to add certain provisions affecting revenue or spending years from now in order to cut the bill’s stated price tag.

A number of the bill’s generous giveaways will have negative effects on productive incentives. It’s also clear that some items in the bill will supplement the far Left’s educational agenda, which is seeped in critical theory. And the bill will increase the dominance of the federal government over not only the private sector, but state and local sovereignty as well. This is another stage in the metastasis of the federal bureaucracy and the dependency fostered by the welfare state.

Taxing the Golden Goose

But here’s the really big rub: the whole mess has to be paid for. The flip side of our growing dependency on government is the huge obligation to fund it. Check this out:

“American ‘consumer units,’ as BLS calls them, spent a net total of $17,211.12 on taxes last year while spending only $16,839.89 on food, clothing, healthcare and entertainment combined,”

Democrats continue to dicker over the tax provisions of the bill, but the most recent iteration of their plan is to cover about $2.9 trillion of the cost via tax hikes. Naturally, the major emphasis is on penalizing corporations and “the rich”. The latest plan includes:

- increasing the corporate income tax from 21% to 26.8%;

- increasing the top tax rate on capital gains from 20% to 25%;

- an increase in the tax rate for incomes greater than $400,000 ($450,000 if married filing jointly)

- adding a 3% tax surcharge for those with adjusted gross incomes in excess of $5 million;

- Higher taxes on tobacco and nicotine products;

- halving the estate and gift tax exemption;

- limiting deductions for executive compensation;

- changes in rules for carried interest and crypto assets.

There are a few offsets, including the promise of tax reductions for individuals earning less than $200,000 and businesses earning less than $400,000. We’ll see about that. Those cuts would expire by 2027, which reduces their “cost” to the government, but it will be controversial when the time comes.

The Dem sell job includes the notion that corporate income belongs to the “rich”, but as I’ve noted before, the burden of the corporate income tax falls largely on corporate workers and consumers. Lower wages and higher prices are almost sure to follow. This would deepen the blade of the Democrats’ political hari-kari, but they pin their hopes on the power of alms. Once bestowed, however, those will be difficult if not impossible to revoke, and the Dems know this all too well.

The assault on the “rich” in the reconciliation bill is both ill-advised and unlikely to yield the levels of revenue projected by Democrats. Like it or not, the wealthy provide the capital for most productive investment. Taxing their returns and their wealth more heavily can only reduce incentive to do so. Those investors will seek out more tax-advantaged uses for their funds. That includes investments in non-productive but federally-subsidized alternatives. Capital gains can often be deferred, of course. These penalties also ensure that more resources will be consumed in compliance and tax-avoidance efforts. The solutions offered by armies of accountants and tax attorneys will tend to direct funds to uses that are suboptimal in terms of growth in economic capacity.

What isn’t funded by new taxes will be borrowed by the federal government or simply printed by the Federal Reserve. Thus, the federal government will not only compete with the private sector for additional resources, but the monetary authority will provide fuel for more inflation.

Fracturing Support?

Fortunately, a few moderate Democrats in both the House and the Senate are balking at the exorbitance of the reconciliation bill. Senator Joe Manchin of West Virginia has said he would like to see a package of no more than $1.5 trillion. That still represents a huge expansion of government, but at least Manchin has offered a whiff of sanity. Equally welcome are threats from radical Democrats like Senator Bernie Sanders and Rep. Antonia Ocasio-Cortez that a failure to pass the full reconciliation package will mean a loss of their support for the original $1.2 trillion infrastructure bill, much of which is wasteful. We should be so lucky! But that’s a lot of pork for politicians to walk away from.

Infra-Shackles

The so-called infrastructure investments in the reconciliation bill represent a range of constraints on economic growth and consumer well being. Increasing the government’s dominance is never a good prescription for productivity, whether due to regulatory and compliance costs, bureaucratization of decision-making, minimizing the role of price signals, pure waste through bad incentives and graft, and public vs. private competition for resources. The destructive tax incentives for funding the bill are an additional layer of constraints on growth. Let’s hope the moderate Democrats hold firm, or even better, that the tantrum-prone radical Democrats are forced to make good on their threats.