Tags

Access to Capital, Antitrust, Blackrock, Climate Action 100+, Corporatism, Diversity, Equity, ESG Fees, ESG Scores, Great Reset, Green Energy, Inclusion, John Cochrane, Mark Brnovich, Principal-Agent Problem, Renewable energy, Renewables, rent seeking, Shareholder Value, Social Justice, Stakeholder Capitalism, Sustainability, Too big to fail, Ukraine Invasion, Vladimir Putin, Woke Investors, Zero-Carbon

ESG scores are used to rate companies on “Environmental, Social, and Governance” criteria. The truth, however, is that ESGs are wholly subjective measures of company performance. There are many different ESG scores available, with no uniform standards for methodology, specific inputs, or weighting schemes. If you think quarterly earnings reports are manipulated, ESGs are an even more pliable tool for misleading investors. It is a market fad, and fund managers are using it as an excuse to charge higher fees to investors. But like any trending phenomenon, for a time, the focus on ESGs might feed-back positively to returns on favored companies. That won’t be sustainable, however, without legislative and regulatory cover, plus a little manipulative help from the ESG engineers and “Great Reset” propagandists.

It’s 100% Political, 0% Economic

ESGs are founded on prioritizing objectives that have little to do with shareholder value or any well-understood yardsticks of financial or operating performance. The demands on company resources for scoring highly on ESG are often nakedly political. This includes adoption of environmental goals such as fraudulent “zero carbon” impacts, the nebulous “sustainability” objective promoted by “green” activists, diversity, inclusion and equity initiatives, and support for activist groups such as Black Lives Matter and Antifa.

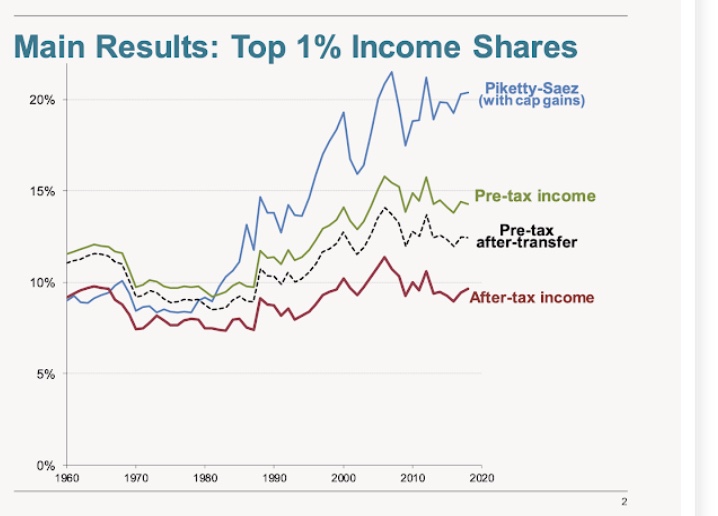

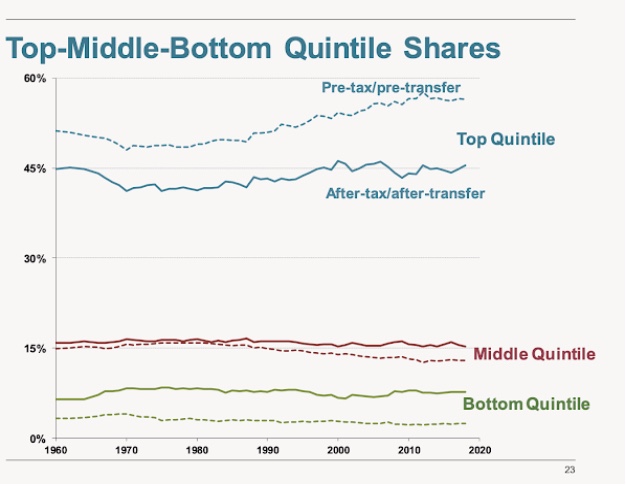

Concepts like “stakeholder value” are critical to the rationale for ESGs. “Stakeholders” can include employees, suppliers, and customers, as well as potential employees. suppliers, and customers. In other words, they can be just about anyone in the broader community, or more likely activists for “social change” whose interests have but the thinnest connection to the business’s productive activities. In essence, so-called stakeholder capitalism amounts to a ceding of control over corporate resources, and ultimately confiscation of wealth from equity owners.

Corporations have long engaged in various kinds of defensive actions, amounting to a modern-day trade in indulgences. No one will be upset about your gas-powered fleet if you buy enough carbon offsets, which just might neutralize the impact of the fleet on your ESG! On a more sinister level, ESG’s provide opportunities for cover against information that might be damaging to firms, such as the use of slave labor overseas. Flatter the right people, give to their causes, “partner” with them on pet initiatives, and your sins will be ignored and your ESG will climb! And ESGs are used in attempts to pacify leftist investors who see the corporation as a vessel for their own social objectives, quite apart from any mission it might have had as a productive enterprise.

Your ESG will shine if you do business that’s politically-favored, like renewable energy, despite its inefficiencies and significant environmental blemishes. But ESGs are not merely used to reward those anointed as virtuous by the Left. They are more forcefully used to punish firms in industries that are out of favor, or firms refusing to participate in buying off authoritarian crusaders. For example, you might be so berserk as to think fossil fuels and climate change represent imminent threats of catastrophe. Naturally, you’ll want to punish oil and gas producers. In fact, if you are in charge of ESG modeling, you might want to penalize almost any extraction industry, with certain exceptions: the massive extraction and disposal costs of renewables will pass without notice.

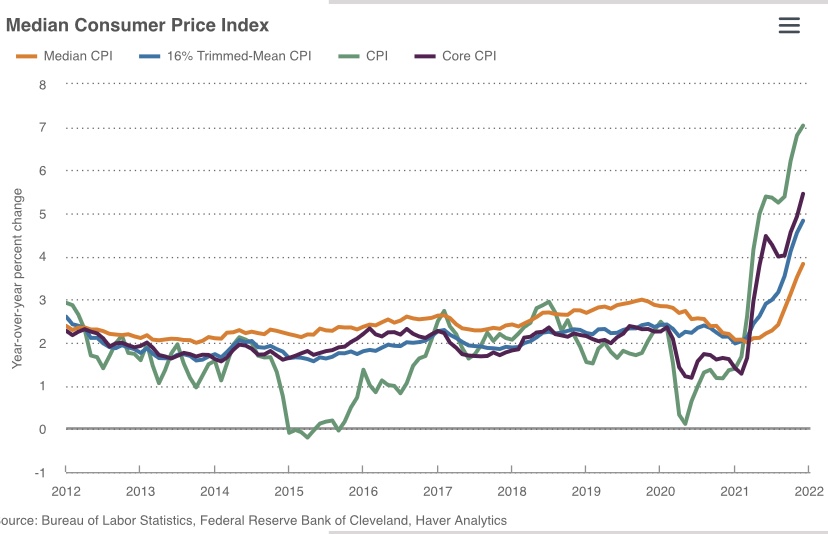

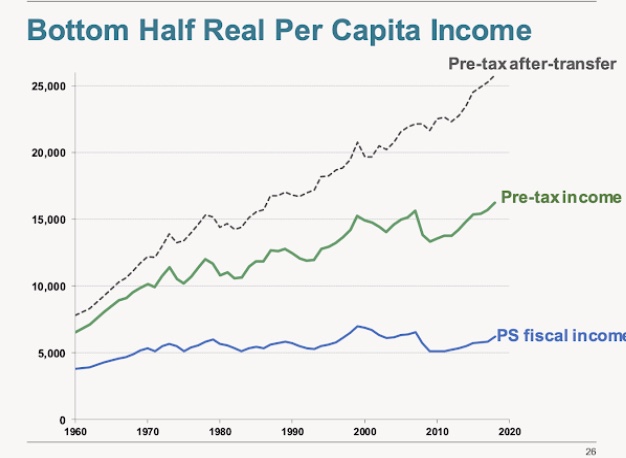

All these machinations occur despite the huge uncertainty surrounding flimsy, model-based predictions of warming and global catastrophe. Never mind that fossil fuels are still relied upon to provide for most of our energy needs and will be for some time to come, including base-load power generation when intermittency prevents renewables from meeting demand. The stability of the power grid depends upon the availability of carbon-based energy, which in fact is marvelously efficient. Yet the ESG crowd (not to mention the Biden Administration) seeks to drive up its cost, including the cost of capital, and these added costs fall most heavily on the poor.

ESG-guided efforts by activists to deny capital to certain segments of the energy sector may constitute antitrust violations. Some big players in the financial industry, who together manage trillions of dollars in investment funds, belong to an advocacy organization called Climate Action 100+. They coordinate on a mission to completely transform the energy industry via “green” investments and divestments of presumptively “dirty” concerns. These players and their clients have huge investments in green energy, and it is in their interest to provide cheap capital to those firms while denying capital to fossil fuel industries. As Arizona Attorney General Mark Brnovich writes at the link above, this is restraint of trade “hiding in plain sight”.

Manipulation

ESGs could be the mother of all principal-agent problems. Corporate CEOs, hired by ownership as stewards and managers of productive assets, are promoting these metrics and activities, which may not align with the interests of ownership. ESG’s are not standardized, and most users will have little insight into exactly how these “stakeholder” sausages are stuffed. In fact, much of the information used for ESGs is extremely ad hoc, not universally disclosed, and is often qualitative. The applicability of these scores to the universe of stocks, and their reliability in guiding investment decisions, is extremely questionable no matter what the investor’s objectives. And of course the models can be manipulated to produce scores that suit the preferences of money managers who have a stake in certain firms or industry segments, and who inflate their fees in exchange for ESG investment advice. And firms can certainly engage in deceptions that boost ESGs, as already discussed.

Like many cultural or consumer trends, investment trends can feed off themselves for a time. If there are enough “woke” investors, ESGs might well feed an unvirtuous cycle of stock purchases in which returns become positively correlated with wokeness. Such a divorce from business fundamentals will eventually take its toll on returns, especially when economic or other conditions present challenges, but that’s not the answer you’ll get from many stock pickers and investment pundits.

At the same time, there are ways in which the preoccupation with ESGs dovetails with the rents often sought in the political arena. Subsidies, for example, will be awarded to firms producing renewables. Politically favored firms are also likely to receive better regulatory treatment.

There are other ways in which firms engaging in wasteful activities can survive profitably, at least for a time. Monopoly power is one, and companies often develop a symbiosis with regulators that hampers smaller competitors. This is traditional rent-seeking corporatism in action, along with the “too-big-to-fail” regime. Sometimes sheer growth in demand for new technologies or networking potential helps to conceal waste. Hot opportunities can leave growing companies awash in cash, some of which will be burned in wasteful endeavors. ESG scoring offers them additional cover.

Cracks In the Edifice

John Cochrane notes a fundamental, long-term contradiction for those who invest based on ESGs: an influx of capital will tend to drive down returns in those firms and industries, while the returns on firms having low ESGs will be driven upward. Yet advocates claim you can invest for virtue and superior returns. That can’t outlast real market forces, especially as ESG efforts dilute any mission a firm might have as a productive enterprise.

Vladimir Putin’s brutal invasion of Ukraine has revealed other cracks in the ESG edifice. We now have parties arguing that defense stocks should be awarded ESG points! Also, that oil production by specific nations should be scored highly. There is also an awakening to the viability of nuclear power as an energy source. Then we have the problem of delivering on Biden’s promise to Europe of more liquified natural gas exports. That will be difficult given the way Biden has bludgeoned the industry, as well as the ESG conspiracy to deny it access to capital. Just watch the ESG hacks backpedal. Now, even the evangelists at Blackrock are wavering. To see the thread of supposed ESG consistency unravel would be enough to make you laugh if the entire conspiracy weren’t so grotesque.

Closing

The pretensions underlying “green” initiatives undertaken by large corporations are good mainly for virtue signaling, to collect public subsidies, and to earn better ESG scores. They are usually wasteful in a pure economic sense. The same is true of social justice and diversity initiatives, which can be perversely racist in their effects and undermine the rule of law.

Ultimately, we must recognize that the best contribution any producer can make to society is to create value for shareholders and customers by doing what it does well. The business world, however, has gone far astray in the direction of rank corporatism, and keep this in mind: any company supporting a sprawling HR department, pervasive diversity efforts, “sustainability” initiatives, and preoccupations with “stakeholder” outreach is distracted from its raison d’etre, its purpose as a business enterprise to produce something of value. It is probably captive to outside interests who have essentially commandeered management’s attention and shareholders’ resources.

When it comes to investing, I prefer absolute neutrality with respect to out-of-mission social goals. Sure, do no harm, but the focus should remain squarely on goals inherent in the creation of value for customers and shareholders.