Tags

Bank Liquidity, Biden Administration, Bing, Capital Gains Income, Chuck Schumer, Civil War, Debt Ceiling, Debt Limit Suspension, Default, Discharge Petition, Extraordinary Measures, Federal Deficits, Fourteenth Amendment, Google, Janet Yellen, Kevin McCarthy, Minting Coin, Modern Monetary Theary, Par Value, Perpetuities, Premium Bonds, Spending Restraint, statism

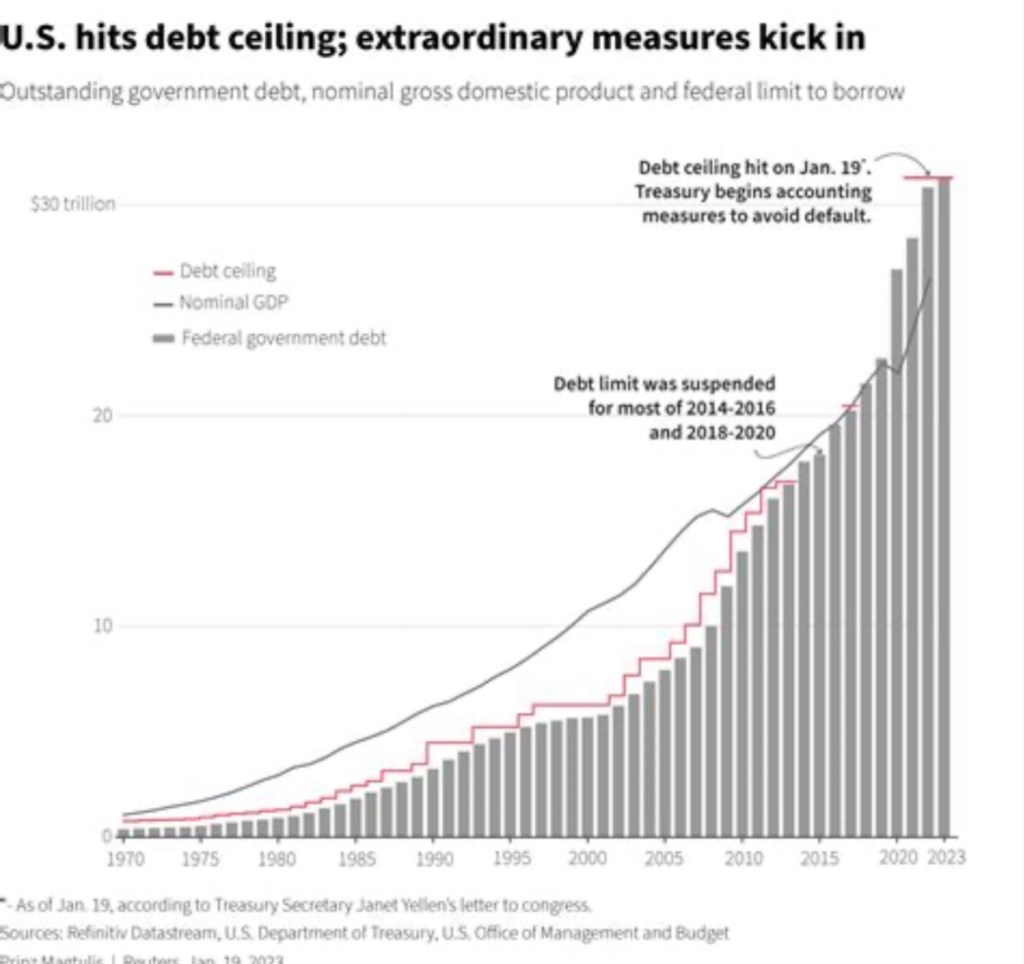

Long-awaited developments in the federal debt limit standoff shook loose in late April when Republicans passed a debt limit bill in the House of Representatives. Were it signed into law, the bill would extend the debt ceiling by about $1.5 trillion while incorporating elements of spending restraint. That approach is highly unpopular with democrats, but the zero-hour looms: Treasury Secretary Janet Yellen says the Treasury will run out of funds to pay all of the government’s obligations in early June. Soon we’ll have a better fix on President Biden’s response to the republicans, as he’s invited congressional leaders to the White House this Tuesday, May 8th to discuss the issue.

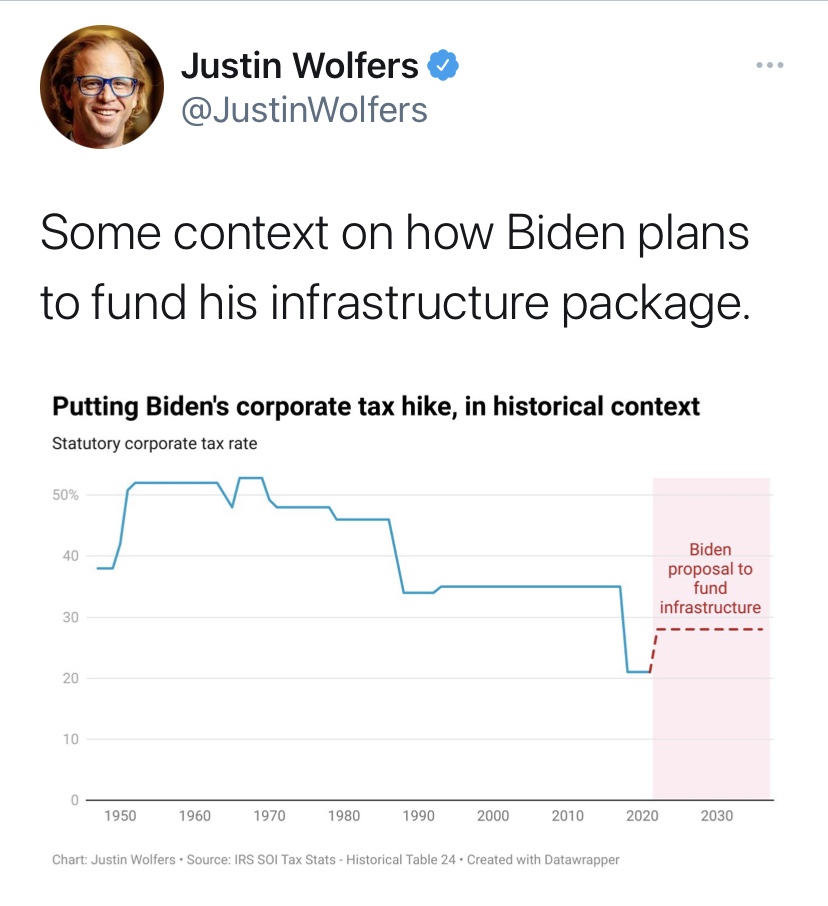

Biden wants a “clean” debt limit bill without changes impacting the budget path or existing appropriations. Senate Majority Leader Chuck Schumer would like to see a “clean” suspension of the debt limit. Republicans would like to use a debt limit extension to impose some spending restraint. They’ve focused only on the discretionary side of the budget, however, while much-needed reforms of mandatory programs like Social Security and Medicare were left aside. In fairness, both political parties have made massive contributions over the years to the burgeoning public debt, so not many are free of blame. But any time is a good time to try to enforce some fiscal discipline.

The Extraordinary Has Its Limits

Three months ago I wrote that the Treasury’s “extraordinary measures” to avoid breaching the debt limit would probably allow adequate time to break the impasse. In other words, accounting maneuvers allowed spending to continue without the sale of new debt. That bought some time, but perhaps not as much as hoped … tax filing season has revealed that revenue is coming in short of expectations, probably because weak asset markets have not generated anticipated levels of taxable capital gains income. In any case, very little progress was made over the past three months on settling the debt limit issue until the House passed the plan pushed by McCarthy. So we await the results of the pow-wow at the White House this week.

A Legislative Trick?

There’s been talk that House democrats will try to push through a “clean” debt limit bill of one sort or another by using a so-called discharge petition. They conveniently snuck this measure into an unrelated piece of legislation back in January. The upshot is that a bill meeting certain conditions must go to the floor for a vote if the discharge petition on the issue has at least 218 signatures. That means at least five republicans must join the democrats to force a vote and then join them again to pass a clean debt limit bill. That’s a long shot for democrats. Given the odds, will Biden deign to negotiate with House Speaker Kevin McCarthy? Even if he does, Biden will probably stall a while longer to extend the game of chicken. His hope would be for a few House republicans to lose their resolve for budget discipline in the face of looming default.

An Aside On Some Falsehoods

There’s a good measure of jingoistic BS surrounding the public debt. For example, you’ve probably heard from prominent voices in the debate that the U.S. has never defaulted on its debt and dad-gummit, it won’t start now! But the federal government has defaulted on its debt four times in the past! In three of those cases, the government reneged on commitments to convert bills or certificates into precious metals. The first default occurred during the Civil War, however, when the Union was unable to pay its war costs and subsequently went on a money printing binge. Unfortunately, we’re now engaged in a civil war of public versus private claims on resources, but the government can’t pay its bills without piling on debt. The statist forces now in control of the executive branch continue to insist that every American should demand more federal borrowing.

Here’s more BS in the form of linguistics that seemingly pervade all budget discussions these days: the House bill includes modest spending restraints, but mostly these are reductions in the growth of spending. Yet these are routinely described by democrats and the media as spending cuts. We could use another bill in the House demanding clear language that abides by the commonly accepted meaning of words. Fat chance!

The Trillion Dollar Coin

In my earlier debt limit post, I discussed two unconventional solutions to the Treasury’s financing dilemma. Both are conceived as short-term workarounds.

One is the minting of a $1 trillion platinum coin by the Treasury, which would deposit the coin at the Federal Reserve. The Fed would then sell back to the public (banks) existing Treasury bonds out of its massive holdings (> $8 trillion). The Treasury could then use the proceeds to pay the government’s bills. Thus, the Fed would do what the Treasury is prohibited from doing under the debt ceiling: selling debt.

When the debt ceiling is ultimately lifted, the “coin” process would be reversed (and the coin melted) without any impact on the money supply. As described, this is wholly different from earlier proposals to mint coins that would feed growth in the stock of money. Those were the brainchildren of so-called Modern Monetary Theorists and a few left-wing members of Congress.

There hasn’t been much discussion of “the coin” in recent months. In any case, the Fed would not be obligated to cooperate with the Treasury on this kind of workaround. The Fed has urged fiscal discipline, and it could simply refuse to take the coin if it felt that debt limit negotiations should be settled between Congress and the President.

Premium Bonds

The other workaround I discussed earlier is the sale by the Treasury of premium bonds or even perpetuities. This involves a little definitional trickery, as the debt limit is expressed in terms of the par value of debt. An example of premium bonds is given at the link above. High interest, low par bonds could be issued by the Treasury with the proceeds used to pay off older discounted bonds and pay the government’s bills. Perpetuities are an extreme case of premium bonds because they have zero par value and would not count against the debt limit at all. They simply pay interest forever with no return of principle. Paradoxically, perpetuities might also be less controversial because they would not involve payments to retire older debt.

Constitutional Challenge

The Biden Administration has pondered another way out of the jam, one that is perhaps more radical than either premium bonds or minting a big coin: challenge the debt ceiling on constitutional grounds. The idea is based on a clause in the Fourteenth Amendment stating that the: “validity of the public debt of the United States… shall not be questioned.” That’s an extremely vague provision. Presumably, as an amendment to the Constitution, this “rule” applies to the federal government itself, not to anyone dumping Treasury debt because its value is at risk. Any fair interpretation would dictate that the government should do nothing to undermine the value of outstanding public debt.

Let’s put aside the significant degree to which the real value of the public debt has been eroded historically by inflationary fiscal and monetary policy. That leaves us with the following questions:

- Does a legislated debt limit (in and of itself) undermine the value of the public debt? Why would restraining the growth of debt or setting a limit on its quantity do such a thing?

- Would a refusal to legislate an increase in the debt limit undermine or “question” the debt’s value? No, because belt-tightening is always a valid alternative to default. The Fourteenth Amendment is not a rationale for fiscal over-extension.

- If we frame this as a question of default vs. fiscal restraint, only the former undermines the value of the debt.

From here, it looks like the blame for bringing the value of the public debt into question is squarely on the spendthrifts. Profligacy undermines the value of one’s commitments, so one can hardly blame those wishing to use the debt ceiling to promote fiscal responsibility. Any challenge to the debt ceiling based on the Fourteenth Amendment is likely to be guffawed out of court.

The Market’s Likely Rebuke

The market will probably react harshly if the debt ceiling impasse continues. That would bring higher yields on outstanding Treasury debt and a sharp worsening of the liquidity crisis for banks holding devalued Treasury debt. Naturally, Biden will attempt to blame the GOP for any bad outcome. His Treasury could attempt to buy more time by announcing the minting of a large coin or the sale of premium bonds, including perpetuities. Ultimately, neither of those moves would do much to stem the damage. The real problem is fiscal incontinence.